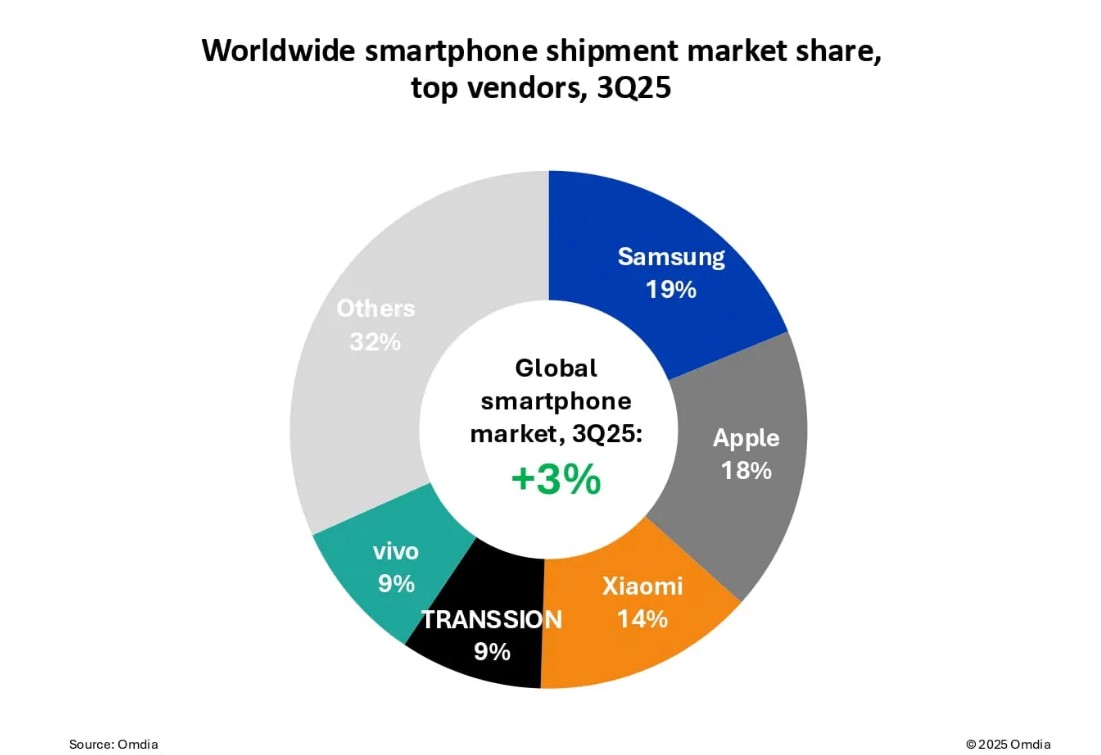

According to data from market research company Omdia, Samsung leads the global smartphone market share in the third quarter of this year with 19%. This is the third consecutive quarter that Samsung has been No. 1 in the market, thanks to its stability in the Galaxy A series and Z Fold 7 series.

Apple has increased the number of iPhones shipped by 4% compared to the same period last year, achieving the highest Q3 performance ever, as initial demand for the iPhone 17 series increased in some markets. As a result, Apple ranked second in terms of global market share with 18%.

Xiaomi is behind with 14% market share globally, while Transsion and Vivo each account for 9% market share. The remaining companies such as Huawei, Oppo, Honor, Google, Tecno... account for the remaining 32% of the market share.

Consumers demand for smartphone upgrades and replacements is recovering, boosting the market after a volatile start to the year, as shown by the growth of all 5 leading suppliers compared to the third quarter of 2024.

The acceptance of the industry's largest product launch events is very positive as leading suppliers balance the focus on hardware and software. Outstanding hardware products this season - foldable phones, thin phones, bright colors and border screens - have attracted everyone's attention. Compared to previous quarters, some suppliers have increased production targets due to initial demand far exceeding expectations, said Le Xuan Chiew, an analyst at Omdia.

iPhone 17 is one of the highlights of the global smartphone market from July to September 2025. The iPhone 17 version has basically exceeded expectations with upgraded memory while the price remains the same, while the redesigned iPhone 17 Pro and Pro Max continue to attract consumers globally.

The number of iPhone Air products shipped is still modest, but its marketing efficiency has been proven to be strong and acts as a core technical testing platform for Apple, capable of positioning Apple for future design improvements.

However, concerns and economic instability continue to weigh on suppliers' strategic plans, as many suppliers have to carefully consider the scale of output, profits and revenue targets.

Suppliers are still cautious about the surrounding difficulties, but short-term success will depend on clearly identifying opportunities with marketing strategies and bringing products to the market effectively.