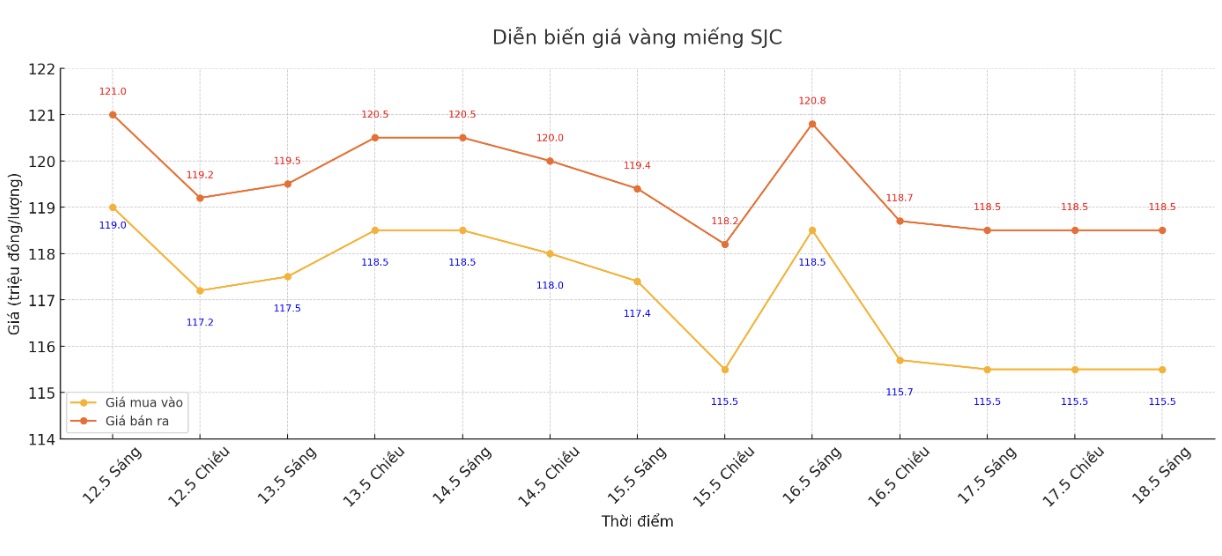

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at 115.5-118.5 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (May 11, 2025), the price of SJC gold bars at DOJI decreased by VND4.5 million/tael for buying and VND3.5 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 115.5-118.5 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (May 11, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 4.5 million VND/tael for buying and decreased by 3.5 million VND/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of May 11 and selling it in today's session (May 18), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 6.5 million VND/tael.

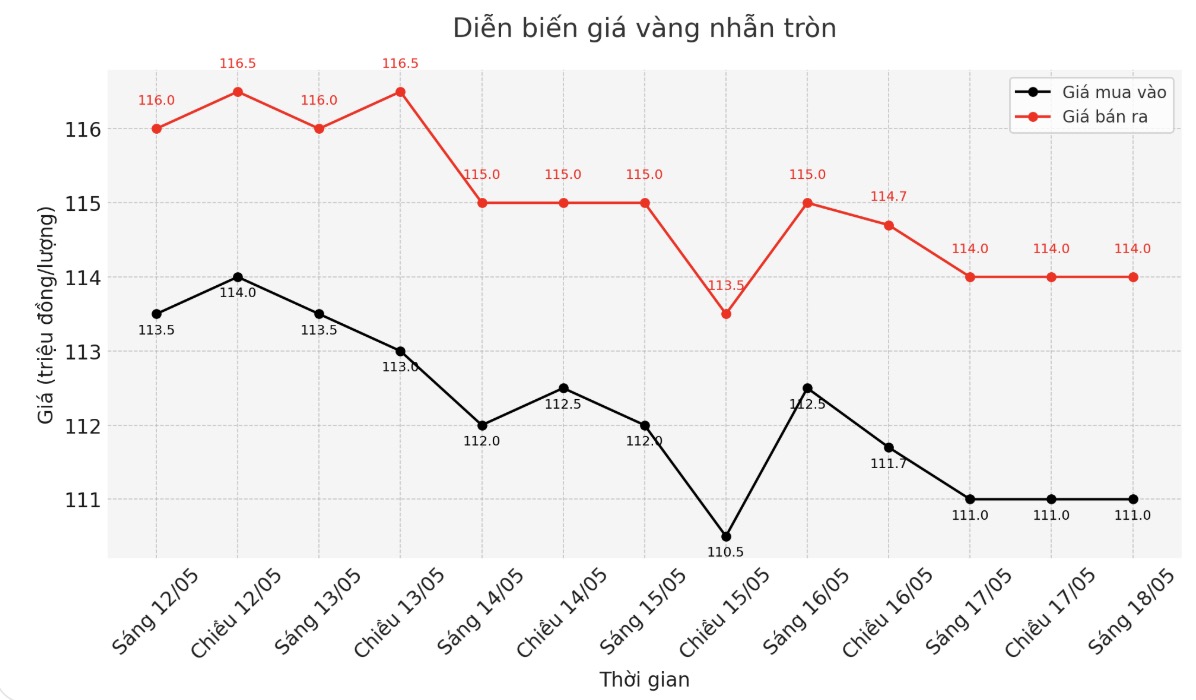

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 111-114 million VND/tael (buy - sell); down 3.5 million VND/tael for buying and down 3 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114-117 million VND/tael (buy - sell); down 3 million VND/tael in both directions compared to the closing price of the previous trading session. The difference between buying and selling is at 3 million VND/tael.

If buying gold rings in the session of May 11 and selling in today's session (May 18), buyers at DOJI and Bao Tin Minh Chau will both lose 6 million VND/tael.

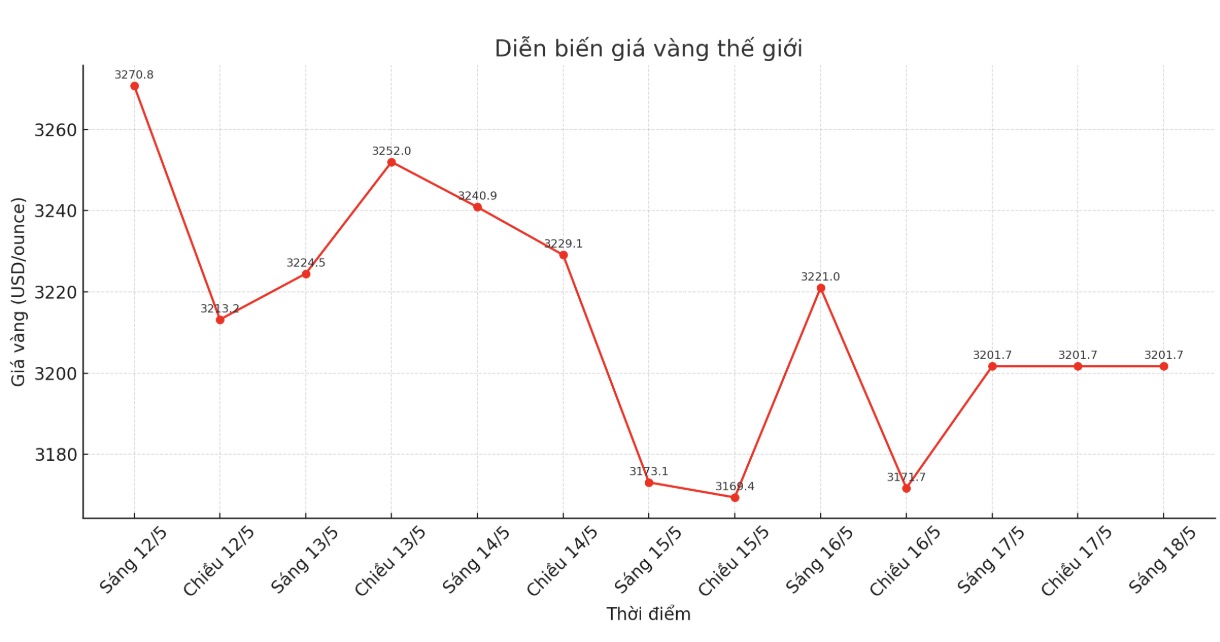

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,201.7 USD/ounce, down 121.6 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

The latest weekly gold survey from Kitco News shows that industry experts are leaning towards a downward price scenario next week.

Of the 16 experts surveyed, only 2 (12) believe that gold prices will increase next week. Meanwhile, 10 people (63%) predict gold prices will continue to fall. The remaining four (25%) see prices moving sideways.

Adrian Day - Chairman of Adrian Day Asset Management - predicts that gold prices will continue to decline in the coming time when the US adjusts tax rates. However, he said this would open up an attractive buying opportunity afterwards.

Sharing the same view, Adam Button - Head of currency strategy at Forexlive.com - said that the current trend is still bearish due to weak market momentum. However, he expects gold prices to find a bottom, likely still above $3,000/ounce.

Kevin Grady - Chairman of Phoenix Futures and Options - believes that gold prices still have room to decrease in the short and medium term.

I am leaning towards a downward trend next week. When trade deals start to be announced, I think gold prices will retreat to $3,000/ounce," he said.

On the other hand, Darin Newsom at Barchart.com said that the June spot gold chart still showed a short-term uptrend, as long as prices remained above $3,123.3/ounce. According to him, central bank buying continues to be a supporting factor for gold.

Mr. Michael Moor - founder of Moor Analytics - commented that if the gold price exceeds 3,148.2 USD/ounce, the market could enter a new up cycle that will last for many days. Conversely, if it returns below this threshold, the downward pressure will return.

See more news related to gold prices HERE...