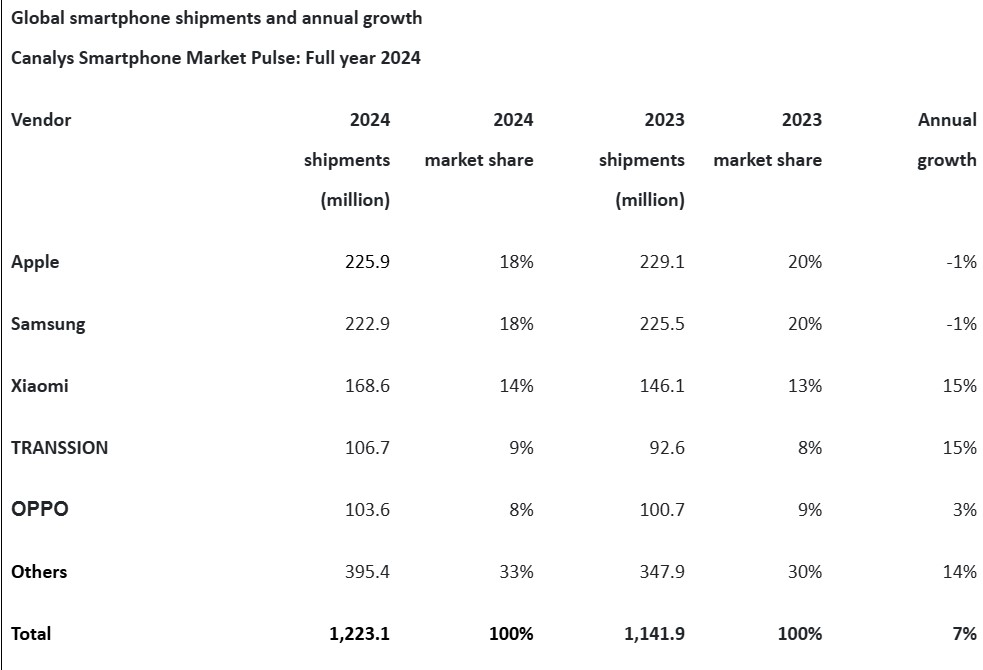

According to the latest research by Canalys, the global smartphone market is set to grow 7% in 2024 compared to 2023 to reach 1.22 billion units, marking a recovery after two consecutive years of decline.

Apple defended its top spot in the rankings of the world's top smartphone makers, thanks to growth in emerging markets, steady performance in North America and Europe, thereby offsetting its challenges in mainland China.

For the full year of 2024, iPhone shipments fell 1% to 225.9 million units, accounting for 18% of the global smartphone market share.

Samsung followed closely in second place amid its continued focus on profitability, as its shipments also fell 1% year-on-year in 2023 to 222.9 million units.

Xiaomi retained its third spot, with its shipments rising 15% to 168.6 million units in 2024.

Transsion ranked fourth with 106.7 million smartphones sold. Meanwhile, Oppo (including its sub-brand OnePlus) sold 103.6 million units.

“2024 is the year of comeback for the smartphone industry, delivering the highest annual global shipments post-pandemic.

Demand has surged in the mass market segment, driven by the smartphone refresh cycle purchased during the pandemic along with channel additions.

In addition to strong growth in emerging markets, mature economies have begun to recover, illustrated by mainland China's growth of 4%, North America's 1% and Europe's 3%.

Demand in these regions has been driven by major vendor promotions, such as discounts, returns and device bundles, which are being offered across the shopping channel,” said Runar Bjorhovde, Analyst at Canalys.

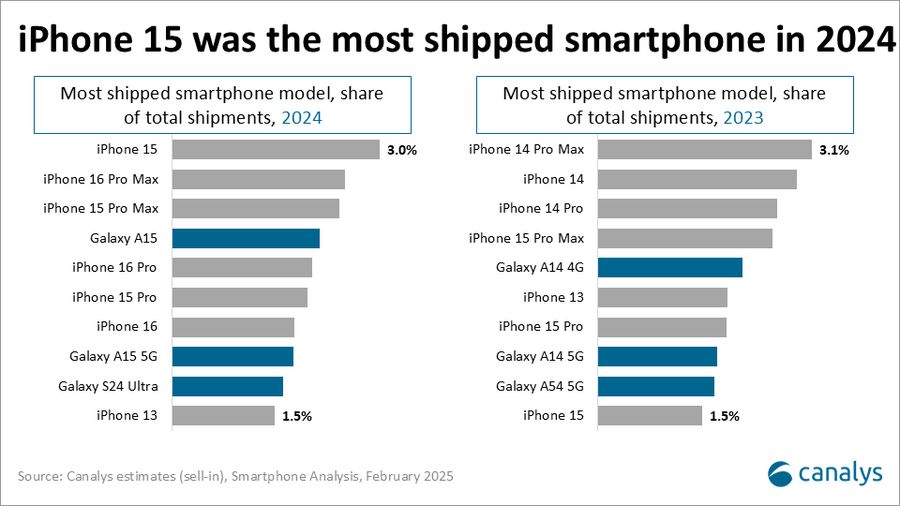

According to experts, Apple and Samsung's leadership in the smartphone industry reflects the market's continued trend toward premiumization. For Apple, they shipped 55 million iPhone 16 and Pro Max units, 11% higher than their predecessors, the iPhone 15 Pro and Pro Max.

Meanwhile, Samsung has seen its strongest S series sales since 2019, leaning more heavily on the Ultra line than ever before. The South Korean company looks to continue growing the S series with the Galaxy S25, through a continued focus on AI-powered experiences including the additional Gemini Advanced subscription.

According to Canalys, smartphone manufacturers will face many difficulties in 2025. Emerging markets will be the main growth drivers of the industry in 2024, but the growth rate has slowed as some markets are reaching saturation point.

Therefore, “finding the right balance between short-term performance, inventory management and long-term investment will be key for suppliers to succeed in these markets,” Canalys said.