According to commodity strategists at Goldman Sachs (a leading financial - investment banking group in the US, with a large influence in the global financial market), if private investors participate in asset diversification along with central banks, gold prices could even far exceed the base forecast of 4,900 USD/ounce.

The power race for AI and geopolitics between the US and China, along with major fluctuations in global energy supply, are key factors that shape our investment views" - Goldman Sachs wrote in the 2026 commodity outlook report.

Looking ahead, Goldman Sachs believes that their base macroeconomic scenario includes "solid global GDP growth and the Fed cutting interest rates by a total of 50 basis points in 2026", thereby further supporting the upward momentum of the commodity market.

Goldman Sachs experts emphasize that two major structural trends will dominate the commodity market next year.

First, on a macro level, goods are likely to remain the focus of geopolitical and technological competition – AI between the US and China," the report said. “Second, on a micro level, two major waves of energy supply starting from 2025 will lead our forecasts for the energy group.”

Among all commodities under consideration, Goldman Sachs is most optimistic about gold – in which central banks' buying demand is key.

We forecast that central banks will continue to buy gold strongly in 2026, averaging about 70 tons per month (nearly the average of 66 tons in the past 12 months, but 4 times higher than the level of 17 tons/month before 2022), and this factor will contribute about 14 percentage points to the forecast gold price increase until December 2026 for three reasons," experts analyzed.

First, the freeze of Russia's reserves in 2022 created a major turning point in how reserve managers in emerging economies perceive geopolitical risks.

Second, the proportion of gold reserves of many central banks in emerging markets, such as the People's Bank of China (PBoC), is still low compared to the global average, especially in the context of China's desire to internationalize the Renminbi. Third, surveys show that the central bank's demand for gold is at a record high.

Goldman Sachs also believes that their gold price forecast also contains increased risks if this asset diversification trend spreads to the private investor sector - which has caused investors and central banks to directly compete for gold supply, thereby contributing to the formation of a price-rising market that has lasted for many years.

Gold ETF funds currently account for only 0.17% of US private investors' financial portfolios, 6 basis points lower than the 2012 peak," Goldman Sachs said. "We estimate that every time the proportion of gold in US investors' financial portfolios increases by 1 basis point – due to buying more gold rather than price increases – gold prices will increase by about 1.4%.

In addition, Goldman Sachs emphasizes the "security" role of goods for investment portfolios in the current geopolitical context.

Even though gold is still our most preferred long-term buying commodity, we believe that broader holding of commodity types in strategic portfolio allocation is very necessary," the report wrote. "Goods supply is geographically highly concentrated, while geopolitical, trade and AI competition is increasing, making the use of commodity advantage as a pressure tool more common. This increases the risk of supply disruption and emphasizes the risk hedging value of goods.

Experts warn that "the portfolio of stocks and bonds is not really well diversified in the event that commodity supply shocks both increase inflation, weaken growth, and push commodity prices up.

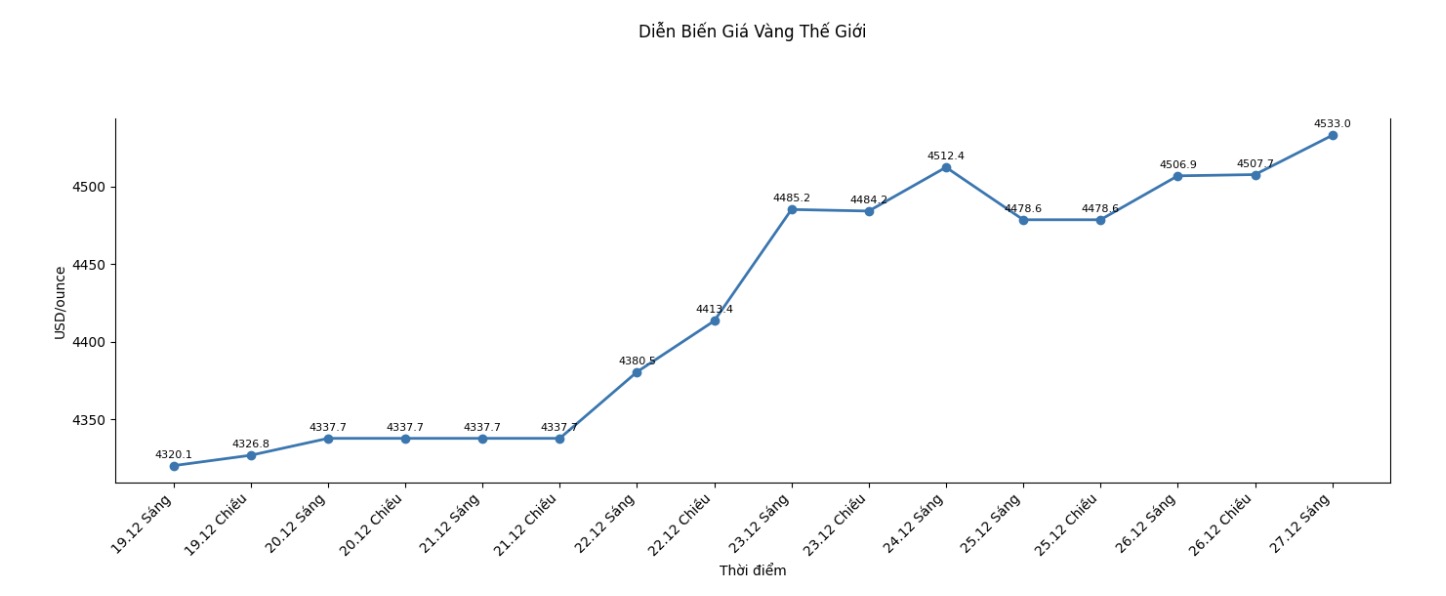

According to Goldman Sachs' forecast, gold prices may adjust to a low of 4,200 USD/ounce in the first quarter of 2026, then rise back above 4,400 USD/ounce in the second quarter. In the third quarter, gold prices may set a new historical peak around 4,630 USD/ounce, before reaching about 4,900 USD/ounce at the end of the fourth quarter of 2026.