According to statistics from the General Statistics Office, in 2024, the total revenue from non-life insurance premiums is estimated at 78.3 trillion VND, an increase of 10.2% over the previous year. Meanwhile, insurance benefit payments decreased by 6.3%, creating favorable conditions for some businesses to improve profit margins.

However, not everyone benefits. Companies with good cost control strategies continue to make breakthroughs, but businesses affected by natural disasters and high compensation costs struggle to maintain profits.

Strong breakthrough businesses

VNR: spectacular growth thanks to cost control

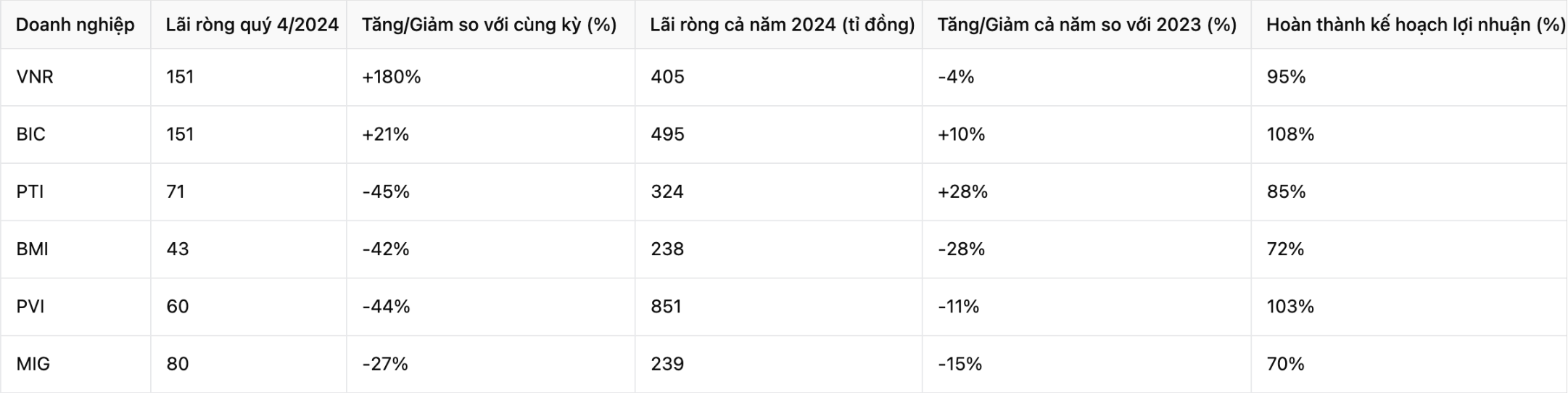

As the enterprise with the most impressive results in 2024, Vietnam National Reinsurance Corporation (HNX: VNR) recorded 151 billion VND in net interest in the fourth quarter of 2024, 2.8 times higher than the same period.

VNR's biggest bright spot came from reinsurance fee revenue, reaching VND691 billion, up sharply by 78%. Meanwhile, the cost of reinsurance transfers increased by only 16%, helping the profit margin improve.

In the whole year, VNR made a profit of VND405 billion, down only slightly by 4% despite a net loss of VND46 billion in the third quarter of 2024. Thanks to the timely adjustment strategy, the company is close to completing the annual plan.

BIC: Insurance profits increase by 63%, net interest continues to increase by double digits

Vietnam Bank for Investment and Development Insurance Corporation (HOSE: BIC) also had a positive year when the profit from insurance business in the fourth quarter increased by 63%, reaching VND460 billion.

BIC is one of the rare companies that control compensation costs well, thanks to which net profit reached 151 billion VND, up 21% over the same period.

For the whole year, BIC made a profit of VND495 billion, up 10% over the previous year and exceeding the profit plan by 108%.

The common point of strong growth businesses is that insurance revenue increases faster than costs. These enterprises strictly control compensation and optimize reinsurance transfer costs. Maintain stable cash flow and reduce dependence on financial profits.

Enterprises struggle due to cost pressure

PTI: Financial profits plummeted by 91%, net interest decreased sharply

Unlike BIC or VNR, Post Insurance Corporation (HNX: PTI) encountered many difficulties when financial profits decreased by 91%, to only 8 billion VND.

This caused net profit in the fourth quarter to decrease by 45% to VND71 billion, although gross profit from insurance business still increased by 22%.

In 2024, PTI reached VND 324 billion in net interest, up 28%, but this increase is mainly due to reduced compensation costs but core operational efficiency.

BMI: Lowest profit since 2021

Bao Minh Joint Stock Corporation (HOSE: BMI) had unsatisfactory results, when net profit in the fourth quarter of 2024 only reached VND43 billion, down 42% over the same period.

The main reason is that profits from both insurance and finance have decreased. In 2024, BMI earned VND238 billion, the lowest level since 2021.

PVI: Heavy damage caused by storm Yagi, profits plummet

Natural disasters continue to be a factor that puts pressure on the non-life insurance industry. PVI Joint Stock Company (HNX: PVI) recorded a net profit decrease of 44% in the fourth quarter to VND60 billion, mainly due to increased compensation costs after Typhoon Yagi.

Accumulated for the whole year, the company made a profit of VND851 billion, down 11%, but still exceeded the profit plan.

MIG: Ambitious plan but implementation is less than 70%

The Military Insurance Corporation (HOSE: MIG) set a pre-tax profit target of VND440 billion in 2024, but the actual results only reached 70% of the plan.

Net interest in 2024 decreased by 15%, to VND239 billion, due to sharp increase in compensation and other expenses.

The common point of businesses facing difficulties is that they are affected by natural disasters and unusual losses, depend heavily on financial profits, and are affected when interest rates decrease. In addition, insurance compensation costs are increasing, especially for businesses with large compensation rates.