According to the Ministry of Finance, the current compulsory insurance fee is regulated to be 55,000 VND to 60,000 VND. When unfortunately causing an accident to a third person in terms of health and life, insurance will pay a maximum of 150 million VND/person in an accident. The insurance will pay a maximum of 50 million VND for assets in an accident.

The voluntary motorbike insurance premium will be announced by the insurance companies.

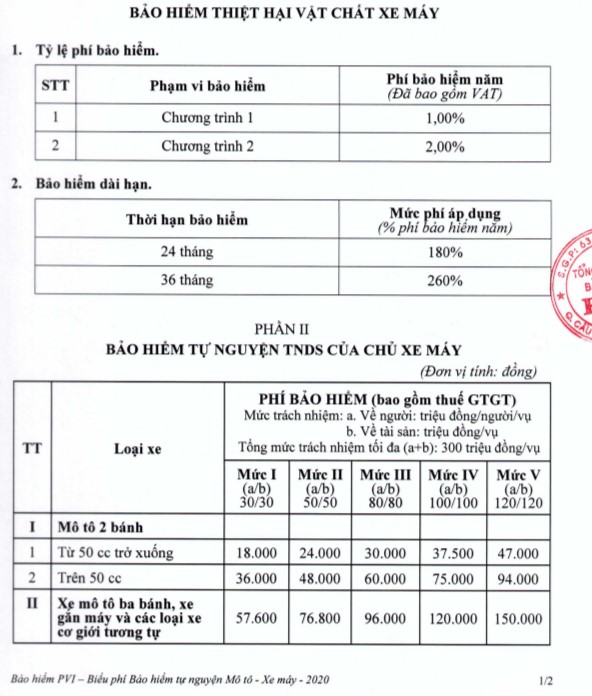

According to a reporter's survey on March 18, PVI Insurance has some voluntary motorbike insurance as follows:

Insurance for accidents of drivers and passengers on motorbikes. This insurance buyer is compensated in case of death or physical injury while driving a motorbike.

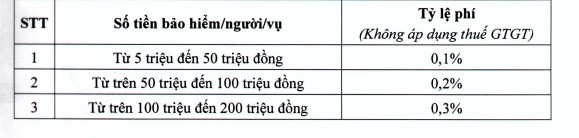

Insurance fees are as follows:

This unit also has motorbike physical damage insurance, a cooperation program with FE Credit. The insured is the owner of a vehicle participating in traffic in Vietnam and has a validity period of up to 10 years (from the date of initial registration).

Insurance benefits, vehicle owners are compensated for material damage caused by natural disasters and unexpected and unpredictable accidents.

The principle of determining this insurance amount and insurance fee is as follows: The insurance buyer participates in insurance with the insurance amount equal to the value of the vehicle at the time of insurance participation. The insurance premium is the insurance amount x 1.65% (including value added tax).

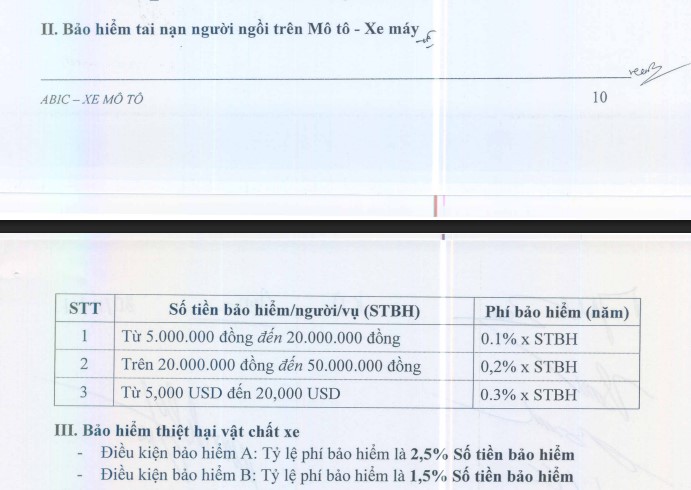

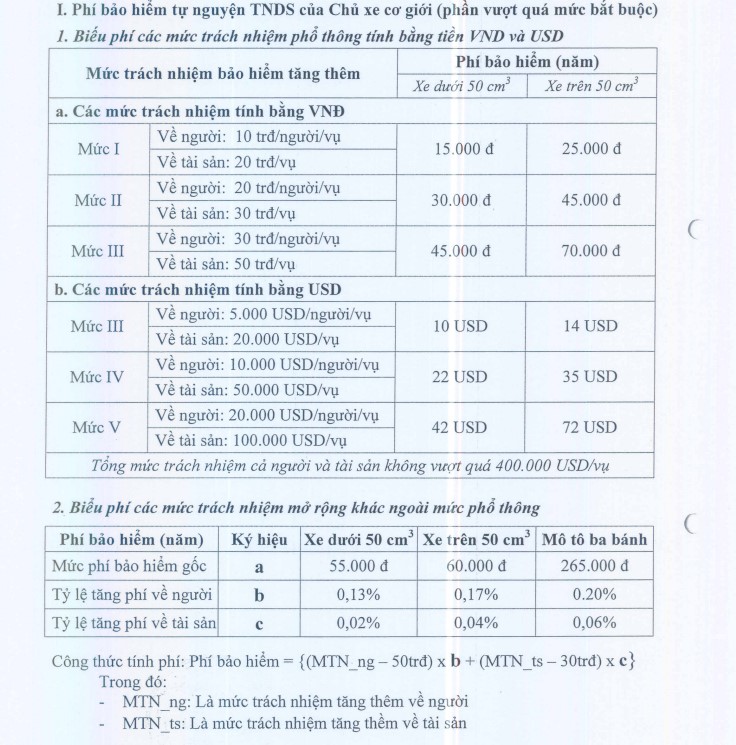

Agribank Insurance (ABIC) has insurance for motorbike accident, material damage and voluntary civil liability insurance for motorbikes increased compared to the mandatory level.

ABIC's voluntary motorbike insurance coverage is the same as accidents that occur to insured people while sitting on or getting off a vehicle while participating in traffic in Vietnam

material damage to the vehicle due to unexpected accidents beyond the control of the vehicle owner or driver in the following cases:

Collision, overturned, fell, and was hit by other objects.

Fire and explosion in cases of fire at private houses, parking lots, and offices.

Resurable natural disasters: Storms, floods, landslides, lightning strikes, earthquakes, hail, sunsets.

Theft, robbery of entire vehicle in the following cases:

Theft when the vehicle is parked at the parking lot with a vehicle parking certificate.

The theft at the parking lot of an agency was being guarded by someone.

Theft when the vehicle is left indoors in case there are signs of breach.

The car was stolen by force.

The ABIC voluntary motorbike insurance premium is as follows:

People should note that there are two types of motorbike insurance: compulsory insurance and voluntary insurance.

Compulsory insurance is civil liability insurance for motor vehicle owners. If there is no such insurance, people will be fined according to the provisions of the law.

Voluntary motorbike insurance is a type of insurance that is not compulsory. Traffic participants can buy more to bring benefits of financial compensation for property or people on the vehicle (including the vehicle owner and passengers) in the event of an accident or incident. If people do not buy this insurance, they will not be fined. On the contrary, if there is only voluntary insurance but no compulsory civil liability insurance of motor vehicle owners, people will still be fined.