High dividend rates appear in many real estate businesses

In the context of the real estate market gradually regaining recovery momentum, many enterprises in the industry have announced plans to divide dividends at high rates, using resources from sudden profits and the process of restructuring cash flow.

According to the record, Vietnam Exhibition Center Joint Stock Company (VEFAC, code VEF) is the enterprise that announces the highest dividend price on the market today. With a ratio of up to 435%, each VEF stock will receive VND43,500, with a total estimated payment value of VND7,247 billion. This dividend is taken from the after-tax profit in the first quarter of 2025, recorded as a breakthrough thanks to the revenue from the transfer of a part of the Vinhomes Global Gate project.

The high dividend ratio also appears in many other enterprises. SJ Group (code SJS) will issue shares to pay dividends over many years and reward shares with a total ratio of up to 159%. D2D (code D2D) - a company operating in Dong Nai - plans to divide the dividend in cash at a rate of 84%, equivalent to VND 8,400/share.

Some other real estate businesses choose to divide dividends in shares to retain cash flow for reinvestment. For example, Khang Dien Investment and Trading Joint Stock Company (K human) will issue more than 101 million shares to pay dividends in 2024 at a rate of 10%, and maintain the same ratio for 2025.

In addition, Dat Phuong Group (DPG) also conducted two payment methods in parallel: cash with a rate of 10% and issued nearly 37.8 million bonus shares with a rate of 60%. The expected cash dividend payment date is July 4, 2025.

Meanwhile, Vinaconex Corporation (VCG) and Thang Long Investment Group (TIG) have dividend rates of 16% and 10% respectively. TIG also plans to increase charter capital through issuing more than 240 million shares, most of which are reserved for existing shareholders.

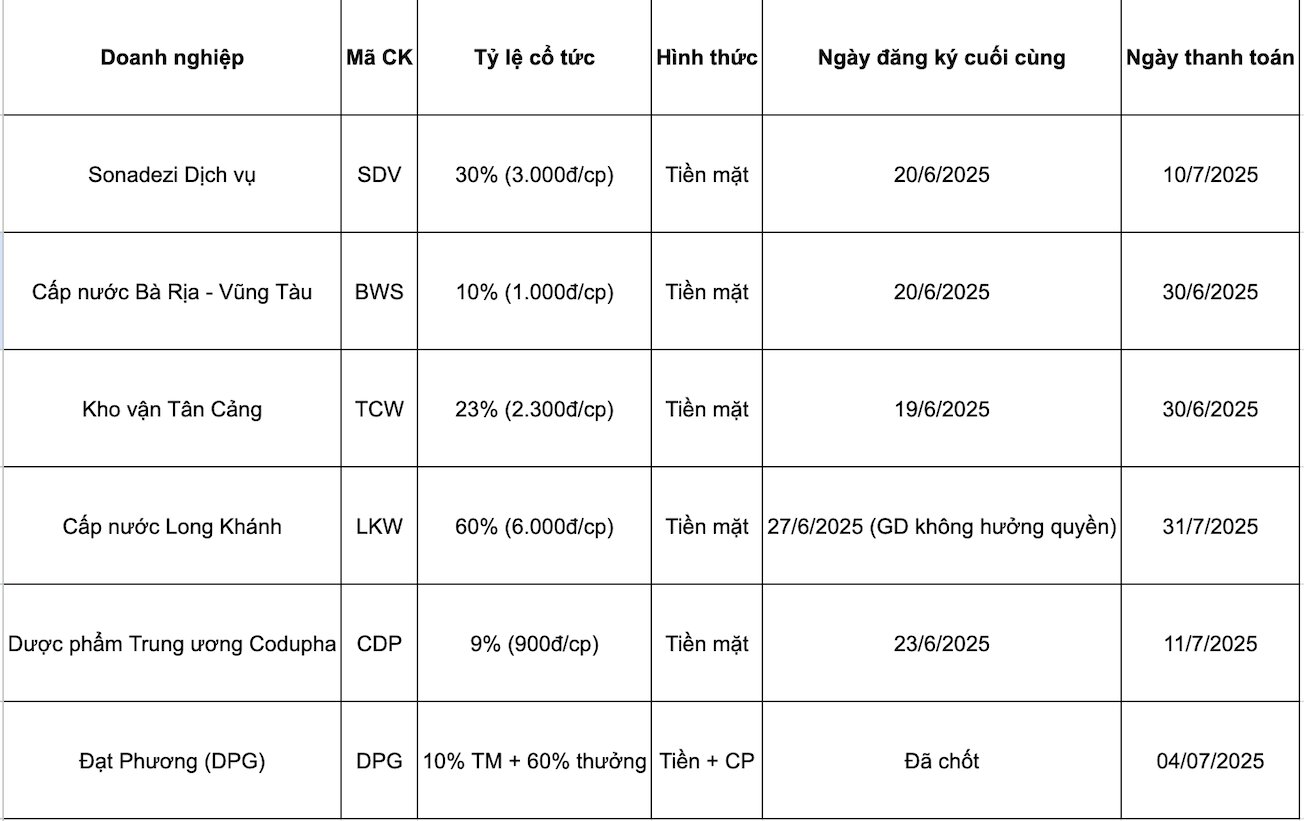

In addition to the group of enterprises listed on HOSE and HNX, many companies operating in the field of infrastructure and industrial park real estate also plan to divide dividends after June 19, 2025, including:

Ba Ria - Vung Tau Water Supply Joint Stock Company (BWS): Cash equivalent of VND 1,000/share, paid on June 30, 2025.

Sonadezi Services Joint Stock Company (SDV): The rate of sharing is 30% in cash, paid on July 10, 2025.

Tan Cang Kho Joint Stock Company (TCW): coties are VND 2,300/share, payment date June 30, 2025.

Long Khanh Water Supply Joint Stock Company (LKW): Expected to divide VND 6,000/share, on July 31, 2025.

Where does the motivation for dividend division come from?

The reason why many businesses are sharing high dividends at the present time is explained by analysts to attract investors before the new issuance plan or preparing for the listing/re- listing period. At the same time, this is also a way to effectively use retained profits - which are not easy to reinvest in the context of the real estate market still having limited liquidity and complicated legal problems.

On the other hand, some businesses choose to divide dividends in shares instead of cash, to retain cash flow to serve project restructuring and long-term investment activities. This form also helps increase charter capital without affecting short-term financial indicators.

Housing supply in 2025 is forecast to increase by about 10% compared to the previous year, thanks to the removal of legality and acceleration of investment licensing, according to VARS. In that context, strengthening financial capacity through dividends is also considered a necessary preparation step for businesses to be more proactive in the recovery period.