Gold prices rose sharply, while silver hit a 14-year high as safe-haven demand increased after the US government officially closed.

December gold futures rose 37.8 USD to 3,911 USD/ounce. Meanwhile, December silver futures rose $0.925, to $47.565 an ounce.

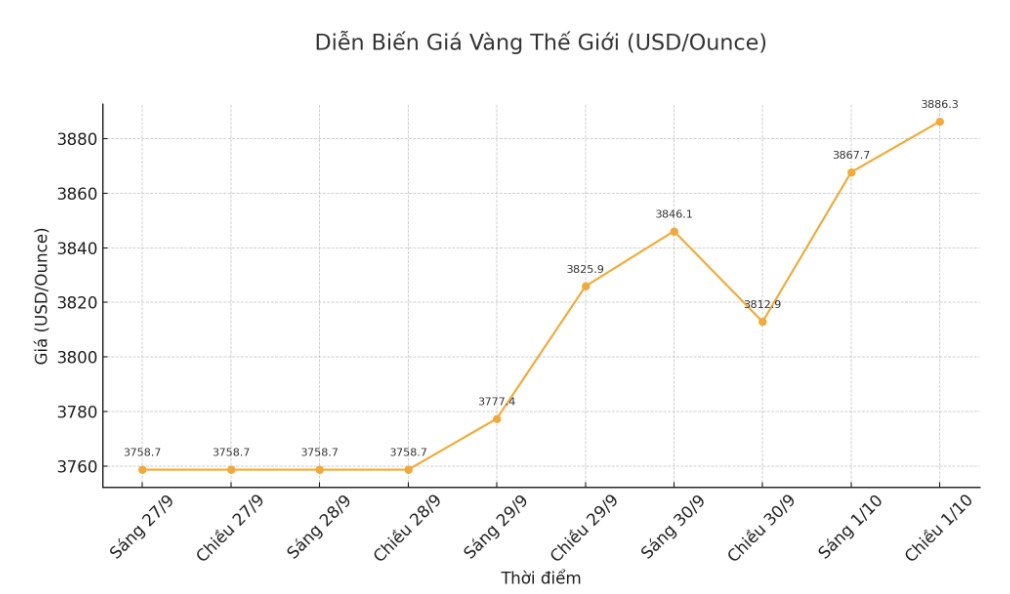

Thus, gold prices are now only a short way from the $4,000/ounce mark. Since the beginning of the year, the precious metal has gained more than 48%, heading for its biggest annual gain since 1979. Silver prices are also approaching the record of over $50/ounce set in 1980.

The US government entered a state of closure for the first time in nearly 7 years when the midnight budget deadline passed without a deal from the Congress.

The White House has asked agencies to implement plans for the lack of funding. This will cause hundreds of thousands of workers to temporarily lose their jobs, many public services to stagnate, and risk pushing up the unemployment rate and delaying the September employment report expected to be released at the end of the week.

The global stock market fluctuated in different directions. US stock indexes are expected to open down as they enter the New York trading session.

Meanwhile, some organizations predict that crude oil prices may fall to the $50/barrel range in the coming quarters due to the "serious supply situation".

Macquarie Group's analysis team believes that oil supply from OPEC+ and other producers will cause the market to fall into a surplus, with a surplus of up to 4.63 million barrels/day in the first quarter of next year.

The International Energy Agency (IEA) previously forecast that global output will exceed the average demand of 3.33 million barrels/day in 2026 - a record annual supply surplus.

Technically, the upward trend of December gold futures still dominated strongly. The next target for buyers is to close above the $4,000 resistance level. On the contrary, the sellers will aim to bring the price below the solid support zone of 3,750 USD.

The most recent resistance level was recorded at the peak overnight of 3,922.7 USD/ounce and then 3,950 USD/ounce. The first support was at the bottom of overnight at $3,880.30/ounce, followed by $3,850/ounce.

Overseas markets today showed a slight decrease in the USD index, crude oil prices traded around 62 USD/barrel, and the yield on the 10-year US Treasury note was 4.152%.

See more news related to gold prices HERE...