Today (January 28), world coffee prices fluctuated in opposite directions, while the domestic market fell sharply after a series of consecutive increases. Robusta coffee prices on the London floor fell after reaching a new record, while Arabica coffee prices in New York continued to increase due to exchange rate factors and the political situation.

Domestic coffee prices today (January 28) suddenly dropped shockingly

The domestic coffee market today recorded a sharp decrease of VND 1,000/kg compared to yesterday, bringing the purchase price to fluctuate between VND 123,700 - 124,500/kg.

In Lam Dong province, Di Linh, Bao Loc and Lam Ha districts all recorded purchasing prices at 123,700 VND/kg, the lowest level in the Central Highlands region.

In Dak Lak, coffee prices in Cu M'gar district reached VND124,300/kg, while Ea H'leo and Buon Ho districts had lower prices, reaching VND124,200/kg.

In Dak Nong, traders purchased in Gia Nghia at 124,500 VND/kg, the highest in the region, and in Dak R'lap at 124,400 VND/kg.

Gia Lai province recorded the purchase price in Chu Prong at 124,000 VND/kg, while Pleiku and La Grai remained at 123,900 VND/kg.

In Kon Tum, coffee price today also reached 123,900 VND/kg.

Thus, domestic coffee prices fell sharply, reflecting an adjustment after many consecutive days of increase.

World coffee prices

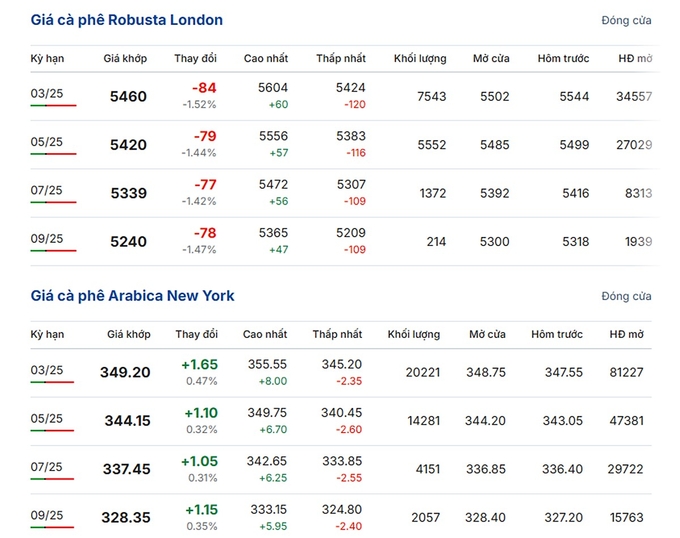

On the London floor, Robusta coffee prices had a dramatic trading session when they reached the milestone of 5,600 USD/ton (March 2025 contract), surpassing the historical peak but then plummeted. At the end of the session, prices fell sharply in all terms:

March 2025 term: 5,460 USD/ton, down 84 USD (-1.52%).

May 2025 term: 5,420 USD/ton, down 79 USD (-1.44%).

July 2025 term: 5,339 USD/ton, down 77 USD (-1.42%).

September 2025 term: 5,240 USD/ton, down 78 USD (-1.47%).

Meanwhile, Arabica coffee prices on the New York floor moved in the opposite direction, increasing slightly:

March 2025 futures: 349.20 cents/lb, up 1.65 cents (+0.47%).

May 2025 futures: 344.15 cents/lb, up 1.1 cents (+0.32%).

The falling USD index has benefited Arabica, while rapidly rising coffee inventories on the London exchange have put pressure on Robusta prices. In addition, former President Trump’s announcement of sanctions against Colombia also contributed to pushing Arabica prices higher due to supply concerns.

Coffee price forecast

According to experts, the sharp drop in domestic coffee prices today is a normal phenomenon after a series of consecutive increases. This reflects investors' profit-taking psychology and the necessary adjustment of the market after reaching a record high.

However, coffee prices are still at historically high levels, ensuring good profits for coffee growers. With stable global demand and limited supply from Vietnam during the Lunar New Year holiday, the market still has the potential to keep prices high until May 2025.

Experts also recommend that farmers and businesses avoid panic selling to protect long-term interests. Meanwhile, weather conditions and production in major exporting countries such as Brazil will continue to be factors that strongly influence world coffee prices.