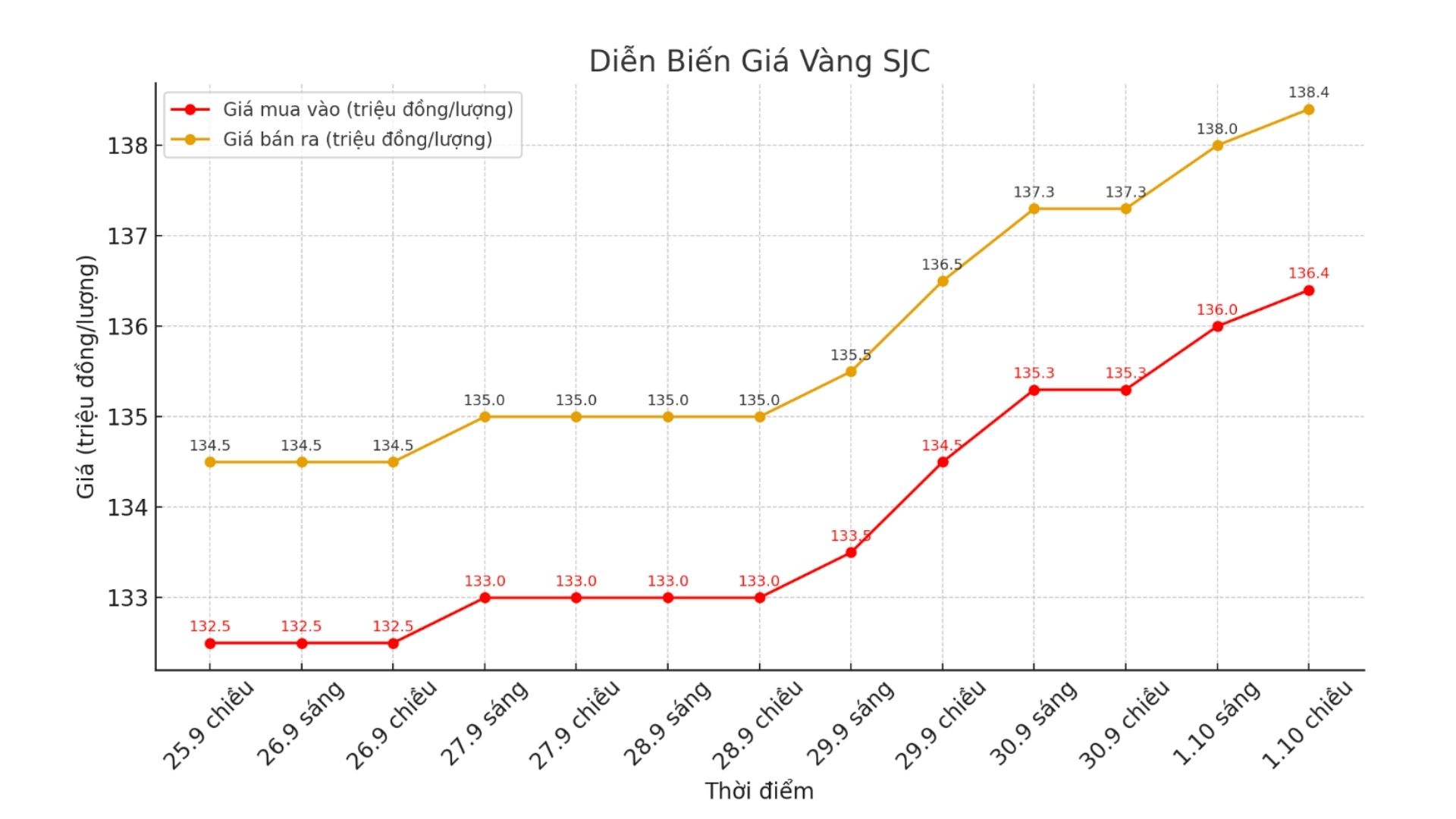

SJC gold bar price

As of 5:55 p.m., DOJI Group listed the price of SJC gold bars at VND136.4-138.4 million/tael (buy - sell), an increase of VND1.1 million/tael in both directions compared to a day before. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 136.4-138.4 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions compared to a day ago. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 135.6-138.4 million VND/tael (buy - sell), an increase of 2.3 million VND/tael for buying and an increase of 1.6 million VND/tael for selling compared to a day ago. The difference between buying and selling prices is at 2.8 million VND/tael.

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 132-135 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions compared to a day before. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 133-136 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Phu Quy listed the price of gold rings at 133.3-135.3 million VND/tael (buy - sell), an increase of 2.7 million VND/tael for buying and an increase of 1.7 million VND/tael for selling at 2 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

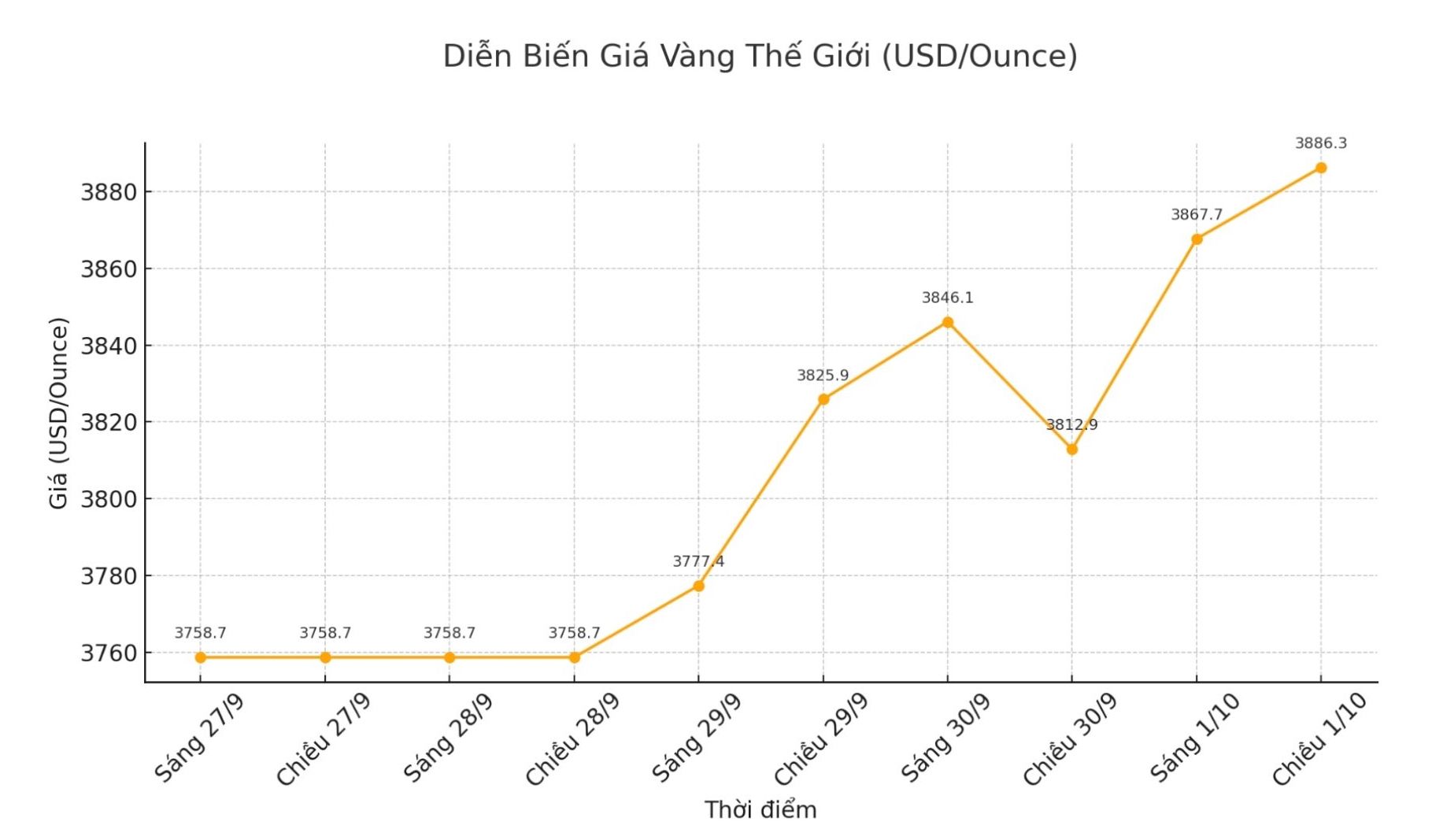

World gold price

The world gold price was listed at 6:35 p.m. at 3,886.3 USD/ounce, a sharp increase of 73.4 USD compared to a day ago.

Gold price forecast

Gold prices rose to a record high on Wednesday, thanks to safe-haven inflows after the US government's official shutdown and weak labor figures, increasing expectations of the US Federal Reserve (FED) cutting interest rates.

On October 1, the US government officially closed after the Senate rejected a temporary spending bill, opening a budget crisis that would have caused the government to close for the 15th time since 1981, according to the US Treasury Department.

The reason comes from the long-standing disagreement between Republicans and Democrats in approving a $1.7 trillion budget package to maintain the operations of federal agencies.

Nicholas Frappell - global director of organizational markets at ABC Refinery - said that the US government's closure opens up the risk of a long-term deadlock, which could cause thousands of federal employees to lose their jobs.

Gold is benefiting from concerns about a weakening US dollar, tense political situations related to the US government's shutdown, as well as general geopolitical instability.

He said the outlook remains positive, with gold likely heading towards $3,900/ounce, possibly even $4,000/ounce," said Nicholas Frappell.

According to Michael Hsueh - precious metals analyst at Deutsche Bank - risks that could curb gold's increase include the USD reversing to increase prices, a surprisingly strong FED policy, and fiscal reform in the US.

Gold is considered a safe haven in the context of economic and political instability, and benefits from a low interest rate environment due to no interest. Since the beginning of the year, gold has increased by more than 47%.

Meanwhile, markets in China - the world's largest gold consumer - are still closed for the Mid-Autumn Festival holiday and will reopen on October 9.

In India, gold imports from August to September have almost doubled. Over the past few weeks, banks and gold shops have been rushing to clear large amounts of gold, an unnamed Indian government official told Reuters. Its been a long time since weve seen such a bustling scene.

Notable economic data of the week

Wednesday: ADP Private sector Employment Report (US), ISM Manufacturing PMI.

Thursday: Application for weekly unemployment benefits (US).

Friday: US Non-farm Payrolls, ISM Services PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...