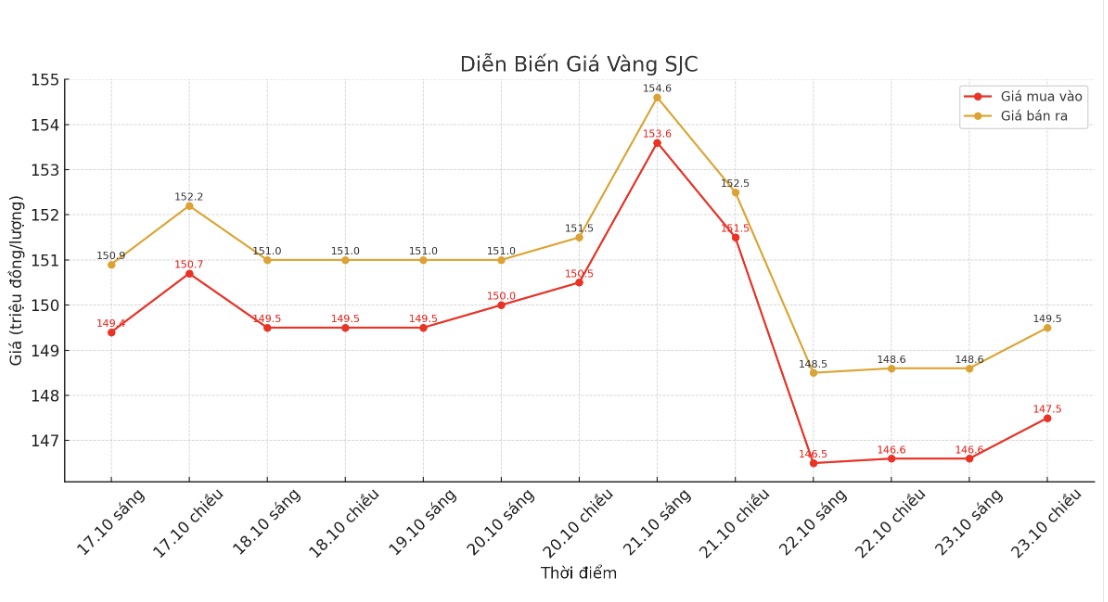

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 147.5-149.5 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold. 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.5-149.5 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold. 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 147-149.5 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and an increase of 900,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

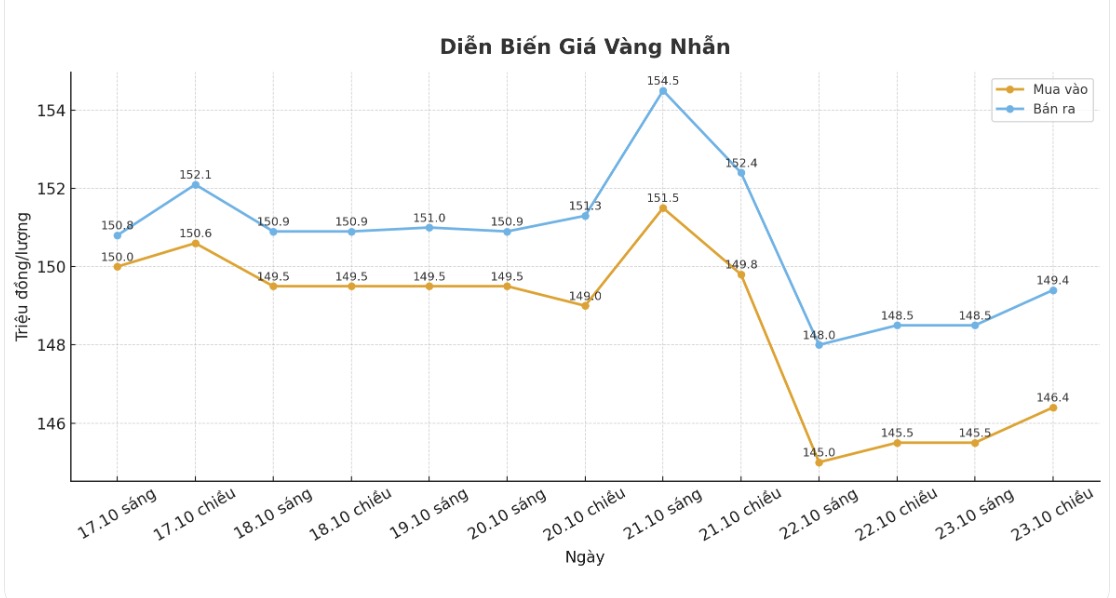

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.4-149.4 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.5-153.5 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.5-149.5 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

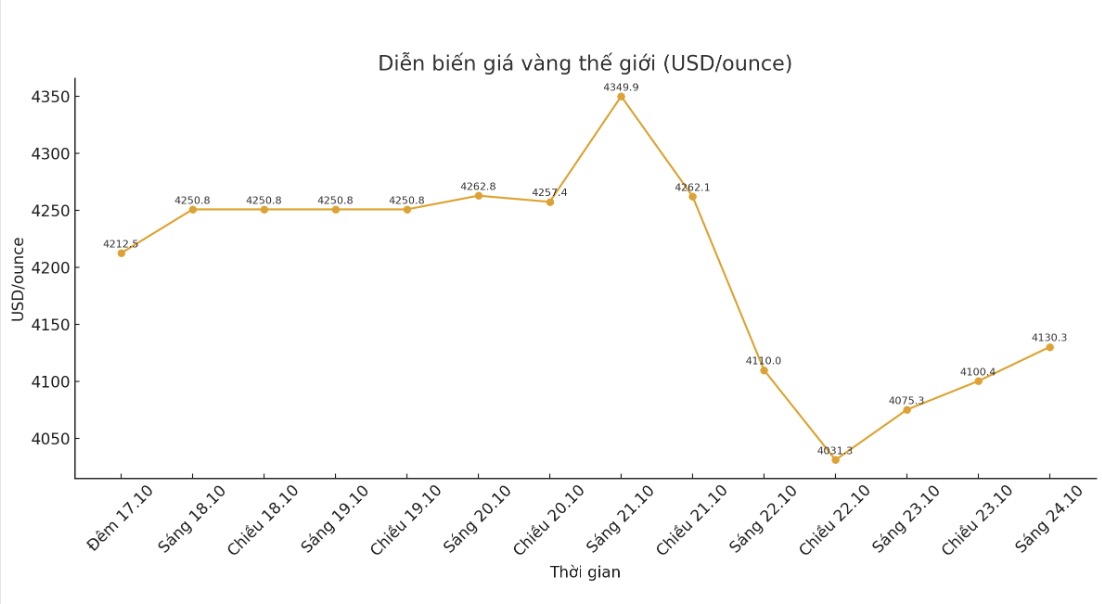

World gold price

Recorded at 0:30 am, the world spot gold price was listed at 4,130.3 USD/ounce, up 99.1 USD.

Gold price forecast

According to Jim Wyckoff - senior analyst at Kitco, world gold and silver prices rebounded as bottom-fishing buying pressure appeared after previous deep declines. The price fluctuations remain high, which if prolonged can be disadvantageous for investors expecting prices to increase.

Despite the recent strong correction, analysts believe that the increase in gold prices will continue thanks to expectations of a Fed rate cut and a weakening USD, boosting demand for buying from institutional and individual investors. Morgan Stanley assessed gold as continuing to play an important safe-haven asset in the context of geopolitical instability, concerns about US policy and strong capital flows into ETFs as well as net purchases from central banks. The organization has raised its gold price forecast for 2026 to $4,400/ounce.

However, risks remain if the US dollar remains strong or the Fed cuts rates less than expected. Gold prices that are too high can reduce jewelry demand and cause central banks to reduce purchases. Mineral supply is increasing slowly, while the mining industry is unlikely to experience a new investment "super cycle" due to procedures and finances.

Technically, buyers still dominate the gold market in the short term. The next target is to break above the key resistance zone of $4,250/ounce, while the sellers aim to pull prices back below the psychological support level of $4,000/ounce.

The 4,175 - 4,200 USD/ounce area is a notable barrier. The levels of 4,100 USD/ounce and 4,079.6 USD/ounce played a near support role.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...