First of all, buyers need to understand that the name motorcycle insurance is an abbreviation. Motorcycle insurance has two types: compulsory insurance and voluntary insurance.

Compulsory insurance is civil liability insurance for motor vehicle owners. Without this type of insurance, people will be fined according to the law.

Voluntary motorcycle insurance: This is a non-compulsory insurance. Traffic participants can buy additional insurance to provide financial compensation for property or passengers (including the vehicle owner and passengers) in the event of an accident, fire or theft. If people do not buy this insurance, they will not be fined. On the contrary, if they only have voluntary insurance without compulsory civil liability insurance for motor vehicle owners, they will still be fined.

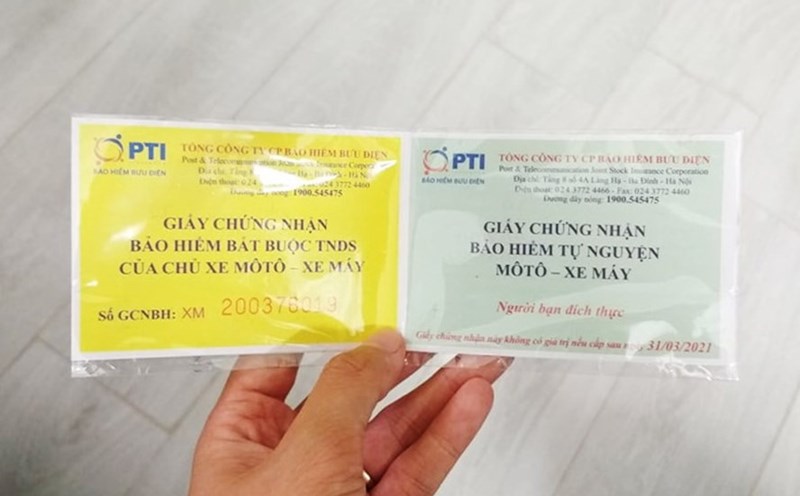

Survey by Lao Dong Newspaper reporter at the end of October at some insurance companies such as: PTI Motorcycle Insurance of Post and Telecommunication Joint Stock Insurance Corporation, Bao Viet Insurance, MIC Military Insurance, PVI Insurance Corporation... The selling price of civil liability insurance for motorcycles (motorbike insurance) has the same price.

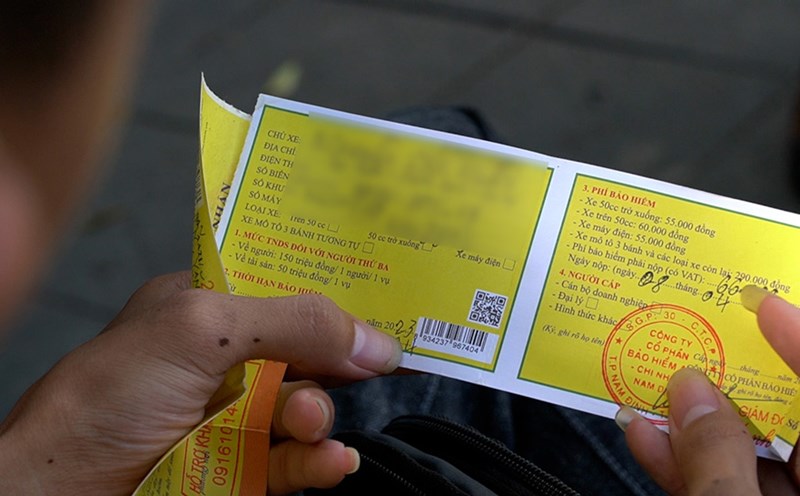

Accordingly, the common motorbike insurance price for motorbikes over 50cc of all companies is 66 thousand/year.

Motorbikes under 50cc: 60,500 VND/year.

Large displacement motorbikes, 3-wheeled motorbikes and other vehicles over 175cc: VND 319,000/year.

Companies note that people need the following documents when buying motorbike insurance:

Citizen ID/National Identity Card/Passport. A copy may be used.

Motorcycle registration or vehicle registration. A copy is acceptable.

While compulsory motorbike insurance has a unified and common price, voluntary motorbike insurance has fewer insurance companies participating, and the price of voluntary motorbike insurance is not the same.

In addition to compulsory civil liability insurance products, Vietnam Aviation Insurance Corporation (VNI) also has voluntary motorbike insurance products, which are accident insurance for passengers.

For this type of insurance, VNI charges the following fees: vehicle owners can choose to participate in insurance amounts from 1 million VND/person/incident to 10 million VND/person/incident.

In addition, VNI also sells physical damage insurance for motorbikes. VNI announces that the insurance premium for this type of insurance is 1% x insurance amount.

The amount of insurance the policyholder requests for vehicle insurance, the insurance amount cannot be greater than the market value of the vehicle.

VNI compensates motorbike owners who purchase physical insurance for physical losses and damages to the vehicle due to the following causes:

Fire and explosion: VNI pays compensation according to the market value of the vehicle at the time of loss but not exceeding 100% of the insurance amount.

Theft at parking lots as prescribed: VNI pays compensation according to the market value of the vehicle at the time of loss but not exceeding 100% of the insurance amount.

Theft at home, residence; robbery: VNI pays compensation according to the market value of the vehicle at the time of loss but not exceeding 80% of the insurance amount.

Cathay Century Insurance Company also introduces compulsory civil liability insurance for VND66,000/year.

Passenger insurance, the unit price for this type of insurance is 56,000 VND. The compensation level is 30 million VND/person/incident.