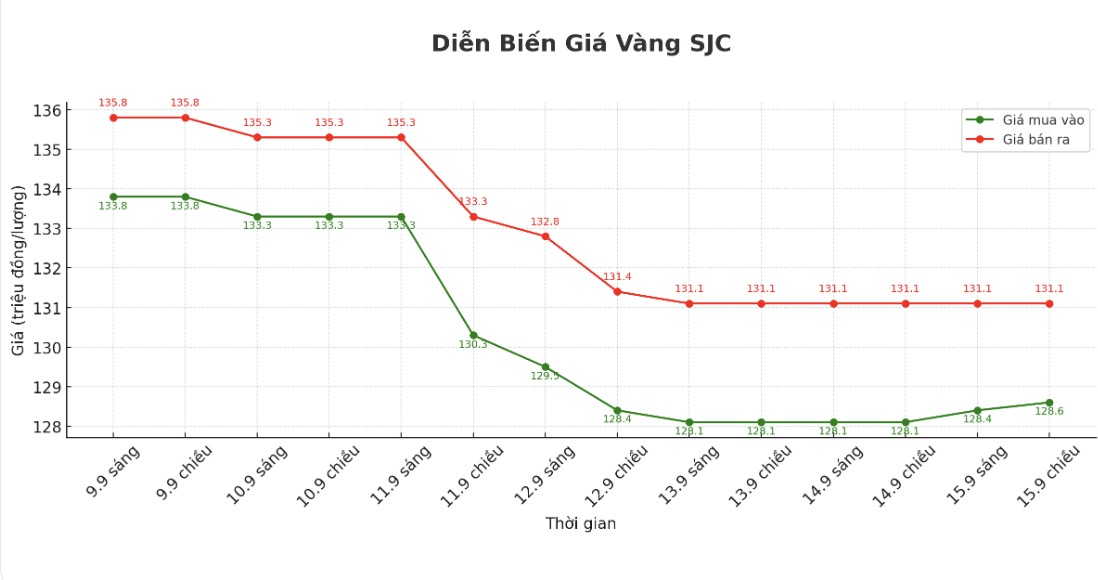

SJC gold bar price

As of 6:00 a.m. on September 16, the price of SJC gold bars was listed by DOJI Group at 128.6-131.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and unchanged for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-131.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 127.5-131.1 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3.6 million VND/tael.

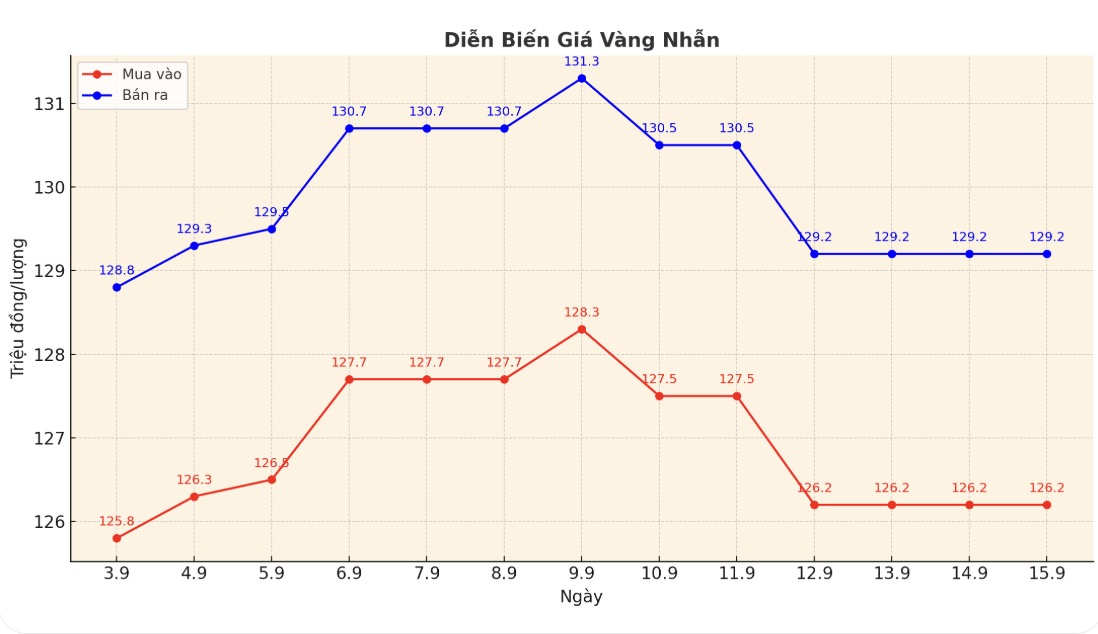

9999 gold ring price

As of 6:00 a.m. on September 16, DOJI Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.5-128.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

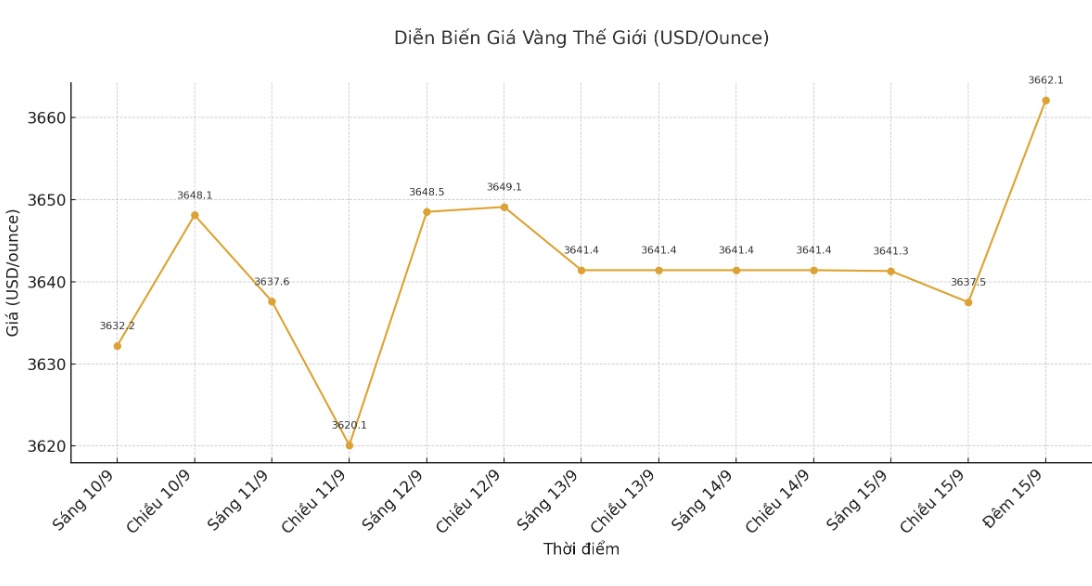

World gold price

The world gold price was listed at 22:00 on September 15 at 3,662.1 USD/ounce, up 20.7 USD.

Gold price forecast

Gold and silver prices fell slightly in the trading session on Monday, due to profit-taking efforts from short-term futures traders after previous increases.

However, the market quickly increased sharply after the New York manufacturing index suddenly decreased. The Empire State manufacturing survey fell to -8.7 in September, after August's 11.9 in the Federal Reserve, New York branch said. This data was much worse than expected, as market consensus expected it to fall to 5.0.

Based operations in New York State eased slightly in September, according to feedback from businesses participating in the Empire State manufacturing survey. The general business conditions index fell 21 points to -8.7, the first time a negative level has been recorded since June, the report said.

The global stock market last night had mixed movements. The US stock index is expected to open slightly when the New York session begins.

Over the weekend, Fitch Ratings downgraded the French government's credit rating to A+ from AA-, citing the increased public debt burden and political instability.

Fitch warned that the budget consolidation process will be limited as the French presidential election in 2027 approaches. Fitch forecasts France's budget deficit will remain above 5% of GDP in the 2026-2027 period and believes that upcoming budget negotiations will hardly achieve the tightening measures as initially proposed.

China's industrial production increased by 5.2% in August compared to the same period, down from the 5.7% increase in July and lower than the forecast of 5.8%. This is the lowest increase in a year, mainly due to slowing production and electricity output.

China's retail sales also rose 3.4% year-on-year, below the forecast of 3.8%, indicating that the impact of the consumer stimulus program has weakened.

Global markets await a Federal Open Market Committee (FOMC) meeting that began Tuesday morning and ended Wednesday afternoon with a statement and press conference from Fed Chairman Jerome Powell.

The FOMC is expected to cut interest rates by 25 basis points, the first time since November 2024. The decision comes as the US Federal Reserve (FED) has been criticized for its slow response to weak US economic data, including a sharp adjustment to reduce employment and inflation data due to tariffs.

New forecasts could show slowing growth and rising unemployment, while Fed Chairman Jerome Powell is expected to face many questions.

In outside markets, the US dollar index decreased slightly, while crude oil prices almost moved sideways around 62.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.06%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...