Gold prices went sideways as traders temporarily put aside tensions in Venezuela to focus on a series of important US economic data to be released this week. Meanwhile, silver prices rose for the third consecutive session.

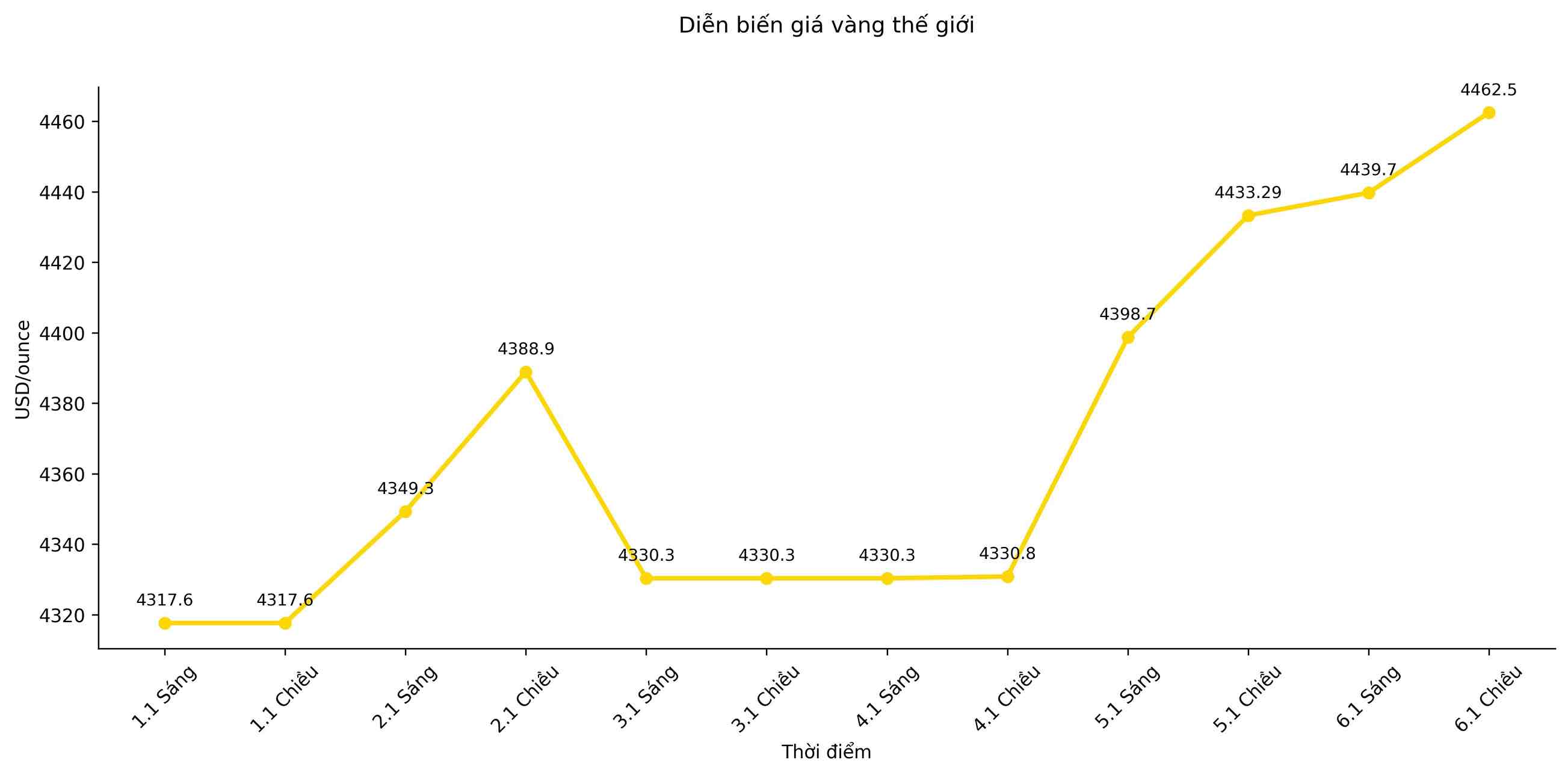

Spot gold prices remained almost unchanged, fluctuating around 4,461.76 USD/ounce, after increasing by 2.7% in the previous session thanks to information that US forces arrested Venezuelan leader Nicolas Maduro. The political situation in this South American country is still potentially unstable, especially after US President Donald Trump announced that Washington plans to "run" Venezuela. In related developments, Ms. Delcy Rodriguez has sworn in as acting president.

The market is currently shifting its attention to a series of US economic data expected to be released this week, with the focus on the December jobs report released on Friday. Speaking on Monday, the Chairman of the Minneapolis Federal Reserve, Neel Kashkari, said that interest rates may now be moving closer to neutrality for the US economy, and the upcoming data will play a key role in orienting US Federal Reserve policy.

According to Ms. Dilin Wu, a strategist at Pepperstone Group Ltd., escalating tensions in Venezuela have provided short-term support for gold's safe-haven needs, but this impact may only be limited if tensions in the Caribbean region do not continue to increase.

Gold prices have just closed the year with the strongest increase since 1979, continuously setting new records in the past year thanks to stable buying power from central banks and capital flows into gold ETF funds. Three consecutive interest rate cuts by the US Federal Reserve (Fed) also created significant momentum for the group of precious metals - which do not yield returns.

However, the outlook for next year is assessed as "much more balanced", according to Mr. Fawad Razaqzada, an analyst at City Index Ltd. He believes that central bank gold buying, global bond yield trends and remaining room for monetary policy easing will become decisive factors.

Previously, gold prices peaked at a historic level of 4,549.92 USD/ounce on December 26. Some major banks still forecast that gold prices could continue to rise in the near future, especially in the context that the Fed is expected to continue to lower interest rates and President Trump is carrying out a restructuring of the US central bank leadership. Goldman Sachs Group Inc once identified their base scenario as gold prices could reach 4,900 USD/ounce, with risks leaning towards the upward trend.

However, in the short term, the market still faces concerns about adjustment pressure as major commodity indices enter a rebalancing phase. The record strong increase in gold and silver may force passive investment funds to sell off contracts to suit the new ratio, starting from Thursday.

Silver prices rose sharply, at one point jumping 3.6% in Tuesday's session. In China, LONGi Green Energy Technology Group said it will start replacing silver with basic metals in solar panel production - the latest move by the solar energy industry to minimize the impact of rising silver costs.

As of this afternoon's trading session, spot gold prices edged up 0.2% to 4,466.16 USD/ounce. Silver prices rose 3.1% to 78.96 USD/ounce. Platinum rose 2.3% while palladium rose 1.6%. The Bloomberg Dollar Spot Index, the measure of the strength of the USD, fell 0.1%.