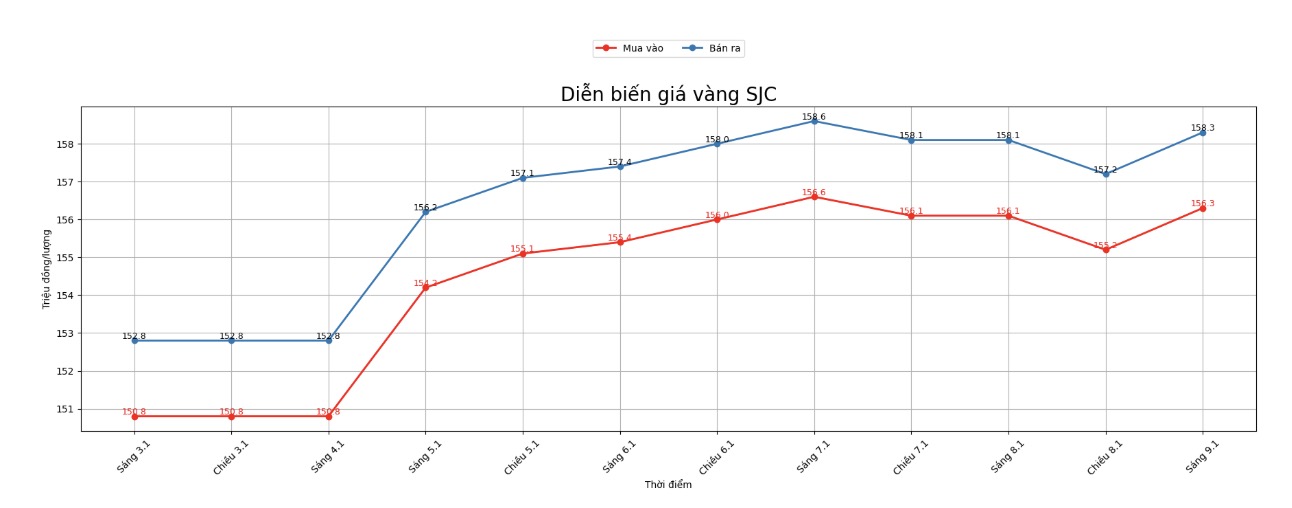

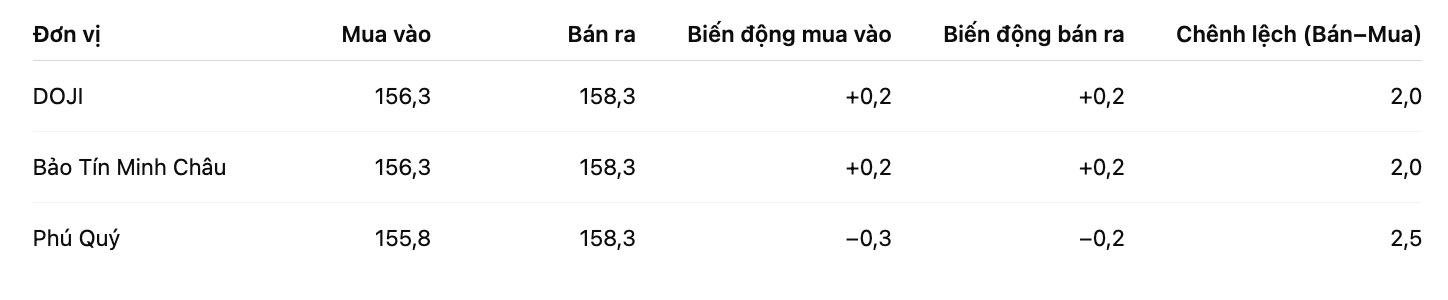

SJC gold bar price

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at the threshold of 156.3-158.3 million VND/tael (buying - selling), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 156.3-158.3 million VND/tael (buying - selling), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 155.8-158.3 million VND/tael (buying - selling), down 300,000 VND/tael on the buying side and down 200,000 VND/tael on the selling side. The difference between buying and selling prices is at 2.5 million VND/tael.

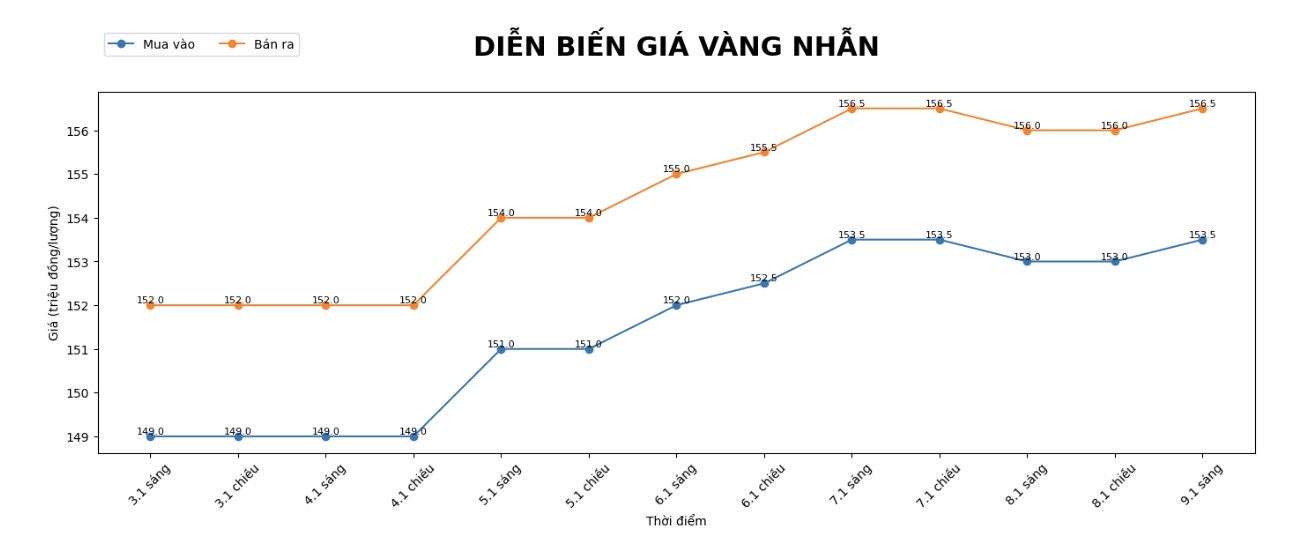

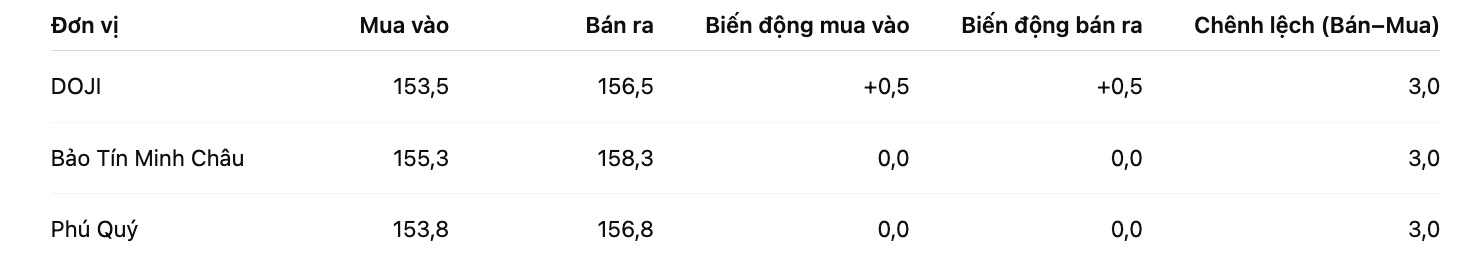

9999 gold ring price

As of 9:15 am, DOJI Group listed the price of gold rings at 153.5-156.5 million VND/tael (buying - selling), an increase of 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.3-158.3 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 153.8-156.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

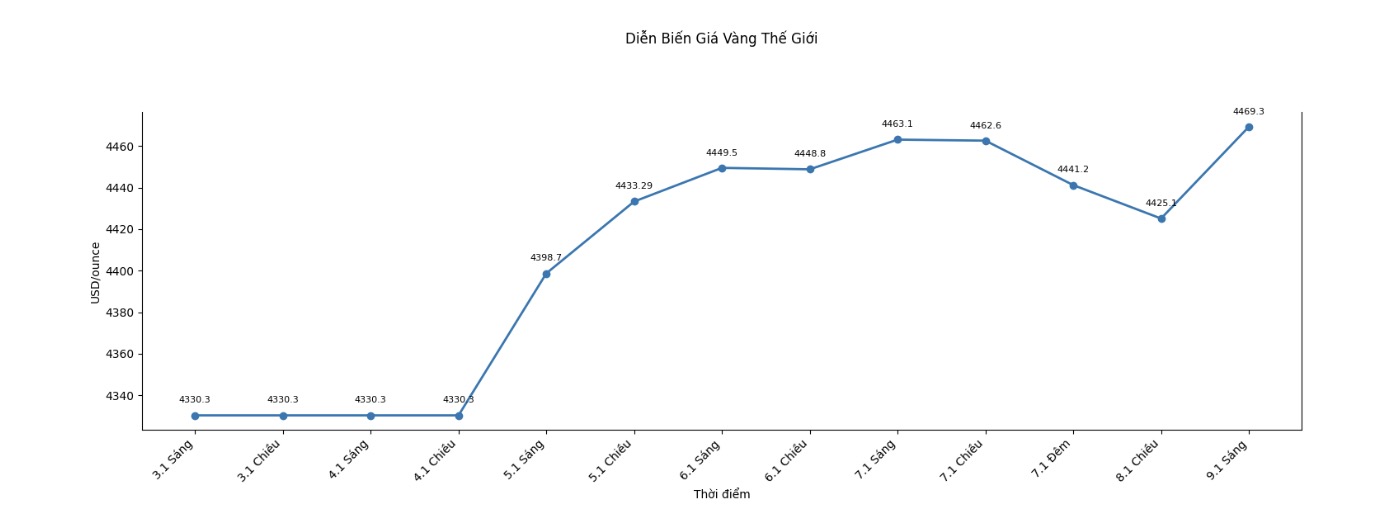

World gold price

At 9:18 am, world gold prices were listed around the threshold of 4,466.3 USD/ounce, up 35 USD compared to the previous day.

Gold price forecast

World gold prices are showing remarkable recovery after falling deeper than the peak in the previous session. However, current developments show that the precious metal market is still facing many short-term resistances, especially from the restructuring of commodity indices and fluctuations of the USD.

According to Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank, gold and silver are under significant pressure as the Bloomberg Commodity Index rebalancing process enters its peak period. “In the next few days, the COMEX futures contract market may record sales of up to 6–7 billion USD for each metal, due to the requirement to adjust the proportion in the index basket” - Mr. Hansen assessed. This activity is technical, but large enough to cause strong fluctuations in the short term.

At the same time, the USD remained around its highest level in nearly a month, as investors cautiously awaited the US non-farm job report. Recent data shows that the US labor market is showing signs of cooling down, with the number of vacant jobs falling to their lowest level in more than a year. This makes expectations that the US Federal Reserve (FED) will cut interest rates this year continued to be maintained, thereby partly supporting gold in the medium term.

From a longer-term perspective, the prospects of the precious metal are still positively assessed thanks to persistent gold buying demand from central banks and geopolitical risks showing no signs of completely cooling down. HSBC Bank forecasts that gold prices may reach the 5,000 USD/ounce mark in the first half of 2026, as global public debt increases and the trend of diversifying foreign exchange reserves continues.

Technically, the gold futures for the most recent month are fluctuating in a narrow range, showing a clear tug-of-war between buyers and sellers. If successfully surpassing the resistance zone around 4,500 USD/ounce, gold prices may open up new room for increase. Conversely, in a scenario of strong selling pressure, the support zone around 4,400 USD/ounce will play a key role.

In the context of still large fluctuations, experts recommend that investors be cautious with short-term "surfing" strategies, and closely monitor macroeconomic data and monetary policy movements to make appropriate decisions.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...