According to the US Department of Labor's Monthly Employment and Labor Revenue Survey (JOLTS) report, the number of job positions being recruited in May increased to 7.77 million, exceeding the forecast of 7.32 million and higher than the 7.39 million in April.

This is the highest level since January, reflecting strong recruitment demand. In the same month, the number of recruited workers increased slightly to 5.5 million, while the total number of workers who quit or were laid off decreased to 5.2 million.

The newly released JOLTS data far exceeded the forecast, reflecting that recruitment demand in the US is still very strong. The stable labor market has reduced expectations that the US Federal Reserve (FED) will soon cut interest rates, because the economy has not shown any clear signs of weakness and there is still potential inflationary pressure.

This is a disadvantage for gold prices in the short term, because high interest rates increase the cost of holding gold, often hindering the attractiveness of precious metals.

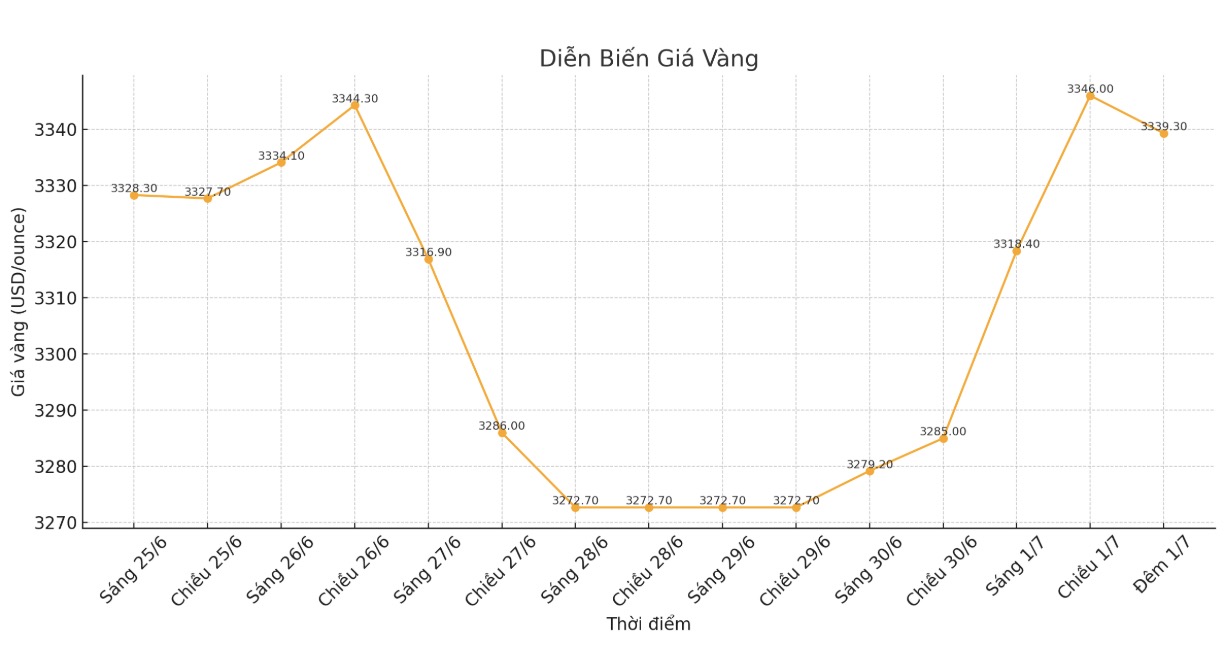

In fact, after the employment data was released, gold prices adjusted slightly from the peak in the session, but still maintained above the important support level thanks to other supporting factors such as inflation concerns and geopolitical risks.

At the same time, the Institute for Supply Management (ISM) announced that the Producer Purchasing Managers' Index (PMI) increased to 49 points in June, up from 48.5 in May and exceeding the forecast by 48.8 points. This is a sign that the rate of production decline is slowing down, thanks to improved inventory and output.

Ms. Susan Spence - Chairman of the ISM Manufacturing Business Survey - said that the manufacturing index has increased sharply to 50.3 points, surpassing the threshold of expanding manufacturing activities, while the Price Index increased slightly to 69.7, showing high inflationary pressure. However, the New Order index decreased to 46.4 points, and the Employment index continued to decrease to 45, reflecting that businesses are still cautious in recruiting despite increased output.

The US manufacturing PMI index rose more than expected, showing that the rate of production decline is slowing down thanks to improved inventories and output. This development partly puts light pressure on gold prices, as more stable economic signals could reduce safe-haven demand and make the Fed not rush to cut interest rates.

However, the PMI remains below 50, reflecting shrinking manufacturing, while inflationary pressures continue to increase. Therefore, this information is not strong enough to reverse the upward trend of gold in the medium term, but only slows down the increase in the short term.

Although the Fed has not rushed to ease policy, investors still expect a rate cut to take place after the summer, continuing to support gold prices in the medium term.