Article 2 of the draft stipulates the subjects subject to special income tax.

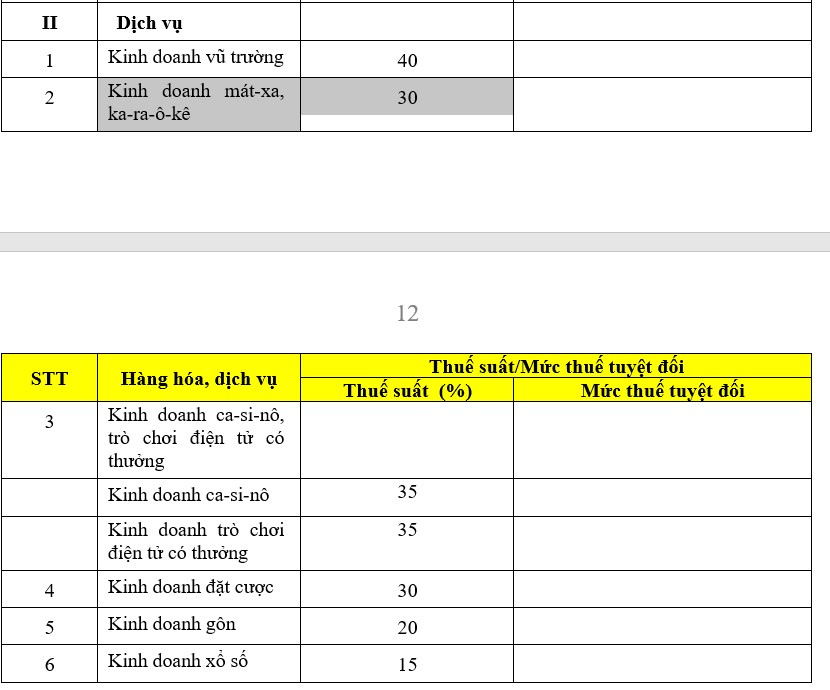

In which, the service sector includes:

Dance club business;

Massage, room and garden business (karaoke);

Casiino business; rewarded video games include jackpot games,slot and similar machines;

Betting business includes sports and entertainment betting and other forms of betting as prescribed by law;

Golf business includes golf practice court business, selling membership cards, golf playing tickets;

Lottery business;

The following goods are subject to special consumption tax:

Cigarettes according to the provisions of the Law on Prevention and Control of Tobacco Harm;

Alcohol according to the provisions of the Law on Prevention and Control of Harmful Effects of Alcohol and Beer;

Beer according to the provisions of the Law on Prevention and Control of Alcohol and Beer Harmful Effects;

Vehicles with engines under 24 seats, including: Passenger cars; four-wheeled motorized passenger vehicles; passenger pick-up cars; double-cabin cargo pick-up cars; VAN trucks with two or more rows of seats, with a fixed divider design between the passenger compartment and the cargo compartment;

Two-wheeled motorbikes, three-wheeled motorbikes with a cylinder capacity of over 125cm3;

Aircraft, helicopters, tourists and yachts;

Gasoline of all kinds;

Coordinate the temperature with a capacity of over 18,000 BTU to 90,000 BTU except for the type according to the manufacturer's design only for installation on means of transport including cars, trains, ships, boats, and airplanes. In case the organization or individual producing or selling or the organization or individual importing separately each part is a hot or cold unit, the goods sold or imported (hot or cold unit) are still subject to special consumption tax as for the complete product (complete air conditioning machine); Newspaper; Gold, votive paper, not including votive paper, which is a children's toys, teaching aids;

Vietnam standard soft drinks (TCVN) have a sugar content of over 5g/100ml;

The goods specified in Clause 1 of this Article are complete products, excluding components for assembling these goods.

In case it is necessary to amend and supplement taxable subjects to suit the socio-economic context in each period, the Government shall submit to the National Assembly Standing Committee for consideration, decision and synthesis of the Government Report, and report to the National Assembly at the nearest session.

The Government shall detail and guide the implementation of this Article.

Regarding the special consumption tax rate for mass-produced and exported business services, the draft proposes a tax rate of 30%. In addition, other types of services subject to special consumption tax are as follows: