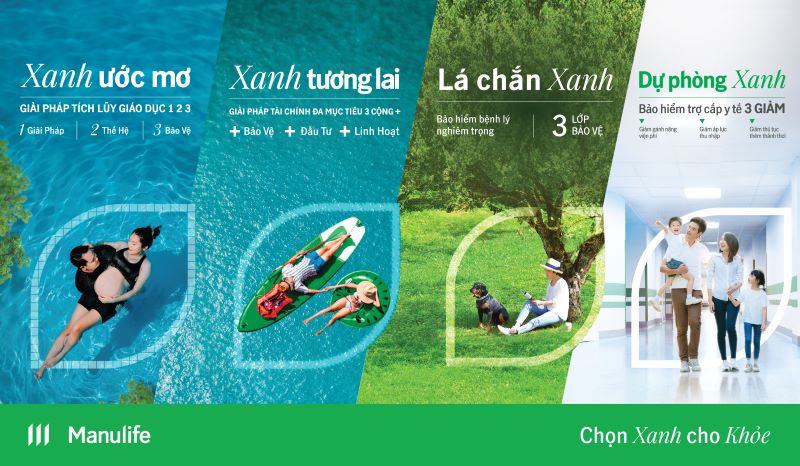

Green Solution set are the first products of Manulifes new generation of insurance, developed according to the orientation of the new Law on Insurance Business. These products are all expanded in scope and insurance benefits to meet the increasingly diverse needs of people, from saving for children's education and future, to protecting against serious illnesses, reducing the burden of hospital fees, and flexibly investing in long-term financial goals... Depending on needs, customers can choose the right insurance solution.

Xanh Tuong Lai is an insurance product linked to the unit. This is a multi-purpose financial solution, combining protection and investment in unit-linked funds managed by Manulife Investment Fund Management Company (Vietnam). Thanks to its flexible characteristics, the product is suitable for many different goals and target customers, from young people starting a business to families with long-term protection and investment needs.

Xanh Uoc Mo is a joint insurance product, committed to the minimum interest rate, meeting the needs of protecting parents, while accumulating finances for children's education and future. Compared to previous general product lines, Xanh Uoc Mo has higher flexibility when allowing customers to choose different levels of protection depending on their needs, with the same insurance premium.

In this launch, both the Green Tuong Lai and Green Uoc Mo products are entitled to additional benefits of insurance increases up to 175% of the initial insurance amount without appraisal or insurance premium increase. Specifically, the insurance amount will be automatically increased over time to 150% of the initial insurance amount. In addition, when customers have a new family member, the insurance amount will increase to 25% of the initial insurance amount. Xanh Uoc Mo also received an additional 1% interest rate in the first 10 years of the contract. In addition, both products have attractive rewards for maintaining long-term contracts.

Green Chong Linh leaves are an insurance product that helps protect against 143 serious diseases. Depending on their needs, customers can choose from 3 different protective layers, including end-stage diseases, early-stage diseases and common health problems today. The product has a wide range of insurance and covers common diseases such as serious thyroid cancer, diabetes complications... for all ages, not limited to certain ages as usual. This is a useful advantage as these diseases are getting younger. Another difference of Green Linh Chan Xanh compared to similar products on the market is that it pays higher, up to 150% of the insurance for gender-based cancers, diseases that are increasingly common in Vietnam. More specifically, after paying the final stage of benefits, the Green Linh cosmetic product did not end, but continued to be valid, protecting customers from 65 other diseases.

Green room Attendance is a health insurance product, paid by hospital stay, including regular treatment and intensive treatment. The special feature of Du Phong Xanh is that the number of days in hospital paid for each year is up to 100 days and there is no limit on the number of days in hospital throughout the contract term until the customer is 75 years old. The product has competitive fees and a simple compensation process, helping customers reduce the burden of hospital fees and reduce income pressure during treatment.

Green Solution set demonstrates Manulifes efforts in adding practical benefits to customers. These products are all designed in a transparent and easy-to-understand direction, with high flexibility and competitive prices. In addition, Manulife also simplifies the language used in insurance contracts, increasing visualionality, helping customers easily grasp information.

Ms. Tina Nguyen, General Director of Manulife Vietnam, said: We are very excited about this Green product set. The products are developed from the company's thorough and in-depth research on trends related to finance, health, medicine, etc. Manulife's goal is to bring practical solutions to be able to accompany customers for a long time throughout their life."

In parallel with the launch of new products, Manulife also invests in developing a team of professional consultants, well-trained in insurance finance and medicine. Recently, the company has cooperated with the Vietnam Young Physicians Association and the Institute of Preventive Medicine and Public Health Training - Hanoi Medical University, implementing a training program on essential knowledge of public health for the consulting team, helping to improve consulting capacity and accompanying customers more closely.

The above new products have now been deployed nationwide by Manulife through a team of professional consultants, ready to work with customers to achieve financial and health goals. For more detailed information about the above products, customers can visit the website www.manulife.com.vn or contact hotline 1900 1776 for support.