World gold prices turned down when US inflation data was lower than expected, further strengthening forecasts that the US Federal Reserve (Fed) will ease monetary policy this year.

The rising USD makes the precious metal more expensive for investors holding other currencies.

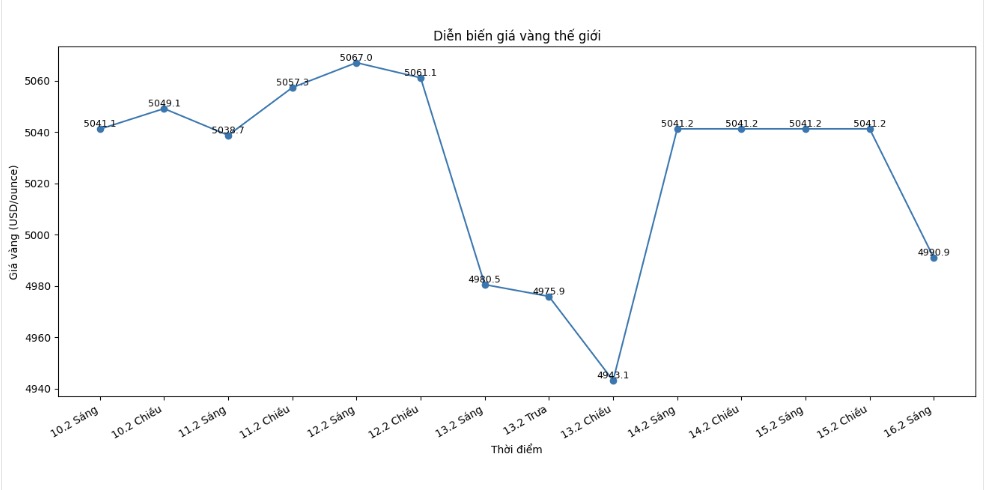

Recorded by Lao Dong reporters at 10:46 am on February 16 (Vietnam time), spot gold fell sharply to 4,990.9 USD/ounce. US gold futures contract for April delivery at 1:11 am GMT (ie 8:11 am Vietnam time) also fell 0.1%, to 5,039.5 USD/ounce.

Previously, the US Department of Labor announced that the consumer price index (CPI) for January increased by 0.2%, lower than the 0.3% forecast by economic experts. This increase continued the 0.3% increase of December. Cooling down inflation increased expectations that the Fed would soon cut interest rates.

Data compiled by LSEG shows that the market currently forecasts that the Fed may cut a total of 75 basis points this year, with the first correction likely to take place in July.

Experts believe that gold - an unprofitable asset - often benefits in a low interest rate environment, when the opportunity cost to hold precious metals decreases.

In related developments, international media reported that the Fed is expected to appoint Randall Guynn to the position of Director in charge of supervision and regulation, an important position in managing the banking system.

Meanwhile, geopolitical tensions continue to attract market attention. According to Reuters, two US officials said that the country's military is preparing for operational scenarios that could last weeks related to Iran. Meanwhile, Israeli Prime Minister Benjamin Netanyahu said that any agreement with Iran should consider the issue of nuclear infrastructure.

On the other precious metal market, spot silver at 10:51 sharply decreased to 74.91 USD/ounce. Platinum remained at 2,046 USD/ounce, while palladium increased by 0.4% to 1,660 USD/ounce.

See more news related to gold prices HERE...