If the vehicle owner wants to receive insurance for himself, he must purchase another type of motorbike insurance.

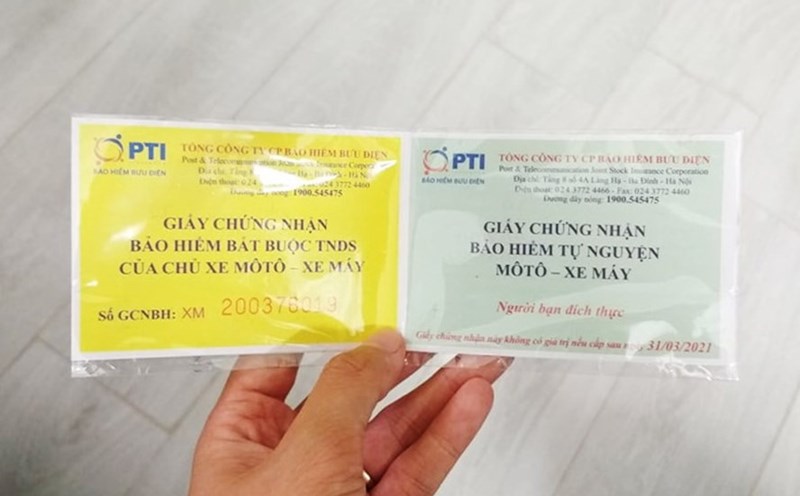

There are two types of motorcycle insurance: compulsory insurance and voluntary insurance.

Compulsory insurance is civil liability insurance for motor vehicle owners. Without this type of insurance, people will be fined according to the law.

Voluntary motorcycle insurance is a non-compulsory type of insurance. Traffic participants can buy additional insurance to provide financial compensation for property or passengers (including the vehicle owner and passengers) in case of accidents or incidents. If people do not buy this insurance, they will not be fined. On the contrary, if they only have voluntary insurance but do not have compulsory civil liability insurance for motor vehicle owners, they will still be fined.

A survey by Lao Dong Newspaper reporters in early November at a number of insurance companies with voluntary insurance products that pay compensation for health and life for people in the car (including the car owner and passengers) typically includes Cathay Century Insurance, VNI Insurance, Abic Insurance...

Passenger insurance premiums vary widely from insurance company to insurance company.

Accordingly, Cathay Century Insurance Company introduces passenger insurance, the unit price of this insurance is 56,000 VND. The compensation level is 30 million VND/person/incident.

For this type of insurance, VNI charges the following fees: vehicle owners can choose to participate in insurance amounts from 1 million/person/incident to 10 million/person/incident.

ABIC insurance charges this insurance fee at 20 thousand/1 year. The liability insurance level for people is 10 million/person/incident.

Regarding administrative procedures for passenger insurance, each insurance company has its own regulations. Companies such as VNI and Cathay have their own regulations on insurance acceptance procedures.

ABIC notifies the procedure, the insured person cooperates with ABIC to collect documents and papers after the accident:

Accident notice and claim form (according to the company's form).

Certified copy of competent authority or ABIC representative:

Certificate of insurance.

Vehicle registration.

Driving license (where required by law).

A copy of the Police's Accident Investigation Conclusion or the Accident File (certified by the Police where the accident was handled) including:

Crime scene investigation report, crime scene diagram, photo copy.

Minutes of inspection of vehicles involved in the accident.

Preliminary announcement of initial investigation results of traffic accident.

Other documents related to the traffic accident (if any).

In case the incident does not involve or does not require the participation of the Police, the Vehicle Owner shall immediately notify (except in cases of legitimate reasons) ABIC to coordinate in preparing a file and collecting documents proving the cause and settlement of the accident or the compensation claim file must include the full name, address, phone number... of the witness and confirmation from the local authorities where the accident occurred.

Minutes and documents determining the responsibility of the Third Party (in case of involving a Third Party).

Effective Court Judgment or Decision (if any).

Documents to determine damage:

Personal injury includes: Medical documents determining the injury status of the Insured such as: Hospital discharge papers; Surgery papers; Medical records; Medical records; Certificate of disability rate; X-ray readings; Films; Death certificate (in case of death)...