Recently, in addition to the social housing development sector that has received attention, many investors with strengths in commercial housing have shifted to industrial real estate, which is a "rare" bright spot in the market.

Real estate expert Nguyen The Diep - Member of the Vietnam Real Estate Association - said that with the advantage of cheap and abundant labor, more and more international manufacturing enterprises are expressing their desire to set up factories in Vietnam. This is the potential for the industrial real estate industry to shine.

In particular, according to Mr. Diep, when the three Laws related to real estate officially come into effect, it will help remove legal obstacles, creating conditions for the real estate market to develop transparently, healthily and sustainably.

In fact, industrial real estate has proven its resilience by maintaining good occupancy rates and rental prices continuously increasing over time. Accordingly, Savills' report showed that industrial parks nationwide have occupancy rates of over 80%. Key northern provinces reached 83% and the southern provinces reached 91%.

CBRE's report also shows that Vietnam's industrial real estate sector in 2024 continues to be a bright spot in the overall real estate market. Throughout 2024, major global manufacturers have announced expansion plans and launched many projects in many different areas in Vietnam.

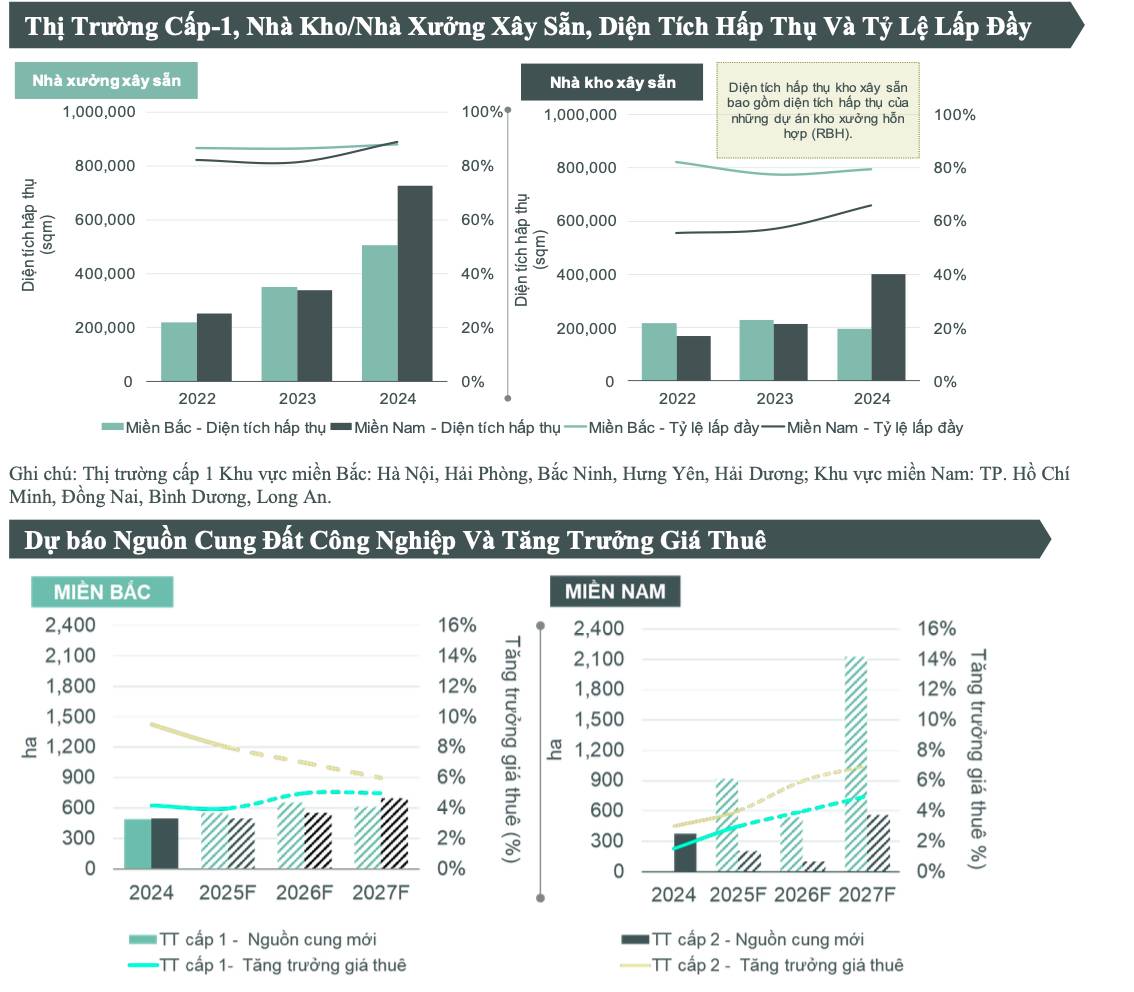

CBRE's report shows that the ready-built warehouse and factory market also had an impressive growth year in 2024.

For the ready-built factory segment, both the North and South regions recorded the highest absorption area in the past 3 years.

The occupancy rate of ready-built factory projects in the North reached 88%, while the occupancy rate of projects in the South reached 89%. This is an impressive result, especially when both regions received the highest new supply in the past 3 years, with each region receiving approximately 0.5 million square meters of new supply.

Meanwhile, leasing transactions are mainly led by large warehouse/factory developers with portfolios spread across many provinces/cities.

According to CBRE’s report, industrial land rental prices are expected to increase by 4-8% per year in the North and 3-7% per year in the South over the next three years. New industrial parks are expected to be concentrated in markets such as Hai Phong and Vinh Phuc in the North or Binh Duong, Dong Nai, Long An in the South.

Central provinces such as Thanh Hoa, Nghe An, Ha Tinh and Quang Nam are expected to have new industrial parks developed by professional investors, supporting the growth of these emerging industrial markets.

Faced with increasingly hot developments in the industrial park real estate market, Mr. Nguyen Van Dinh - Chairman of the Vietnam Association of Realtors (VARS) - commented that the race will continue to heat up because industrial real estate is the "star" segment of the market.

For industrial real estate to maintain its attractiveness and continue to grow strongly in the future, infrastructure and transportation systems need to continue to be developed, planned synchronously and effectively. At the same time, developers and investors need to pay attention to general trends in the industry.