Regulations paving the way for financial technology platforms

According to Circular 40/2024/TT-NHNN, effective from July 1, 2025, payment intermediaries are allowed to receive money directly from banks through the NAPAS system.

This new regulation has paved the way for financial technology platforms to directly participate in the connection layer of national financial infrastructure along with the traditional banking system, instead of providing only Utilities, towards a unified financial infrastructure, where banks and Fintech operate on the same connection standard, the same safety standard.

This also reflects that Vietnam is approaching the "interoperable payment infrastructure" model that many countries such as Singapore, Thailand, and Malaysia have developed, where all cash flows can be transmitted instantly, safely, and transparently between systems.

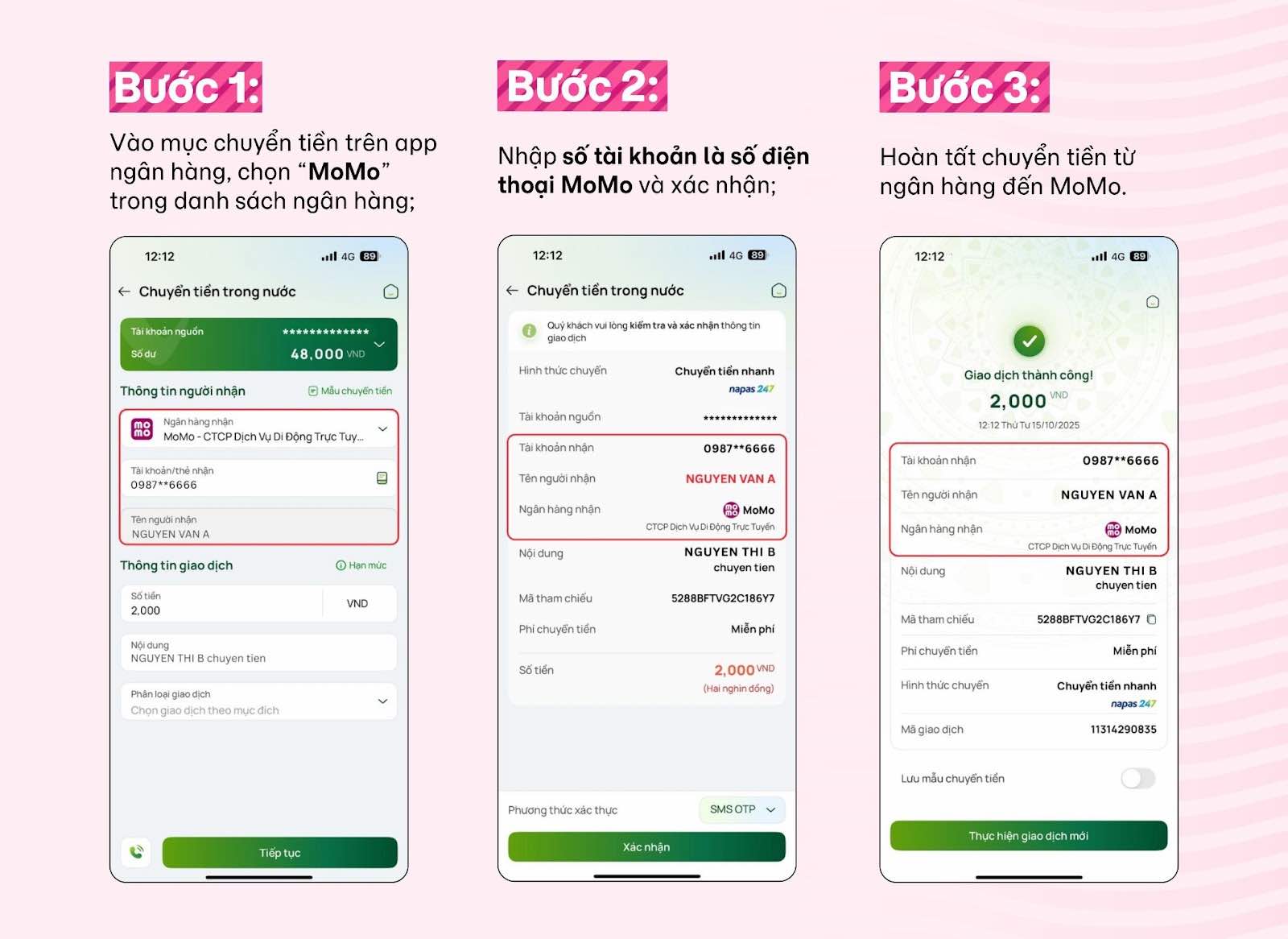

In that picture, businesses with technological capacity and large-scale operations such as MoMo are considered one of the important guidelines to help realize this model. From October 2025, users can receive money from banks via the MoMo phone number corresponding to the account number. When transferring money, the sender only needs to select "MoMo" in the list of beneficiary banks, enter the recipient's phone number and confirm the transaction. The list of banks that have supported this money transfer method is still constantly updated on the official information page.

Interconnection - a new milestone in the development process of fintech Vietnam

In the early stages, the Vietnamese fintech market developed mainly through service innovation to help users pay, transfer, invest, and insurance more conveniently. But with the market reaching a large scale and payment infrastructure expanding, the game is now shifting from utility competition to infrastructure interconnection.

Not standing outside the system, fintech businesses are becoming a part of the financial operating structure, playing a role in maintaining cash flow, data and security for tens of millions of users.

This is an important milestone demonstrating the technological capacity and readiness of domestic fintech platforms. To realize connection to the banking system, payment intermediaries must meet a series of criteria: the ability to process millions of transactions in real time per day, international security standards, and the ability to monitor risks and data security equivalent to banks. MoMo becoming the first unit to directly connect shows that fintech Vietnam has met strong enough technical standards to participate in financial infrastructure where the requirements for reliability are no different from commercial banking.

Looking more broadly, this is not only a milestone of MoMo alone, but a clear demonstration of Vietnam's fintech process of transforming from service innovation to infrastructure connection, helping to ensure that systems can operate synchronously, reduce intermediary costs and increase stability for the entire financial infrastructure when the digital economy expands

Allowing money transfer from banks to MoMo through account numbers first of all helps users transfer money more conveniently, and looking at the broader picture, it also affirms the position of domestic technology enterprises in shaping national financial infrastructure.