Liquidity pressure causes deposit interest rates to increase

At the forum "Credit market and macroeconomic issues" held on December 24, economic experts said that in the context of Vietnam setting high growth targets, the credit market is under great pressure, requiring a more cautious approach to monetary policy management and developing alternative capital sources.

Speaking at the forum, Dr. Can Van Luc - Chief Economist of BIDV, Member of the Prime Minister's Policy Advisory Council said that the total deposit in the banking system is currently about nearly 15 million billion VND, but this cannot be considered "surplus money among the people". This is the total outstanding deposit accumulated over many years, this year alone, mobilization growth is only at 1213%.

Meanwhile, outstanding credit has exceeded VND17 million billion, about VND2 million billion higher than the total mobilized capital. This shows that the banking system does not have excess capital, but is instead under liquidity pressure when credit increases faster than mobilization. According to data up to the end of November, credit increased by 16.6% while capital mobilization increased by only about 13.5%, creating a difference of about 3 percentage points.

Dr. Can Van Luc believes that this is one of the reasons for the increase in deposit interest rates in recent times. He commented that the trend of increasing deposit interest rates is taking place, and some cases will last until the first quarter of 2026. However, lending interest rates did not increase accordingly, because the banking system had to share difficulties and implement the policy of stabilizing interest rates to support growth.

Credit increases rapidly, but cannot be the only driving force

Going deeper into the structure of the financial market, Dr. Can Van Luc emphasized that in the period of 2011-2025, the scale of the Vietnamese financial market will increase by an average of 16.5% per year, 2.5 times higher than the GDP growth rate. The scale of the financial market is currently equivalent to about 300% of GDP, meaning that if the financial market or the real estate market has a large fluctuation, the impact on the economy will be very strong.

Notably, bank credit still accounts for about 50'52% of the total capital supplied to the economy annually, at times up to 57%, while other channels are developing slowly. The stock market only mobilizes about VND100,000150,000 billion per year, equivalent to the mobilization scale of a mid-sized commercial bank. The corporate bond market contributes about 1112%, public investment about 1516%, while new capital contribution from the private enterprise sector only accounts for about 34%.

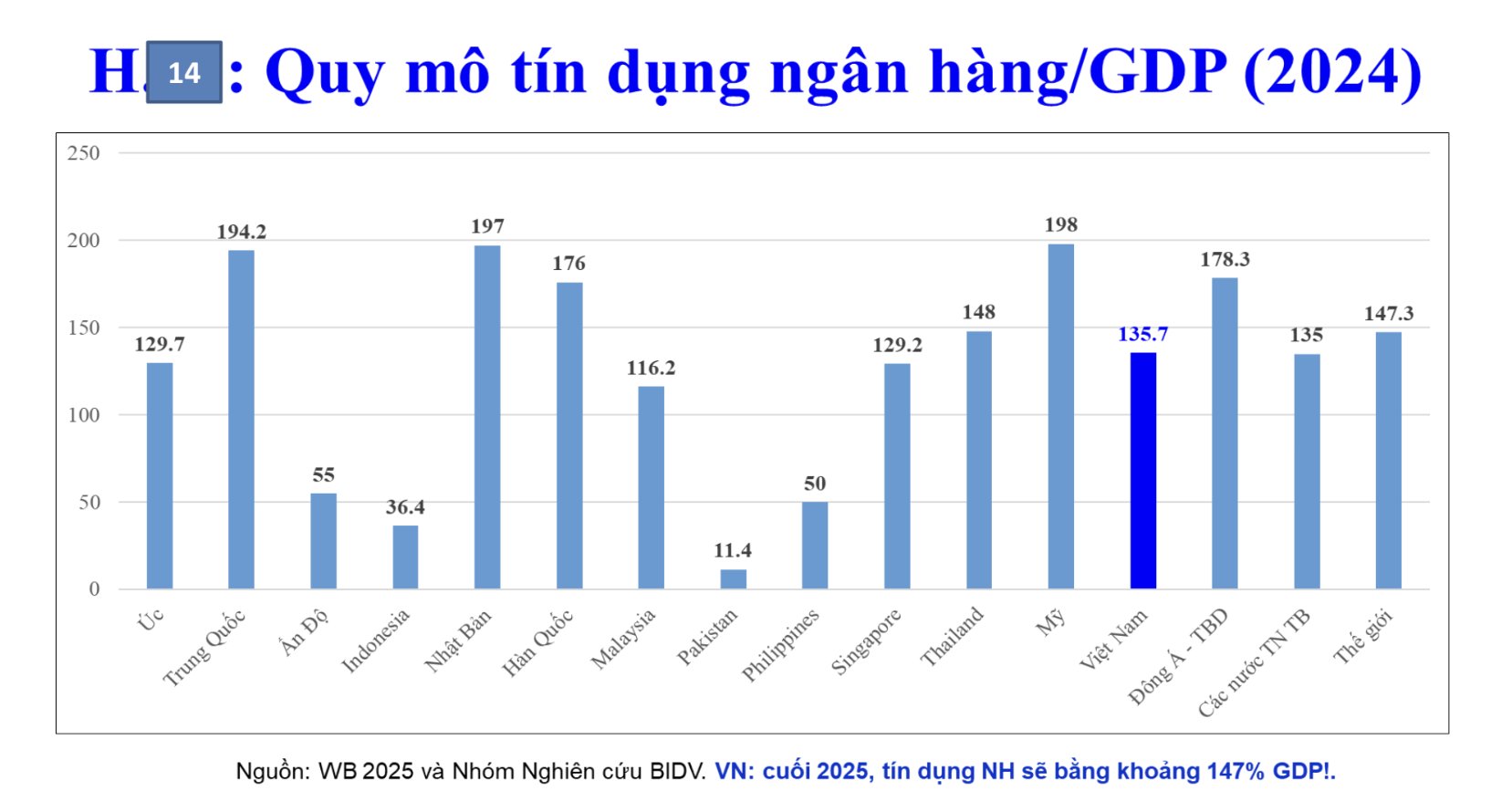

Dr. Can Van Luc warned that the credit/GDP ratio has increased to about 147% by the end of this year. If in the coming period, GDP increases by 10% while credit increases by 1617%, by 2030, this rate can reach 180185% of GDP.

According to him, in that context, diversifying capital sources is a mandatory requirement, especially for medium and long-term capital for science and technology, innovation and venture capital - areas where banking is difficult to effectively finance.

Directing capital flow into production and business

At the forum, Dr. Vo Tri Thanh - Director of the Institute for Brand and Competition Strategy Research (BCSI) commented that for Vietnam today, whether it is about developing the stock or bond market, in fact, these markets still depend heavily on the banking system, clearly demonstrated through liquidity and bond shocks in recent years.

Dr. Vo Tri Thanh emphasized that the current liquidity problem is not just a story of the year-end cycle, but reflects structural pressure. Lessons from before 2011 show that when credit and money supply increase too strongly, macro instability will appear. Although Vietnam has reduced credit growth to a safer level for many years, returning to 1516% in the context of a large economy poses a big challenge.

Another notable point is the gap between savings and investment. According to estimates, Vietnam's savings are about 37% of GDP, while investment is about 33.5% of GDP, or even lower if FDI capital is excluded. This shows that the savings among the population are very large, but have not been effectively converted into production and business.

According to Dr. Vo Tri Thanh, part of the cash flow flows into safe-haven channels and financial asset investment, helping to increase liquidity but not directly creating new production capacity. Real estate investment, although attracting strong capital, is mainly medium and long-term, while banking capital is bound by safety regulations, making the problem of capital allocation increasingly complicated.

Therefore, to mobilize and effectively use resources among the people, the key factor is still strengthening market confidence, improving the investment - business environment and building an overall strategy for the financial market. When confidence is improved, capital flows will shift more strongly to the production - business sector, instead of just rotating in asset channels.