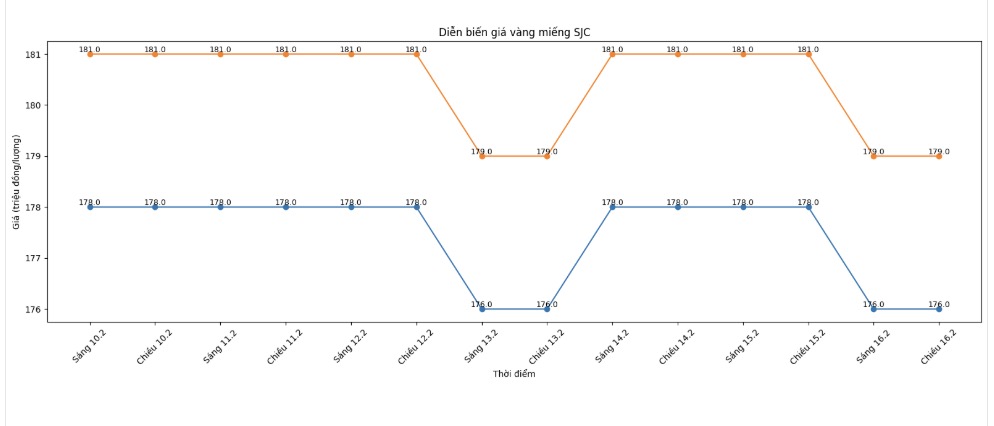

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

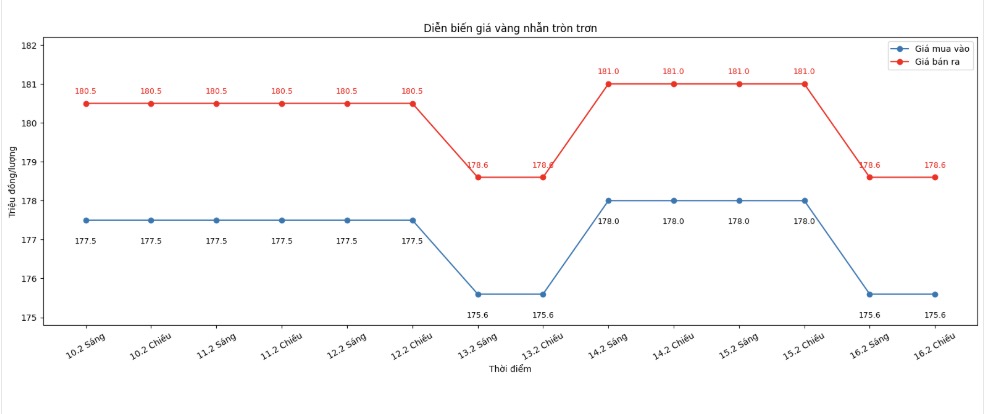

9999 gold ring price

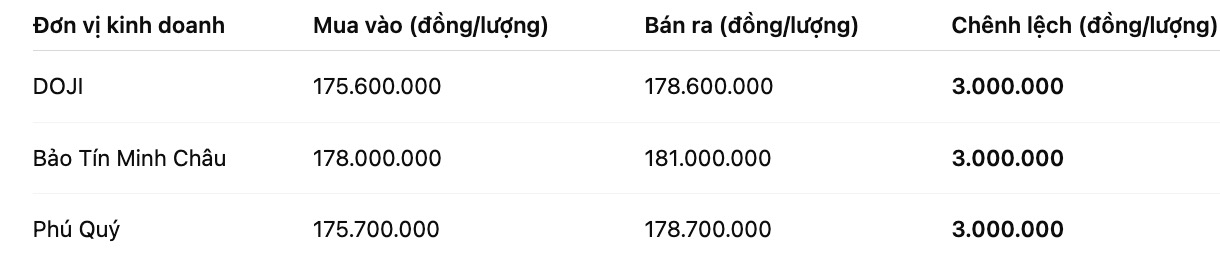

As of 6:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

The buying - selling gap in the country is being widened to nearly 3 million VND/tael, reflecting an increased level of risk. At the same time, world gold prices are struggling at the resistance level of 5,000 USD/ounce and may reverse to decrease at any time. If this scenario occurs, investors are likely to fall into a disadvantageous position, bearing loss pressure due to high differences.

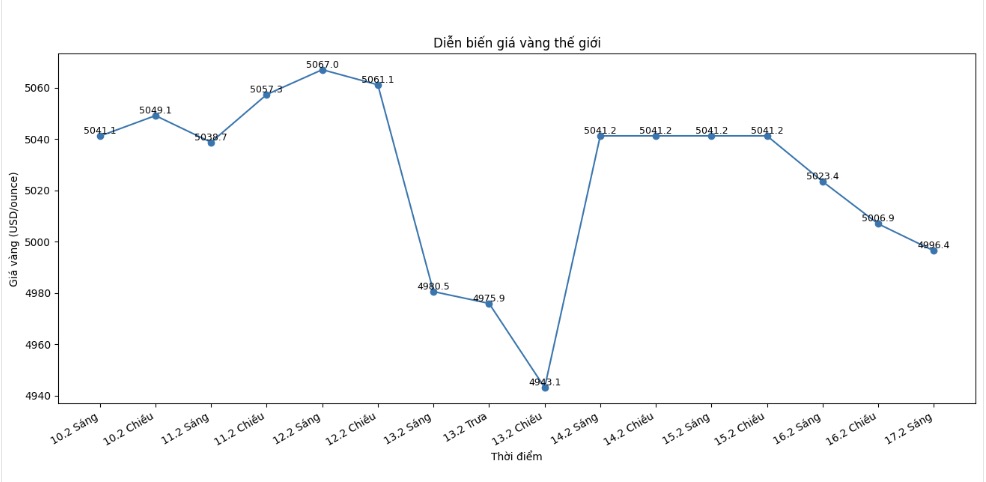

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 4, 996.4 USD/ounce, down 44.8 USD/ounce.

Gold price forecast

World gold prices entered a new trading week with a state of stalemate, in the context of reduced liquidity due to many major markets taking holidays off. Adjustment pressure appeared as the USD maintained its strength, making the precious metal less attractive to investors holding other currencies.

In the first session of the week, spot gold at one point fell deeply before narrowing the decline, reflecting a cautious sentiment overwhelming the market. Low liquidity is seen as a factor amplifying short-term volatility, especially when there is a lack of cash flow from key trading centers in the US and some Asian countries.

Gold is fluctuating around the 5,000 USD/ounce zone in a week of low liquidity due to the holidays," said Giovanni Staunovo, an analyst at UBS. According to this expert, in a thin trading environment, gold prices are easily affected by fluctuations in the USD and unexpected macroeconomic information.

The diễn biến of the USD continues to be an important variable. The greenback's slight increase has created more pressure on gold, while the market still assesses inconsistently the monetary policy outlook of the US Federal Reserve (Fed). Recent economic data shows an uneven picture: inflation shows signs of cooling down, but the labor market still maintains a certain "heat" level.

Investors are currently leaning towards the scenario of the Fed keeping interest rates unchanged in the upcoming meeting. However, expectations for an easing cycle in the second half of the year have not disappeared, thereby partially limiting the downward momentum of gold. In a low interest rate environment, gold - an unprofitable asset - often benefits from the decrease in opportunity cost of holding.

From a more cautious perspective, Mr. Zain Vawda - analyst at MarketPulse by OANDA - believes that gold may continue to fluctuate strongly in the short term. "I temporarily lower the medium-term gold price target to the 5,100 - 5,200 USD/ounce range, but the market is still very sensitive to economic data and USD developments," he said.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...