Shortly after the market closed on Friday, Moody's (Moody's Investors Service - one of the three largest credit rating organizations in the world) lowered its US debt rating from Aaa to Aa1, citing rising interest rates and unsustainable debt growth. At the same time, the company also raised the rating outlook from negative to stable.

Our one-point drop in the 21-point rating scale reflects a more than decade-long increase in government debt and interest rates, which are now significantly higher than in countries with equivalent ratings, Moodys said in a statement.

The downgrading comes as the US government has implemented strong bage-ten straining measures through the Department of Government Efficiency, headed by Tesla CEO Elon Musk.

Although Musk initially pledged to cut $2,000 billion in spending, the actual savings were much lower. According to reports, the actual savings are only around 100 billion USD.

Moody's believes that the prospects for adjusting spending policies and improving budget balance in the US in the medium term still face many challenges.

Succutive US governments and Congress have failed to reach consensus on measures to reverse the trend of large annual budget deficits and rising interest rates.

We do not believe that current budget proposals will lead to strong and long-term cuts in mandatory expenditures as well as budget deficits, Moodys said.

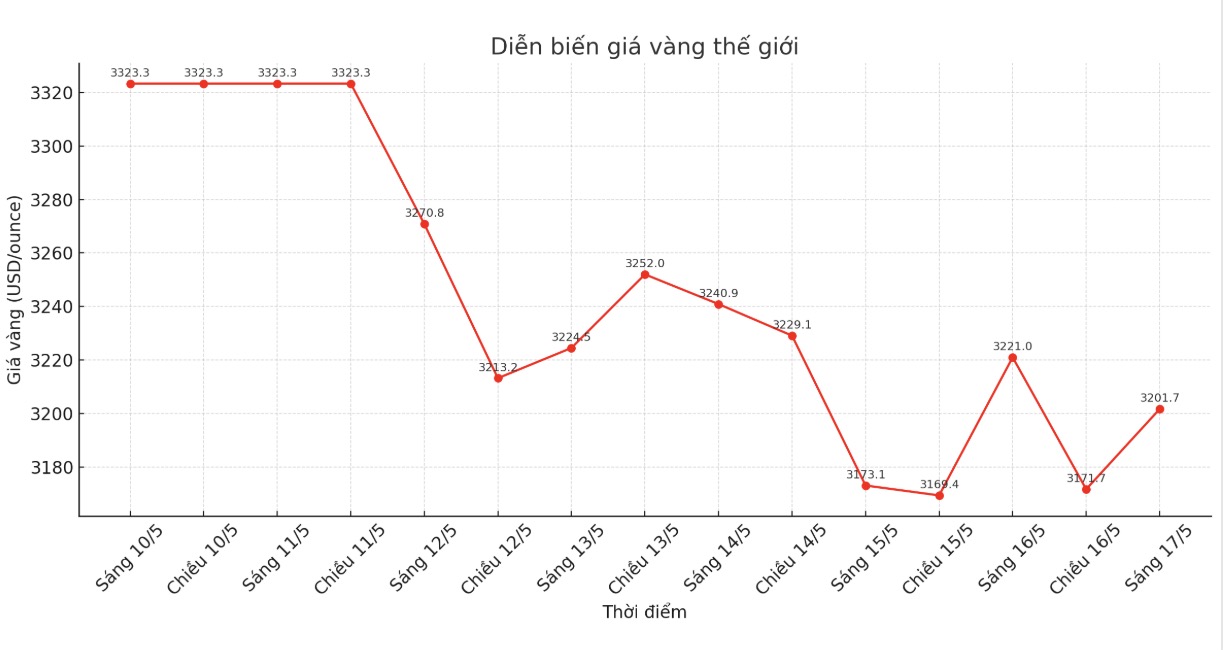

Markets have not yet reacted much to Moody's decision to downgrade before the weekend holiday; however, gold prices have reversed and increased strongly, ending the week back above $3,200/ounce.

While gold prices increased, US Treasury bond yields increased slightly and US stock futures fluctuated in the after-hours trading session, reflecting investors' uncertainty before the weekend holiday.

Moodys is the final rating agency among major organizations that still hold the Aaa rating for US public debt. However, the company has lowered its US credit outlook since the end of 2023 due to concerns about a growing budget deficit and rising interest costs.