How to calculate the latest agricultural land use tax in 2025?

According to the provisions of Chapter 2 of the Law on Agricultural Land Use Tax 1993 and Chapter 2 of Decree 74-CP, agricultural land use tax is calculated according to the following formula:

Agricultural land use tax = Land area x Tax rate calculated in kilos of rice per unit of area of each land class

In which:

* Land area

- The taxable area of each taxpaying household is the actual land area recorded in the State land register or the most recent measurement result confirmed by the competent land management agency according to the provisions of Article 14 of the Land Law.

In case the locality has not established a land book and the measurement data is not accurate, and there is no confirmation from the competent land management agency, the taxable area is the land area recorded in the taxpayer's declaration.

In special cases in places that have not yet completed the land allocation according to Decree 64 64CP, cooperatives and production groups shall assign the taxable area to farming households and individual households for each household self-declaration and with confirmation from the head of the cooperative or agricultural production group.

- The taxable area of each plot of land is the actual area used, assigned to each taxpayer household in accordance with the area recorded in the land book or in the declaration of the household owner.

- Land management agencies at all levels within the scope of authority prescribed in Article 14 of the 2024 Land Law are responsible for coordinating with tax authorities to determine the tax calculation area in their localities.

* Tax rate calculated in kilos of rice on a unit of area of each land class

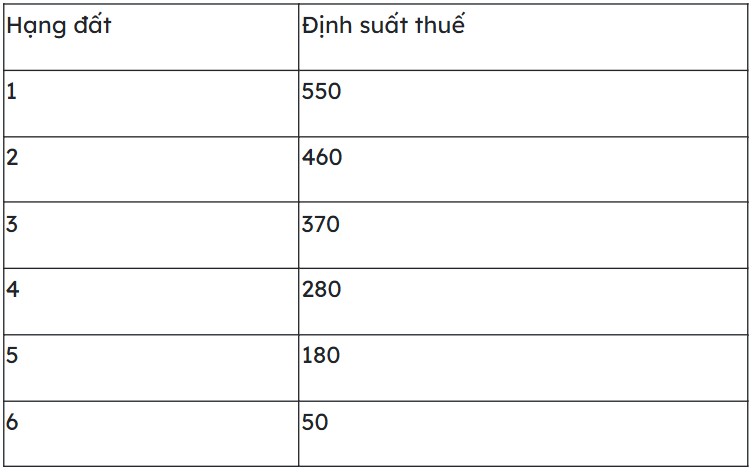

- For land for annual crops and land with aquaculture water surface:

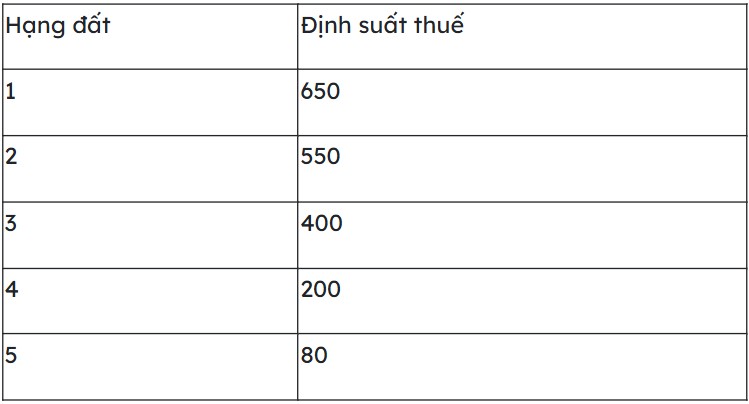

- For land for perennial crops:

- For perennial fruit trees grown on land for annual crops, the tax rate is as follows:

+ Estimated at 1.3 times tax on annual crop land use of the same class, if it is class 1, class 2 and class 3 land;

+ With tax on annual crop land of the same class, if it is class 4, class 5 and class 6 land.

- For land for growing perennial crops harvested once, the tax rate is 4% of the value of exploited output.

Note: Households using agricultural land exceeding the area limit prescribed by the Land Law, in addition to having to pay agricultural land use tax, must also pay additional tax prescribed by the National Assembly Standing Committee for the above area.

Who is subject to agricultural land use tax?

According to the provisions of Article 1 of Decree 74-CP, organizations and individuals using land for agricultural production are obliged to pay agricultural land use tax (collectively referred to as taxpayers) including:

(1) Farming households, private households and individuals;

(2) Organizations and individuals using agricultural land belonging to the land fund for public needs of the commune;

(3) Agricultural, forestry and fishery enterprises including farms, forestry farms, factories, farm stations and other enterprises, state agencies, public service units, armed forces units, social organizations and other units using land for agricultural production, forestry and aquaculture.