According to previous regulations, if residential land is divided, people will have to pay 2 fees: land survey fee and red book issuance fee.

However, according to Part V of Appendix I of Decree 151/2025/ND-CP, from July 1, 2025, the land survey fee will be funded by the State, so people will only have to pay the red book issuance fee if they only separate the land plot.

Note, if the division of residential land is associated with the transfer of land use rights, people must also pay additional registration fees, appraisal fees for granting red books, personal income tax, notary or certification fees.

(1) Red book issuance fee

Pursuant to Point d, Clause 1, Article 5 of Circular 85/2019/TT-BTC, the fee for granting certificates of land use rights, house ownership rights, and assets attached to land includes: Issuing certificates of land use rights, house ownership rights, and assets attached to land; land change registration certificate; cadastral map extract; documents; cadastral records data.

Based on specific local conditions and local socio-economic development policies to stipulate appropriate fee collection levels, ensuring the following principles: The fee for households and individuals in districts under centrally-run cities, inner-city wards under cities or provincial towns is higher than the fee in other areas; the fee for organizations is higher than the fee for households and individuals.

Thus, the fee for granting a Certificate will be decided by the People's Councils of provinces and centrally run cities to apply to their localities, so there will be no uniformity across the country. However, the fee will usually be from 100,000 VND or less for each newly issued red book.

(2) Registration fee

Pursuant to Article 3 of Decree 10/2020/ND-CP, organizations and individuals must pay registration fees when registering home ownership and land use rights.

The current registration fee for houses and land is 0.5%.

Note: exemption from registration fees for inherited houses and land or gifts between: Husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandchild; maternal grandfather, sister and younger siblings are now granted certificates of land use rights, house ownership rights and other assets attached to land by competent state agencies.

(3) Document appraisal fee

Pursuant to Point i, Clause 1, Article 5 of Circular 85/2019/TT-BTC (amended and supplemented in Circular 106/2021/TT-BTC), the fee for appraisal of land use right certificates is the fee collected for appraisal of documents, necessary and sufficient conditions to ensure the issuance of certificates of land use rights, house ownership rights and assets attached to land (including initial issuance, new issuance, issuance of new certificates and certification of changes to issued certificates) according to the provisions of law.

Based on the area of the land plot, the complexity of each type of dossier, the purpose of land use and the specific conditions of the locality to determine the fee for each case.

(4) Personal income tax

Article 12 of Circular 111/2013/TT-BTC (amended and supplemented in Circular 92/2015/TT-BTC) stipulates:

- The tax rate for land sales is 2% on the purchase, sale or sublease price.

- How to calculate tax:

+ Personal income tax on income from land purchase and sale is determined as follows:

Personal income tax payable = Transfer price x Tax rate 2%

+ In case the land purchase and sale is co-owned, the tax obligation is determined separately for each taxpayer according to the real estate ownership ratio.

In cases of land division associated with the transfer, donation, and inheritance of land use rights in the following cases, personal income tax is not required:

- Transferring land use rights between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandchild; maternal grandfather, maternal grandmother and grandchild; brothers, sisters, brothers together.

- Receiving inheritance or gifts of land use rights between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandchild; maternal grandfather, maternal grandmother and grandchild; brothers, sisters and siblings together.

(5) Real estate notary fee

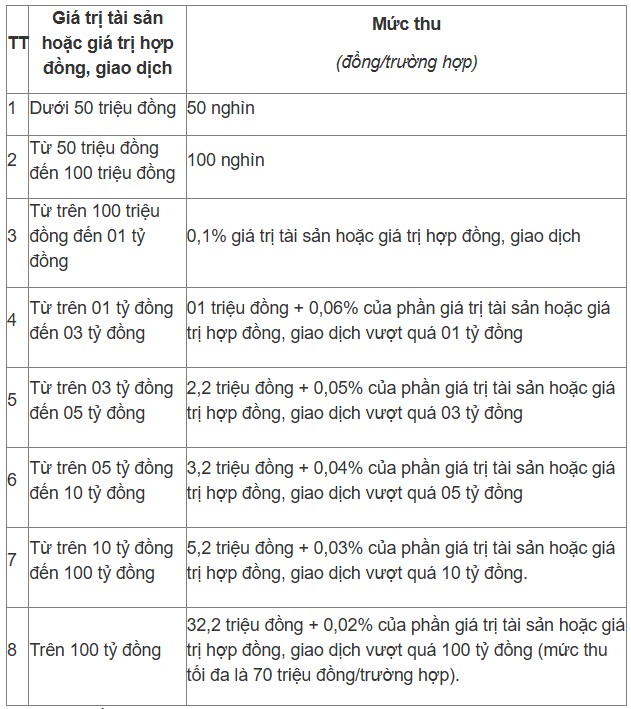

Pursuant to Clause 2, Article 4 of Circular 257/2016/TT-BTC, notary fees for transfer or donation contracts for land use rights are calculated according to the value of land use rights. Accordingly, the collection rate is as follows: