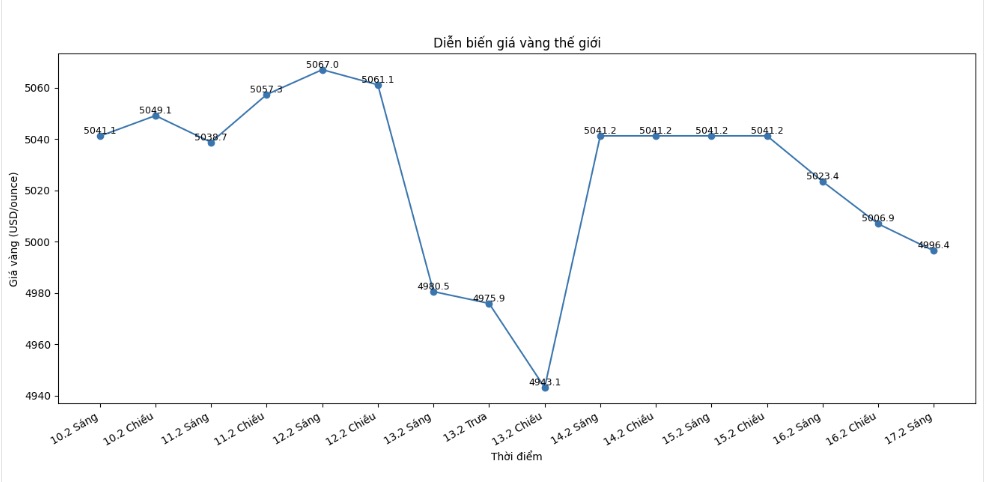

Gold prices almost went sideways in the first trading session of the day, as most Asian markets closed during the Lunar New Year and after the holiday in the US on Monday.

Precious metals fluctuated around the 5,000 USD/ounce mark, after falling 1% in the previous session. Previously, gold had briefly surged in Friday when moderate US inflation data reinforced the possibility that the US Federal Reserve (Fed) would cut interest rates. Low lending interest rates are often a supporting factor for non-rotating precious metals.

The speculative buying wave pushed the multi-year upward momentum of gold to an overheated point at the end of January, bringing the price to set a record above 5,595 USD/ounce. However, the sudden sell-off lasting two days at the time of the month transition caused the price to fall closer to 4,400 USD/ounce, although gold then recovered about half of the decline.

Many major banks - including BNP Paribas SA, Deutsche Bank AG and Goldman Sachs Group Inc. - predict that gold prices will resume the upward trend, thanks to fundamental factors still present such as geopolitical tensions, doubts surrounding the independence of the Fed and the trend of shifting away from currency and government bonds.

We continue to see two key macroeconomic factors supporting gold prices: inflation and the weakening of the USD," Jefferies analysts, including Fahad Tariq, wrote in a report, while raising their 2026 gold price forecast to $5,000/ounce from $4,200 previously. According to this group, investors and central banks are concerned about the above risks, "in fact, there is only one option: hard assets.

As of 7:45 am in Singapore, spot gold prices slightly decreased to 4,961.82 USD/ounce. Silver slightly decreased by 0.1% to 76.58 USD/ounce. Platinum edged down, while palladium increased by 0.4%. Bloomberg Dollar Spot index - a measure of the strength of the USD - went sideways after increasing by 0.1% in the previous session.