According to Manpower Company, employee benefits are divided into two main types: Compulsory and voluntary.

Compulsory welfare

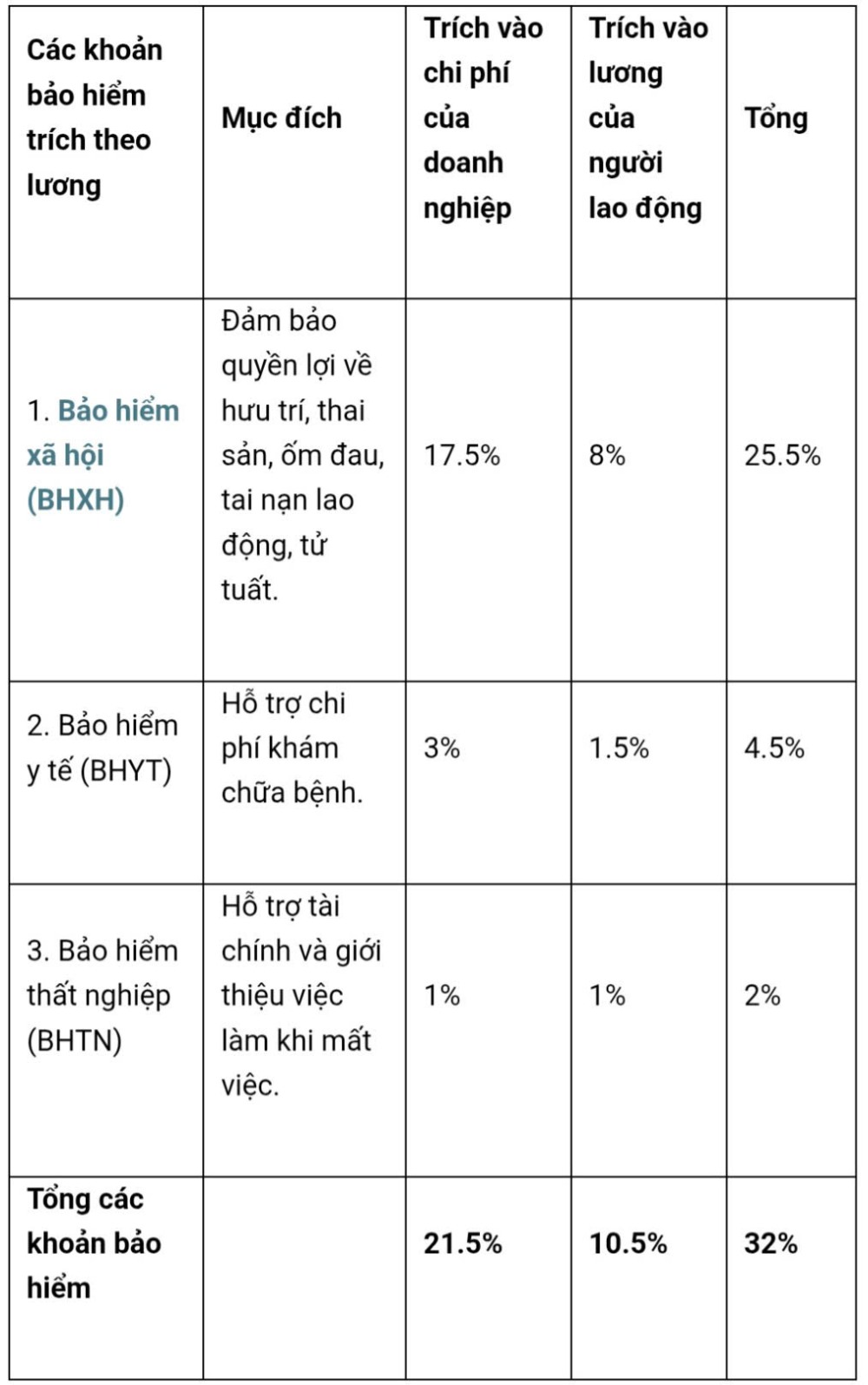

According to the provisions of the 2019 Labor Code, enterprises are required to fully implement these welfare regimes to protect the rights of employees. According to the instructions in Decree 158/2025/ND-CP, the specific insurance deduction rate is as follows:

Thus, every month, enterprises need to pay social insurance at a rate of 32%. Of which, enterprises account for 21.5%, employees account for 10.5%.

Voluntary welfare

In addition to compulsory benefits, many companies also provide voluntary benefits based on financial capacity and company culture, to attract and retain employees.

Voluntary welfare is often divided into two main groups:

Cash payment benefits (financial):

- Bonuses: Performance bonus, quarterly bonus, holiday bonus, especially 13th month salary.

- Allowances: Support for lunch, travel expenses, work expenses, parking or even allowances for raising young children.

- Periodic salary increase: Annual salary increase policy or when there are excellent achievements.

Indirect benefits (non-financial):

- Health and living: Regular health check-ups, high-end health insurance, physical activities and travel, team-building.

- Self-development: Professional training programs, soft skills and tuition support.

- Flexible and balanced: Annual leave, flexible working hours or allowing home/ remotely working.

According to Manpower Company, it should be noted that in some companies, the welfare regime can be adjusted differently depending on the type of labor contract. It can be divided into full-time, part-time, seasonal or trainee employees - based on working time and the level of commitment between the two parties.

For example, full-time or part-time employees will often receive full benefits from the company, while part-time employees, seasonal employees and interns may only receive certain benefits depending on the company's regulations.

Before deciding to accept a job, employees should carefully research both compulsory and voluntary benefits as well as the benefits you will receive for their position to ensure personal rights and choose the most suitable environment.