Youme Law Firm replied:

According to the provisions of Decree No. 293/2025/ND-CP, from January 1, 2026, the minimum wage for employees working under labor contracts will increase by VND 250,000 - VND 350,000/month compared to the provisions of Decree 74/2024/ND-CP.

Deputy Prime Minister Ho Duc Phoc has just signed and issued Decree No. 293/2025/ND-CP dated November 10, 2025, stipulating the minimum wage for employees working under labor contracts. This Decree takes effect from January 1, 2026.

Accordingly, Decree No. 293/2025/ND-CP stipulates the minimum monthly salary and minimum hourly salary applicable to employees working under labor contracts.

The subjects of application of Decree No. 293/2025/ND-CP include:

First, employees work under labor contracts according to the provisions of the Labor Code.

Second, employers according to the provisions of the Labor Code, including: Enterprises according to the provisions of the Law on Enterprises. Agencies, organizations, cooperatives, households and individuals that hire or employ workers to work for them according to the agreement. Other agencies, organizations and individuals related to the implementation of the minimum wage prescribed in this Decree.

Minimum salary increases from 250,000 - 350,000 VND/month from January 1, 2026

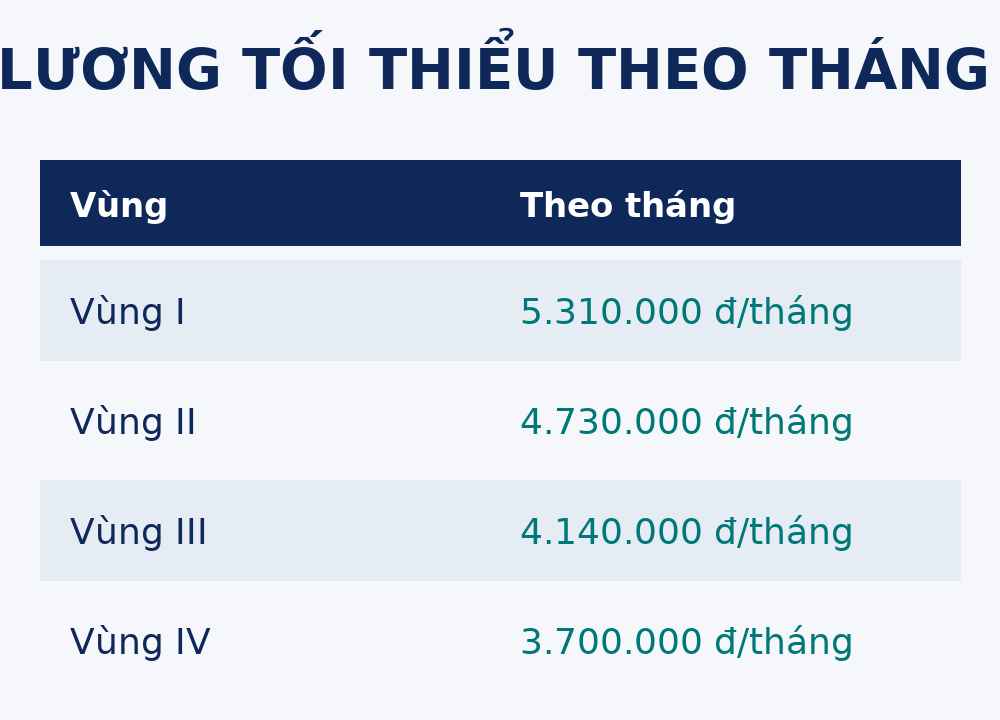

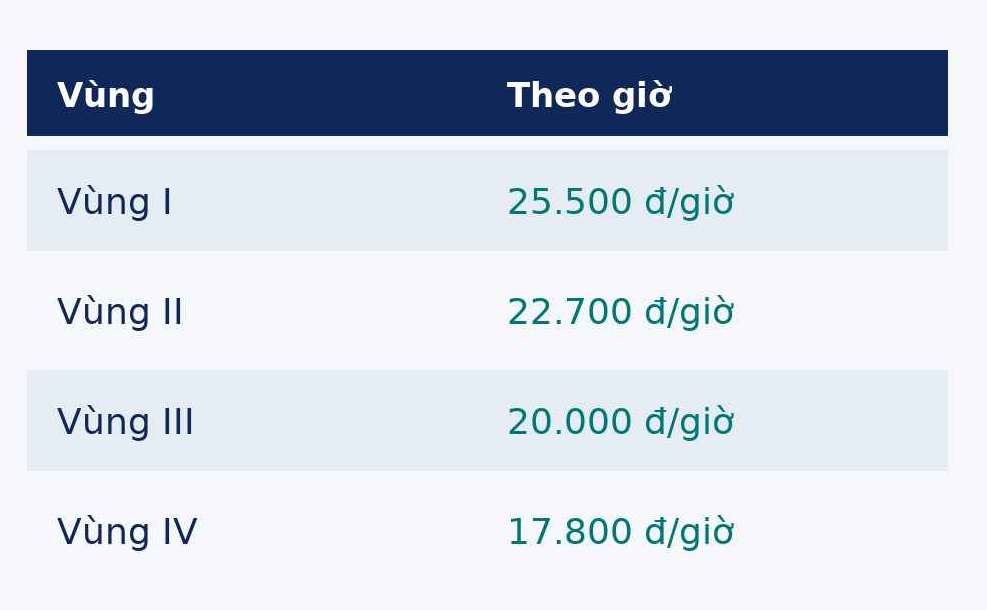

The Decree stipulates the minimum monthly and hourly wages for employees working for employers in regions as follows:

Minimum salary increases from 250,000 VND - 350,000 VND/month

According to Decree 293/2025/ND-CP, the minimum monthly salary in 4 regions is stipulated as follows: Region I: increased by 350,000 VND, from 4,960,000 VND/month to 5,310,000 VND/month; Region II: increased by 320,000 VND, from 4,410,000 VND/month to 4,730,000 VND/month; Region III: increased by 280,000 VND from 3,860 VND/month to 4,140,000 VND/month; Region IV: increased by 250,000 VND from 3,450,000 VND/month to 3,700,000 VND/month.

The minimum hourly wage in region I increases from 23,800 VND/hour to 25,500 VND/hour, region II from 21,200 VND/hour to 22,700 VND/hour, region III from 18,600 VND/hour to 20,000 VND/hour, region IV from 16,600 VND/hour to 17,800 VND/hour.

Thus, the above minimum wage increases from 250,000 VND - 350,000 VND/month (equivalent to an average rate of 7.2%) compared to the current minimum wage stipulated in Decree 74/2024/ND-CP.

According to the Decree, the application of regional areas is determined according to the place of operation of employers as follows:

- Employers operating in a region will apply the minimum wage prescribed for that region.

- Employers with units and branches operating in areas with different minimum wages shall have the unit or branch operating in which area, apply the minimum wage prescribed for that area.

- Employers operating in industrial parks, export processing zones, high-tech zones, and concentrated digital technology zones located in areas with different minimum wages shall apply according to the area with the highest minimum wage.

- Employers operating in the area with a name change or division will temporarily apply the minimum wage prescribed for the area before changing the name or division until the Government has new regulations.

- Employers operating in a newly established area or in many areas with different minimum wages shall apply the minimum wage according to the area with the highest minimum wage until the Government has new regulations.

Applying the minimum wage

Regarding the application of the minimum wage, the Decree stipulates: The minimum monthly salary is the lowest salary used as a basis for negotiating and paying salaries to employees applying the form of monthly salary payment, ensuring the salary according to the job or position of the employee working enough hours to work normally during the month and completing the agreed labor norms or work must not be lower than the minimum monthly salary.

The minimum hourly wage is the lowest wage used as a basis for negotiating and paying wages to employees who apply the form of hourly wages, ensuring the salary according to the job or position of the employee working in an hour and completing the agreed labor norms or work must not be lower than the minimum hourly wage.

For employees applying the form of weekly or daily salary payment or by product or contract salary, the salary of these forms of salary payment if converted monthly or by hour must not be lower than the minimum monthly or hourly minimum wage.

The salary is converted monthly or hourly based on normal working hours chosen by the employer according to the provisions of labor law as follows:

The salary is converted monthly by the salary per week with 52 weeks divided by 12 months; or the salary per day multiplied by the number of normal working days in the month; or the salary per product, the contract is implemented during normal working hours in the month.

The salary is converted by the hour to the salary by week, by day divided by the normal working hours of the week, by day; or the salary by product, the contract salary divided by the number of working hours during the normal working hours to produce products, perform contract tasks.

Thus, not all cases are increased immediately.

If your current salary is equal to or lower than the new minimum wage:

Enterprises are required to adjust the increase from January 1, 2026.

If your salary is higher than the new minimum: Enterprises are not required to increase further.

The increase is an agreement between employees and employers.