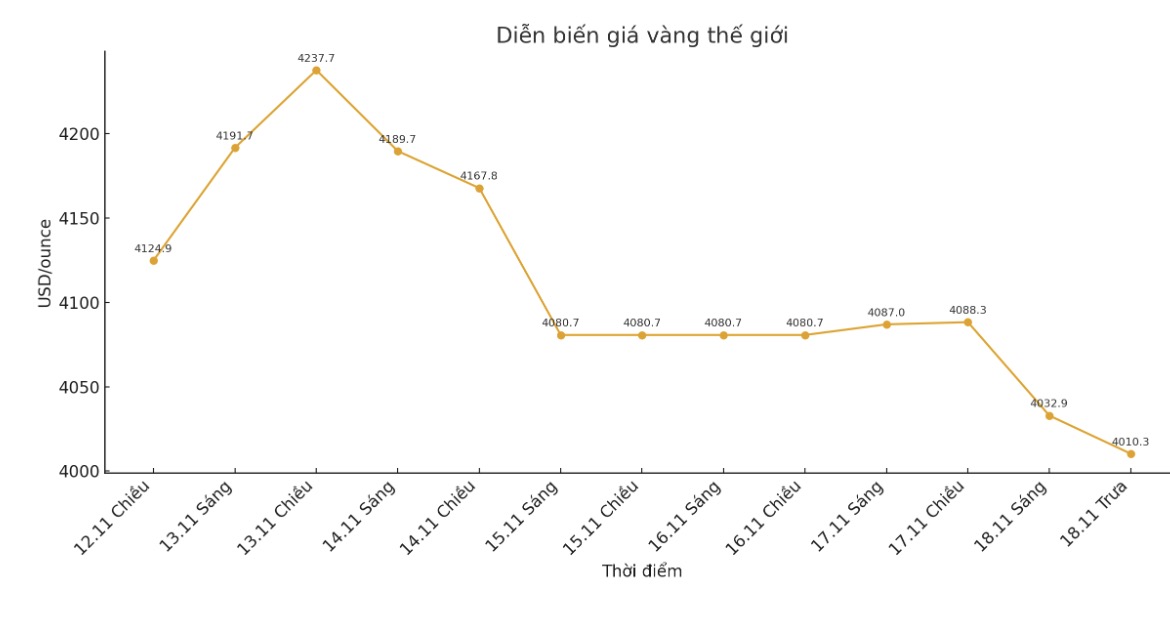

After many tense sessions, the gold market is recording a sharp decline. The downward trend began to appear from last night. At 9:50 p.m. on November 17 (Vietnam time), it was at 4,073.3 USD/ounce, down 7.4 USD compared to a day ago.

By 9:13 a.m. on November 18, the world gold price fell more than 40 USD, down to 4,032.9 USD/ounce. However, the decline shows no signs of stopping. At the time of writing (11:00 on November 18), world gold prices approached the threshold of 4,000 USD/ounce.

World gold prices fell due to pressure as production data improved in the US. According to a report from the New York Federal Reserve, the Empire State Manufacturing Survey rose to 18.7 in November, up from 10.7 in October. This figure far exceeded expectations when economists forecast 6.1.

In addition, gold prices have decreased partly due to the impact of many unfavorable factors in the international market. The strong increase in the US dollar makes gold more expensive for investors holding other currencies, thereby reducing demand.

At the same time, expectations of the US Federal Reserve (FED) cutting interest rates soon weakened, making the market less optimistic about the precious metal. In addition, after a series of hot sessions, many investors took advantage of profit-taking, creating increased selling pressure and dragging gold prices down.

Despite the sharp decline, gold prices still receive many solid supporting factors. In a remarkable development, Goldman Sachs said central banks are likely to have purchased a large amount of gold in November, following a multi-year trend of diversifying reserves to protect against geopolitical and financial risks.

The group estimated purchases of 64 tons in September, up from 21 tons in August. Goldman reiterated in a note that gold prices will reach $4,900 by the end of 2026, with the possibility of increasing further if private investors continue to diversify their portfolios.

The above information creates a strong and sustainable support for the price increase trend. Along with expectations of the FED cutting interest rates and increasing cash flow into gold ETFs, market sentiment has become more positive, boosting investment demand for gold.

See more news related to gold prices HERE...