According to Lao Dong Newspaper reporters, in late 2024 and early 2025, the real estate market will continue to have many apartment projects with new products for sale, providing a significant additional supply for the mid-range and high-end segments.

Most of the newly launched supply is in the high-end and luxury segments, lacking products in the mid-range and affordable segments. The selling prices of the projects are quite diverse, from 40-50 million VND/m2 for mid-range projects in suburban areas such as Gia Lam, Ha Dong, to more than 270 million VND/m2 for high-end projects located in central areas such as Tay Ho and Dong Da districts.

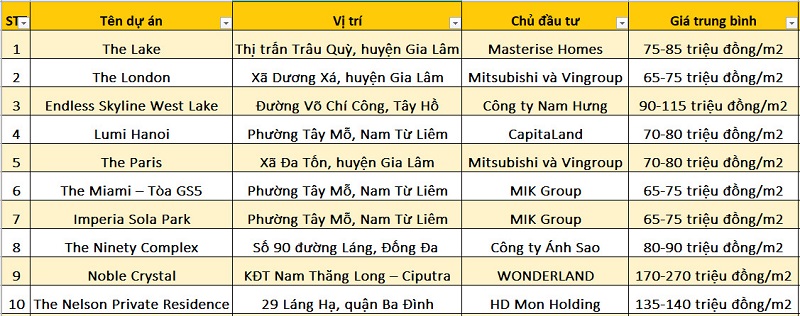

Some projects that have attracted great attention in the market include: The Lake in Gia Lam, with prices ranging from 75-85 million VND/m2; Endless Skyline West Lake in Tay Ho, with prices ranging from 90-115 million VND/m2; or Lumi Hanoi in Nam Tu Liem, with prices ranging from 70-80 million VND/m2.

It can be seen that the average price of primary products in Hanoi is currently quite high, around 60-120 million VND/m2. Even some high-end apartment projects in the suburbs of Hanoi are being offered for sale at hundreds of millions of VND/m2 such as Masteri Grand Avenue (Dong Hoi, Dong Anh) with an average price of 90-120 million VND/m2. MIK Group is also introducing Imperia Co Loa apartments (Dong Hoi, Dong Anh) to the market with prices ranging from 90-110 million VND/m2.

Suburban areas such as Gia Lam, Dong Anh, Ha Dong are currently attractive destinations for new projects thanks to their large land fund and more reasonable prices compared to the city center. Projects such as The London (65-75 million VND/m2), Imperia Sola Park (45-55 million VND/m2) or QMS Top Tower (40-50 million VND/m2) attract attention thanks to their reasonable prices.

Meanwhile, projects located in inner-city districts such as Tay Ho, Ba Dinh or Dong Da focus on the high-end segment, targeting high-income customers looking for real estate products with long-term value.

Looking at the statistics table of newly opened projects, an easily recognizable feature is that the current supply of apartments is not diverse, home buyers do not have many choices. Apartments are mainly in the high-end segment and "clustered" in a few projects, and there are not many investors "with goods". Notably, large investors such as Masterise Homes, Vingroup, CapitaLand or MIK Group are all present in the list of new projects, showing strong competition between major brands.

Commenting on the current selling prices and liquidity of apartments, Ms. Nguyen Hoai An - Senior Director of CBRE Vietnam - said that most of the newly opened projects are located in existing urban areas with high prices. In addition, the selling prices are at a high level partly because of the large investment demand, the cash flow is still pouring into products serving the real housing needs in the center. Therefore, market liquidity is still maintained positively.

It is forecasted that in 2025, the supply of apartments in Hanoi will continue to increase, mainly concentrated in suburban areas and places with strong infrastructure development. This will not only bring more choices for home buyers but also contribute to shaping the new urban development trend of the capital.