1. Land use fee

According to Clause 44, Article 3 of the 2024 Land Law, the land use fee is the amount that the land user must pay to the State when the land allocated land with land use levy, allowing the change of land use purpose or cases of land use and must pay the land use levy in accordance with law. Depending on the object, the collection of land use levies is different.

2. Land rent

Land rent is the amount of money that land users must pay to the State when the State leases land, permits change of land use purpose for land lease or in cases of land use that require payment of land rent according to the provisions of law.

(Based on Clause 45 Article 3 and Clause 1, Article 120 of the 2024 Land Law)

3. Registration fee

Pursuant to Article 4 of Decree 10/2022/ND-CP, organizations and individuals must pay registration fees when registering home ownership and land use rights.

Accordingly, Clause 1, Article 8 of Decree 10/2022/ND-CP stipulates the registration fee collection for houses and land at 0.5%.

Accordingly, the registration fee calculation price when issuing a red book is calculated as follows:

Registration fee = (Priced 1m2 of land in Land Price List x Area) x 0.5%

In which:

+ The price of 1m2 of land to calculate the registration fee is the land price in the Land Price List issued by the Provincial People's Committee at the time of declaration of the registration fee.

+ The land area subject to registration fee is the entire area of the land plot under the legal use rights of an organization or individual determined by the Land Registration Office and provided to the tax authority.

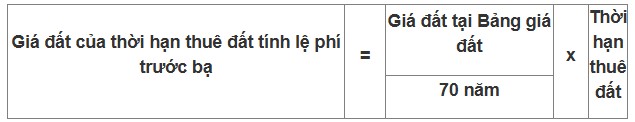

Note: In case the State's land is leased in the form of one -time rental payment for the entire lease period and the land lease term is less than the deadline for the type of land specified at the land price list issued by the provincial People's Committee, the land price of the land rent is determined as follows:

4. Red book issuance fee

At Point d, Clause 2, Article 5 of Circular 85/2019/TT-BTC, the fee for granting certificates of land use rights, house ownership rights, and assets attached to land is the fee that organizations, households, and individuals must pay when being granted certificates of land use rights, house ownership rights, and assets attached to land by competent state agencies.

Fees for granting certificates of land use rights, house ownership rights, and assets attached to land include: Issuing certificates of land use rights, house ownership rights, and assets attached to land; land change registration certificates; cadastral map extracts; documents; cadastral records data.

5. Document appraisal fee

According to Point i, Clause 1, Article 5 of Circular 85/2019/TT-BTC (amended and supplemented in Circular 106/2021/TT-BTC), it is stipulated as follows:

The fee for appraisal of land use right certificates is the revenue for the dossier evaluation work, the necessary conditions and sufficient to ensure the implementation of the certificate of land use rights, ownership of houses and land -attached assets (including the first issue, new issuance, renewal, re -issuance of certificates and volatile certificates in the granted certificate) in accordance with law.

Based on the area of the land plot, the complexity of each type of dossier, the purpose of land use and the specific conditions of the locality to determine the fee for each case.

6. Personal income tax

Pursuant to Article 14 of the Law on Personal Income Tax 2007 (amended and supplemented in 2014 and Article 247 of the Land Law 2024), when making a red book, the transferor of land use rights must pay personal income tax, except for the cases of Clause 4, Article 4 of the Law on Personal Income Tax 2007.

Accordingly, income from real estate transfers is 2% tax rate calculated on the transfer value agreed upon by the parties in the transfer contract.