4 methods of tax declaration

Organize the deduction of the total revenue arising (after deducting the revenue of canceled or returned goods and services) and the value-added tax (VAT) and personal income (PIT) that have been deducted (after deducting the VAT and PIT that have been deducted for the goods and services that have been canceled or returned) arising in the month of each household, individual resident and individual not residing to do business on the e-commerce platform managed by the deduction organization.

Specific synthesis principles are as follows:

Firstly, synthesize the revenue arising from the VAT and personal income tax declaration period deducted from each industry group of each individual doing business on the e-commerce platform.

Second, summarize the revenue arising during the tax declaration period, VAT amount, DTT amount deducted for canceled or refunded goods and services of each industry group of each individual doing business on the e-commerce platform in the month

Third, implement the above two principles of each industry group of each individual doing business on e-commerce platform to determine the amount of tax declaration and payment.

Households and individuals doing business can declare tax records according to one of the following 4 methods:

Method 1: Submit a declaration in XML format: First, the deduction organization must declare the Detailed List of deducted taxes of households and individuals doing business on the e-commerce platform form No. 01-1/BK-CNKD-TMDT on the HTKK application. The automatic application system synthesizes data from Delegation Table 01-1/BK-CNKD-TMDT to Declaration sheet 01/CNKD-TMDT. After that, the deduction organization will perform an output according to XML format to submit the tax declaration on the Administrative Procedure Information System Portal.

Method 2: Declare online on the Administrative Procedure Information System Portal Declaration form 01/CNKD-TMDT and Decree form 01-1/BK-CNKD-TMDT (in this case, Decree form 01-1/BK-CNKD-TMDT is supported with a maximum of 500 data streams). Organize the deduction to make the same declaration as the declaration on the above-mentioned HTKK application and submit it online on the Administrative Procedure Information System Portal.

Method 3: Declare online on the Administrative Procedure Information System Portal Declaration form 01/CNKD-TMDT and attached to Decree form 01-1/BK-CNKD-TMDT with Excel format: Organize deduction to declare declaration form 01/CNKD and sign to submit tax declaration. After successfully submitting the Declaration, organize deductions attached to the statement according to the Excel format according to the data format standards of the tax authority, then continue to sign the statement and send the statement on the Administrative Procedure Information System Portal.

Method 4: In case there is no tax deduction during the tax declaration period, the deduction organization selects the function: "No tax deduction during the period", the default system displays the declaration form No. 01/CNKD-TMDT with a figure of 0, the deduction organization signs and submits the Declaration on the Administrative Procedure Information System Portal.

Some notes when households and individuals doing online business make declarations according to the form

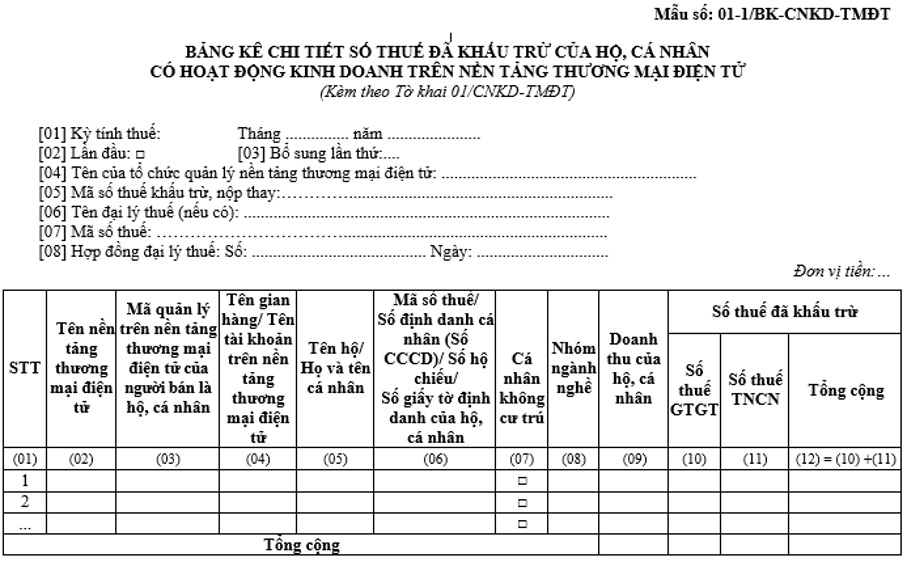

Organize deduction to fully declare the indicators in Form No. 01-1/BK-CNKD-TMDT directly on the HTKK application or download the Statment Table with excel file according to the form of the tax authority. When declaring List 01-1/BK-CNKD-TMDT, the deduction organization should note a number of indicators as follows:

- column (06) Tax code/ Identification number (CCCD)/ License plate identification documents of business households and individuals: Compulsory to accurately complete the MST of business households and individuals as provided by business households and individuals as prescribed in Clause 2, Article 11 of Decree No. 117/2025/ND-CP dated September 26, 2025 of the Government.

- column (07) of non-resident individuals: Enter this box if declaring tax deductions of non-resident individuals.

- column (08) Industry group: (01) Goods; (02) Services: (03) Transportation, services associated with goods; (04) No goods or services or service types can be identified.

For the group of industries (04) declared in case the household or individual cannot determine whether the revenue-generating transaction is goods or services or the type of service, the VAT and personal income tax deduction will be declared at the highest tax rate.

- column (09) Revenue of business households and individuals: Declare monthly revenue arising from each industry group (after deducting the revenue from canceled or returned goods and services).

In case during the tax declaration period, the revenue from selling goods and providing services arising from each industry group is lower than the revenue from selling goods and providing services that are canceled or refunded arising during the tax declaration period, negative revenue will be recorded.

- column (10) VAT Number: Declare the VAT number that has been deducted arising in the month according to each industry group (after deducting the deducted VAT of the canceled or returned goods and services).

In case during the declaration period, the amount of VAT deducted for revenue arising from selling goods and providing services according to the industry group is lower than the VAT deducted for sales of goods and services canceled or refunded for that industry group, the deducted VAT amount shall be recorded as a negative number.

- column 11. personal income tax number: Declare the personal income tax deductible arising in the month according to each industry group (after deducting the deducted personal income tax on canceled or returned goods and services).

In case during the declaration period, the amount of personal income tax deducted for revenue arising from selling goods and providing services according to the industry group is lower than the personal income tax deducted for sales of goods and services canceled or refunded for that industry group, the deducted personal income tax amount shall be recorded as a negative number.

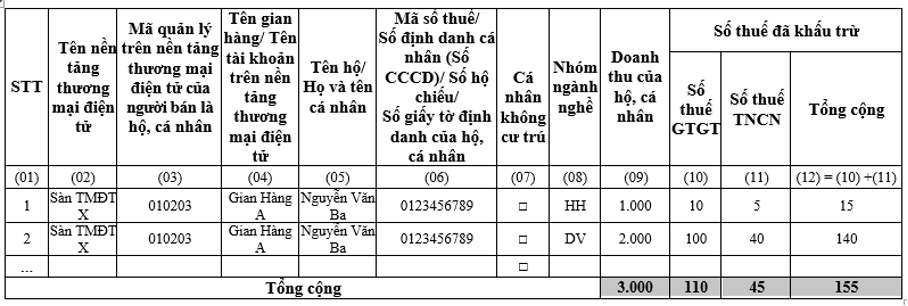

For example: Detailed list of deducted taxes of households and individuals doing business on e-commerce platforms with the following information:

May 2025: the seller (MST 123456789, full name: Nguyen Van Ba) is a residential individual who causes transactions to sell goods and services on E-commerce platform X subject to tax deduction as follows: