Newly opened primary supply decreased by more than 31% over the same period

According to the One Mount Group Market Research & Customer Insight Center, in the first quarter of 2025, only about 340 new apartments were opened for sale in Ho Chi Minh City - down 31.1% over the same period last year. This is the lowest level since the beginning of 2023.

Mr. Tran Minh Tien - Director of One Mount Group Market Research & Customer Insight Center - commented that the main reason comes from the cautious psychology of investors, in the context of many fluctuations in the macro economy and the market needs more time to restore confidence.

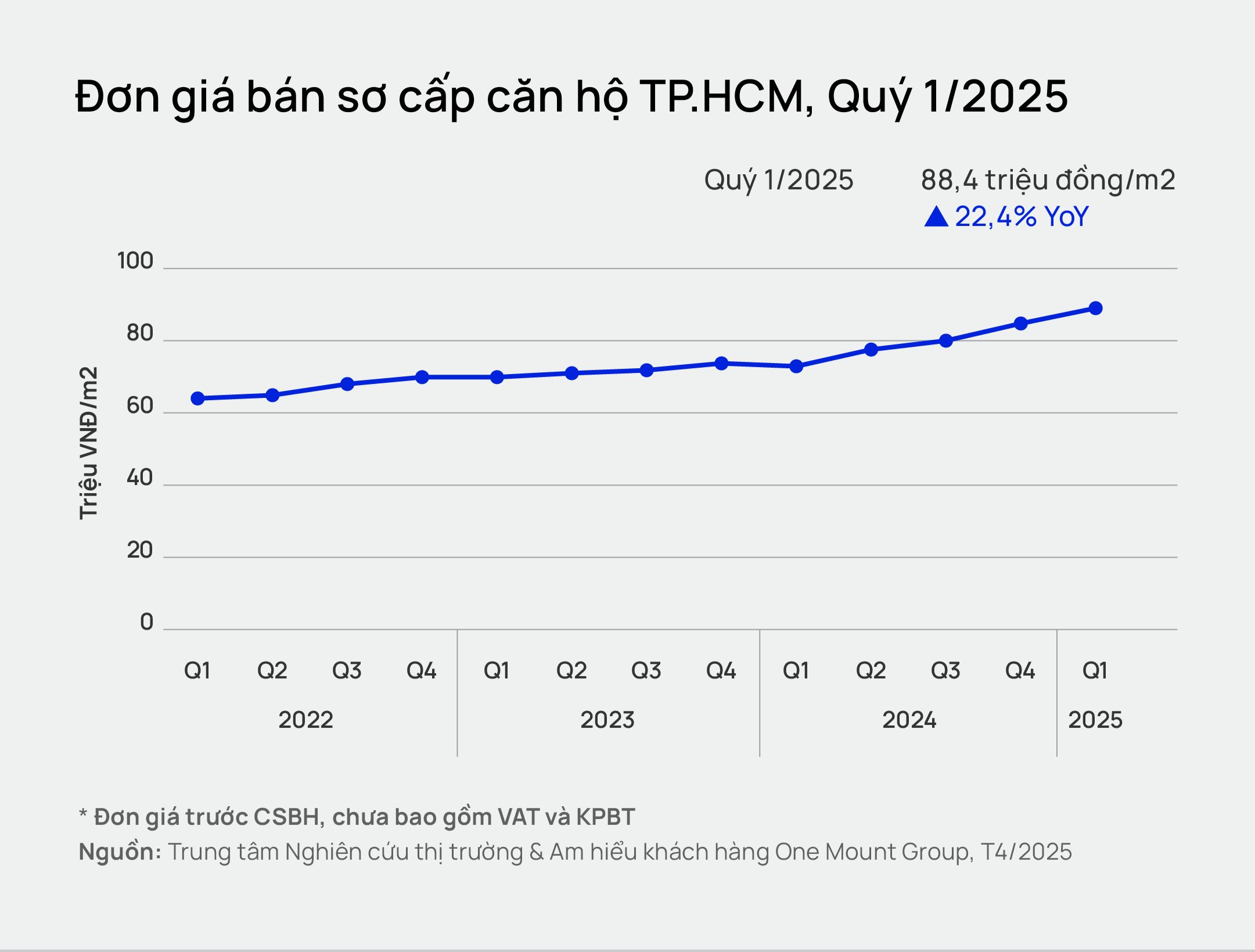

In contrast to the declining newly opened supply, primary apartment prices continue to increase sharply. The average price of the whole market reached 88.4 million VND/m2, up 4.9% over the previous quarter and up to 22.4% over the same period last year.

Notably, most of the projects being opened for sale have had their prices adjusted up. At Vinhomes Grand Park, the increase ranged from 3% to 13% compared to the previous quarter. Meanwhile, Thao Dien Green recorded a price increase of more than 20%, mainly due to the limited number of remaining apartments.

Mr. Tran Minh Tien commented: "eseptive prices continue to increase sharply amid scarce supply, showing that the market still has real demand, but the launch of goods mainly in the high-end segment also reflects the risk of imbalance between supply and demand when the mid-range and affordable segments are increasingly absent".

The market is in a "compression" phase, waiting for breakthrough momentum

In the first quarter of 2025, the whole market recorded 855 apartments sold, up 19.2% over the same period last year. The absorption rate on the total primary supply reaches 12%, an increase of 5 percentage points compared to the same period last year, showing that the demand for buying in reality remains quite well despite the common difficulties. However, the structure of primary apartments selling on the market is still in favor of the high -end segment, accounting for about 60% of the total number of apartments being sold on the market.

One Mount Group Market Research & Customer Insight Center forecasts that for the period of 2025 - 2026, the apartment market in Ho Chi Minh City may welcome about 24,400 newly opened apartments, an increase of 4,400 apartments compared to the previous forecast.

Primary selling prices are expected to continue the upward trend and are likely to surpass the 100 million VND/m2 mark in 2025.

In addition, the apartment market in Ho Chi Minh City received many positive signals in the case of merging Ho Chi Minh City, Binh Duong and Ba Ria - Vung Tau. One of the notable benefits is the ability to partially solve the problem of supply differences between segments. The expansion of administrative boundaries will create more development space for apartment projects in neighboring areas, thereby increasing supply for the Ho Chi Minh City market.

In addition to the supply factor, the cost of project development in Binh Duong and Ba Ria - Vung Tau is currently more competitive than the implementation of projects in the central area of Ho Chi Minh City. This could create conditions for investors to develop projects at more competitive prices, contributing to diversifying the price segment and increasing home access for buyers in Ho Chi Minh City in the long term after the merger.

At the same time, the merger will promote the development of connecting infrastructure between provinces and cities. The improved transportation system will increase connectivity, reduce travel time and increase real estate value in suburban areas. This could create a new wave of investment in projects in areas that were previously less popular.

According to Mr. Tran Minh Tien, the Ho Chi Minh City real estate market in the first quarter of 2025 is in a "compression" phase - where short-term pressures will be the premise for a breakthrough if legal factors, supply and buyer confidence are resolved synchronously in the coming time.