Over the past 12 months, gold futures have increased by nearly 60%, reaching a record in the session to 4,398 USD/ounce earlier this week. This is the strongest increase in decades as investors seek precious metals amid economic and geopolitical instability and confidence in institutions declining globally.

Since mid-August, gold prices have increased by 32%, causing daily fluctuations in gold and silver prices to increase sharply, while mining stocks and silver have begun to weaken relatively. This development warns that the market will enter the profit-taking stage after a series of increases for 9 consecutive weeks.

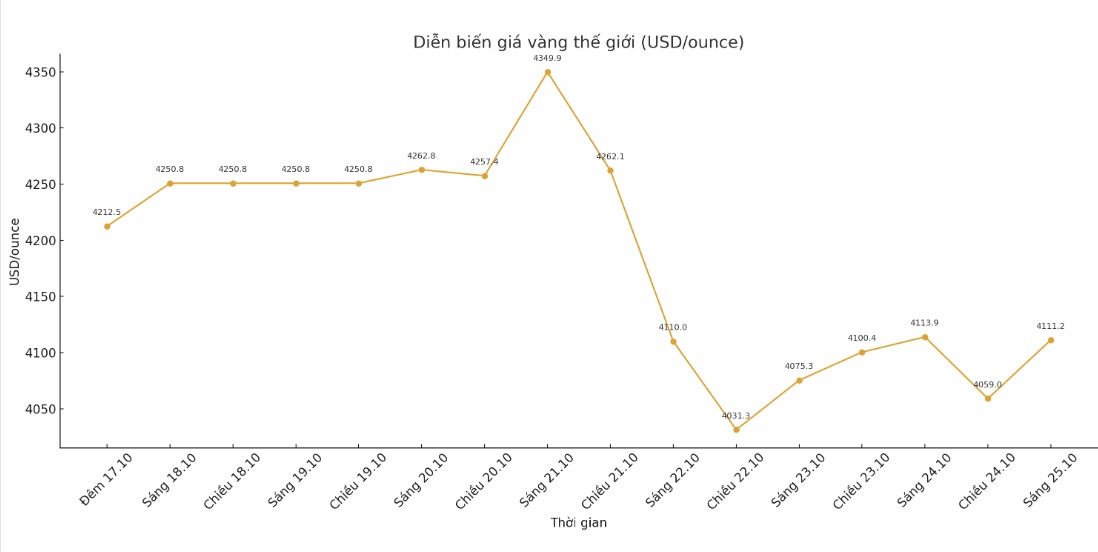

On Tuesday, gold prices fell 5.4% - the strongest daily decline since 2013, with a time of a plunge of more than 6% and dragging silver and other precious metals down.

Recent price fluctuations signal an unpredictable trading period with large opportunities, causing both buyers and sellers to be cautious after CME raised the deposit for gold contracts by 5.5% and silver by 8.5% last weekend.

Although the shocking decrease due to the sell-off caused confusion, this could be a necessary adjustment after a long period of heating up.

Since the beginning of the year, silver has increased by 70%, but has also just seen a 7.2% decline from a historical peak of over 54 USD/ounce - the strongest decrease since September 2011.

As mentioned in the article two weeks ago, the silver market has been in a state of "backwardation" since the beginning of October due to a shortage of supply in London, causing spot prices here to be significantly higher than in New York. This is an important catalyst to help silver surpass the $50 resistance zone - a level that is considered the " Maginot limit" after 45 years.

However, the large amount of silver transported from the US and China to Europe last week has helped cool down material shortages, dragging in spot delivery fees and lower short-term loan interest rates. In addition to the CME increasing its reserves, profit-taking activities took place strongly, causing silver prices to fall below the $50 mark in the middle of the week.

Meanwhile, zinc inventories at LME continued to decrease to 35,300 tons - just enough to meet one day of global consumption, raising new shortage concerns.

The platinum market also recorded a strong leap: spot prices in London increased by 6.4% to 1,646 USD/ounce - the largest daily increase since 2020. Nymex futures increased to a maximum of 4.1%.

According to Dan Ghali - expert of TD Securities, the platinum market is tightening seriously and is at risk of repeating the "squeeze like silver".

December gold futures fell close to the nearest support zone of $4,000/ounce at times, recording a 9% decline in just two days, before recovering to $4,150/ounce at the end of Thursday's session.

The implied volatility of gold is at its highest level in 3 years. CME Group said that the volume of precious metals trading reached a record 2.829 million contracts last Friday.

Analysts predict the fluctuations will be even extreme as the US Federal Reserve (FED) prepares for a policy meeting next week in the context of a lack of economic data due to the US government's prolonged closure. The Fed is expected to cut another 25 basis points while inflation remains above the 2% target.

Before the "no speech ban" period, FED Chairman Jerome Powell affirmed the direction of monetary easing and said that the labor market could weaken further. The Fed is also about to stop narrowing its $6,600 billion accounting balance sheet.

Powell admitted: Given the current view, we could have - and perhaps should - stopped buying assets sooner.

As the US Treasury continues to issue record debt, gold and silver are seen as alternative shelters in the context of a decline in demand for buying government bonds from the private sector and foreign central banks. US public debt has surpassed $38 trillion - just two months after reaching $37 trillion.

Concerns about the risk of a public debt crisis and the controversy over the Fed's independence are mounting.

In the long term, gold prospects are still being reinforced by falling real interest rates, central banks increasing gold purchases and escalating global public debt. However, in the short term, gold having to hold the support level of 4,000 USD/ounce along with the relative weakness of silver and the mining group shows that the ability to make a profit continues.

See more news related to gold prices HERE...