Gold prices went sideways in the new trading session, as the market assessed the impact of the stronger USD and a series of US economic data to be released on Friday - factors that will determine the interest rate orientation of this year.

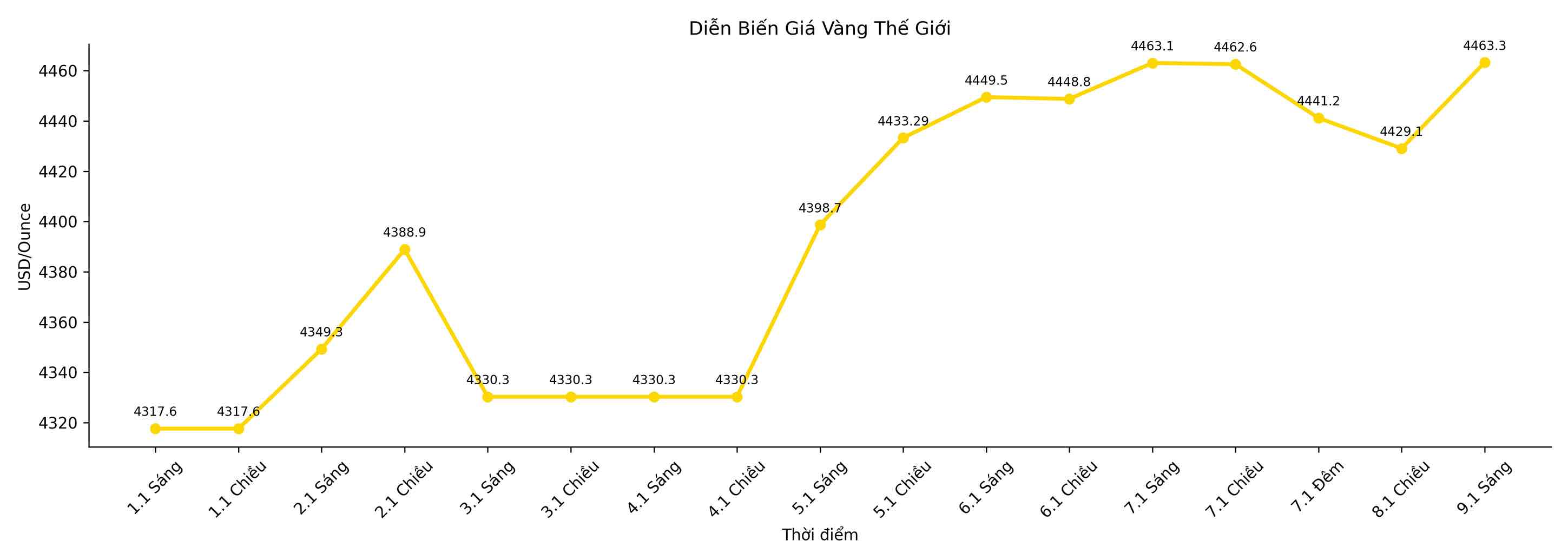

Spot precious metals remained around 4,465 USD/ounce, after increasing 3.4% in the week as of Thursday. Adjustment pressure appeared as the number of first-time US jobless claims in the week ending January 3 was lower than forecast. At the same time, the Bloomberg Dollar Spot Index - a measure of the strength of the greenback - has increased by 0.5% since the beginning of the year, making gold more expensive for most global buyers.

The December jobs report, expected to be released on Friday, will provide more signals about the possibility that the Federal Reserve (Fed) will continue to cut interest rates after three reductions in 2025. According to Bloomberg Economics forecasts, the number of non-farm jobs may increase sharply, while the unemployment rate is said to remain stable - two opposing factors that are unlikely to convince the Fed to resume the interest rate reduction cycle.

Gold has just closed the most brilliant year of 2025 since 1979, increasing by about 65% and continuously peaking, peaking at $4,549.92/ounce at the end of December. This explosive increase is supported by strong buying power from central banks, massive capital flows into gold ETF funds amid concerns about the weakening USD, along with expectations of reduced borrowing costs - a factor that is always beneficial for non-profitable precious metals.

Investors are also closely following the process of choosing a new Fed Chairman. US Treasury Secretary Scott Bessent said that President Donald Trump is expected to make a decision this month on the successor to Jerome Powell, who will end his term in May. According to Bessent, the shortlist includes four candidates.

As of this morning's trading session, gold prices slightly decreased by 0.2% to 4,466.93 USD/ounce. Silver decreased by 0.8% to 76.37 USD, extending the two-session decline but still aiming for an increase in the week. Platinum and palladium also simultaneously decreased.