The nomination of Kevin Warsh to the position of Chairman of the US Federal Reserve (Fed), although it has helped the market reduce some uncertainty, also makes the interest rate outlook more complicated.

In addition, the possibility of clearer trade tariff policies may also lose an important driving force for the precious metals market. This is the assessment of Bart Melek - CEO and Head of Global Goods Strategy at TD Securities.

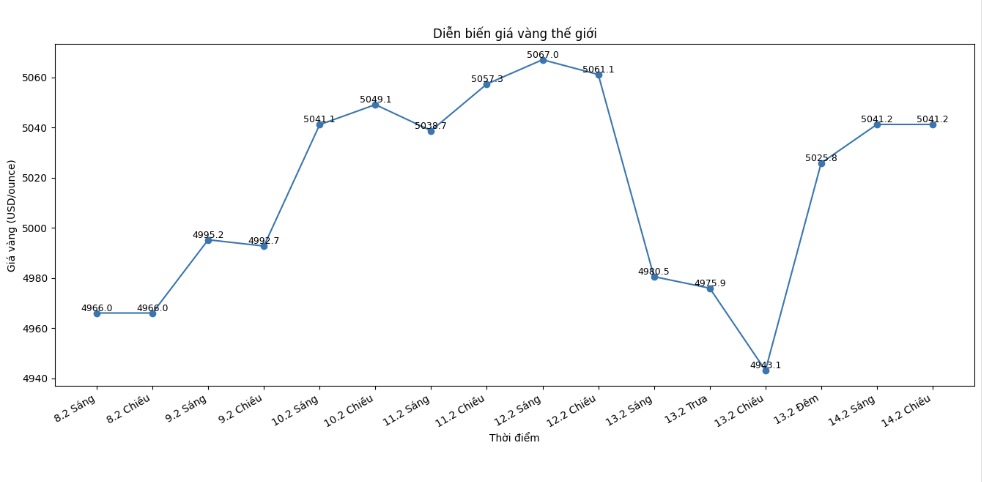

In an interview with BNN Bloomberg on Thursday afternoon, Mr. Melek mentioned recent strong fluctuations of precious metals - including yesterday's sudden sell-off that caused gold prices to plummet by 200 USD in just a few minutes.

I am afraid that volatility will remain a constant state in the coming time. A big problem is that we cannot be sure how US economic data will go. Recently, job data was better than expected, and inflation was also higher than forecast," he said.

Meanwhile, China is entering the Lunar New Year holiday, which may cause market liquidity to decline. We are also not clear about the level of interest in the current "devaluation risk hedging transactions".

Mr. Melek said that when gold and silver continuously hit historical peaks, deep corrections are inevitable. "We don't yet know if interest rates will fall or not" - he added - "It is also unclear how the demand from Asia for precious metals as a defensive tool will continue.

Regarding TD Securities' forecast that the average gold price in Q1/2026 will reach 5,000 USD/ounce but is unlikely to increase higher, Mr. Melek assessed that this is still a positive scenario for investors.

The 5,000 USD/ounce level for the next quarter's average price is still very high compared to history. The supporting factor is that after Mr. Powell leaves office, the Fed may have a president who is more inclined to cut interest rates, especially for short terms.

However, we do not expect gold prices to break through strongly, because it is not clear whether the new Chairman is willing to accept higher inflation in exchange for growth or not. Uncertainty is still very high. When the new Chairman officially takes office in May, the market will have more basis for assessment" - he assessed.

Regarding demand from individual investors, Mr. Melek believes that profit-taking activity may increase. "There is currently not too much excitement from speculators, so the market is in a consolidation phase after the upward momentum.

Regarding the recent strong fluctuations of silver, Mr. Melek said that the main reason comes from the "gamma squeeze" phenomenon (a phenomenon of prices being pushed up or down quickly and strongly because market makers have to buy/sell original assets continuously to hedge against risks when investors flock to trade options).

This phenomenon has temporarily ended. We note the strong participation of individual investors in the options market, especially buying buy options for silver ETF funds.

This forces market regulators to buy physical silver to hedge against risks, in the context that the market is already illiquid and inventory is limited, thereby creating a price tightening effect," he explained.

He also noted the emergence of high leverage funds. "Then, some unfavorable information appeared, as President Trump said he was considering Kevin Warsh for the Fed Chairman position - who is seen as having a tougher stance on inflation, weakening monetary easing expectations.

Referring to the impact of clarifying tariff policies, Mr. Melek said that this is a factor that the market is particularly interested in.

If there is an agreement in June, in which tariffs are postponed or adjusted, metal inventories in the US - such as copper and silver - may reverse. The market may be significantly "relaxed," reducing the scarcity factors that pushed prices to record levels.