According to market research firm Omdia, these figures sign a recovery from a gloomy picture in the first half of 2025.

Due to the impact of changes in US tariff policies, related supply chain restructuring, as well as cautious psychology in distribution channels due to slow retail sales and inventory adjustments by suppliers, the smartphone market in the first 6 months of 2025 did not have much improvement.

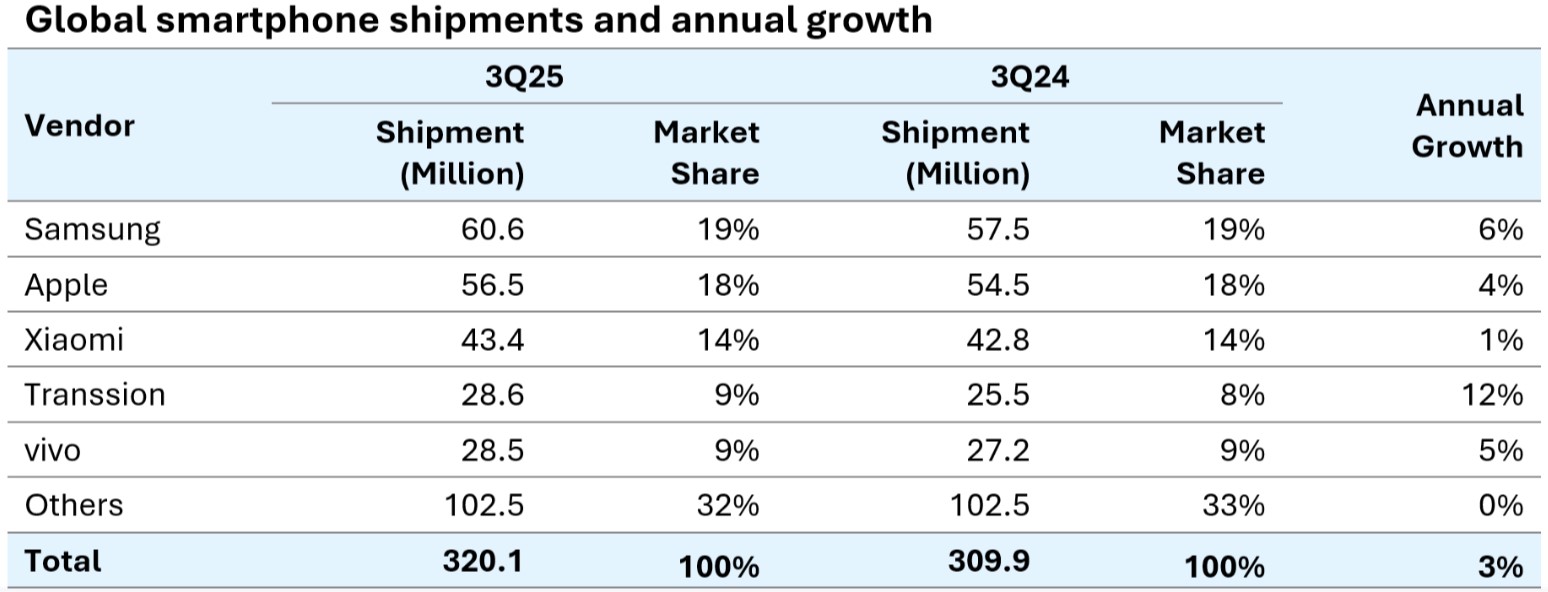

However, in the third quarter of this year, after adjusting inventories, suppliers have proactively seized opportunities for distribution channels and accelerated product launches to suit the market season and festival season. Samsung, Apple, Transsion and Honor all shipped more than two million products compared to the same period last year, boosting the market's growth again.

Samsung is still leading in smartphone sales from July to September 2025, with 60.6 million units, up 6% over the same period last year. This growth is driven by the high-end Galaxy Z Fold 7/Flip 7 models along with the Galaxy A07 and A17 in the mid-range to affordable segment. The strong sales of the Galaxy A series in the Asia-Pacific and Middle East have contributed significantly to the company's total sales.

Apple has shipped 56.5 million units, up 4% year-on-year. The iPhone 17 has basically exceeded launch expectations thanks to its improved value, providing greater storage capacity without price increases, while the improved iPhone 17 Pro and Pro Max continue to attract strong demand globally.

Xiaomi maintains a slight annual growth rate of 1% with 43.4 million units shipped. Although sales in China fell after subsidy programs ended, growth in the Asia-Pacific and other regions offset this decline.

Transsion rose to fourth place, with the number of outgoing goods increasing by 12% over the same period last year after completing inventory adjustments. Vivo, in fifth place, remains strong in India, surpassing Huawei in terms of market share in China and developing across Asia - Pacific, Africa and Latin America.

According to Omdia, the global smartphone market continues to show polarized growth, with an expansion in both the low-cost and high-end segments, while the mid-range segment is still weak. The super-cheap segment (under 100 USD) and the high-end segment (over 700 USD) are boosting overall sales growth.