Gold prices fell on Monday, under pressure from low liquidity as key markets in the US and Asia closed for holidays, while the solid USD further put pressure on the precious metal.

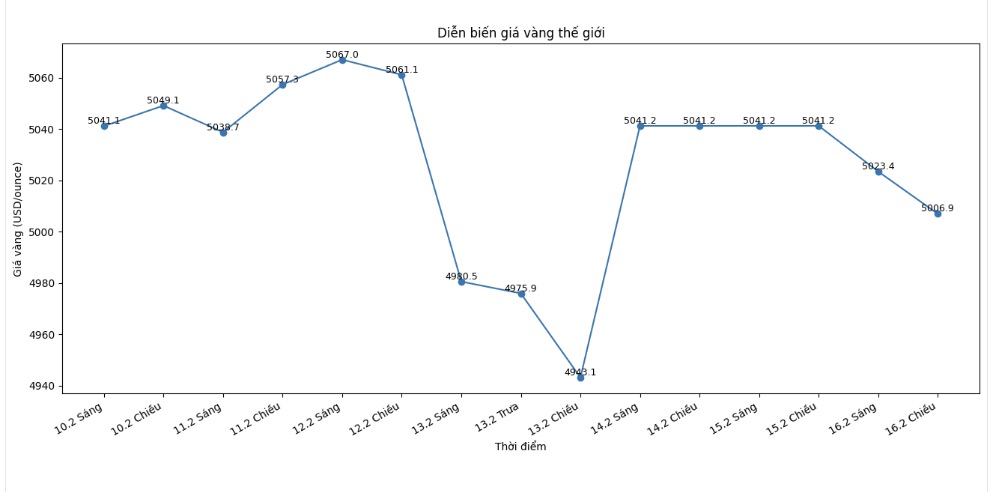

Spot gold fell 0.7% to 5,007.7 USD/ounce at 8:58 GMT (ie 15:58 Vietnam time), after losing more than 1% earlier in the session.

Gold is fluctuating in the range of around 5,000 USD/ounce in a week with low liquidity due to the holidays" - Mr. Giovanni Staunovo, an analyst at UBS, said.

The US market is on holiday for Presidents' Day, while China and some Asian countries are closed for Lunar New Year.

The USD edged up, making gold valued at the greenback more expensive for investors holding other currencies.

Recent US economic data shows a contrasting picture of the Federal Reserve (Fed)'s interest rate cut prospects: the January consumer price index rose lower than forecast, while job growth unexpectedly accelerated in the same month.

Chicago Fed Chairman Austan Goolsbee said on Friday that interest rates may fall, but noted that service inflation remains high.

Investors expect the Fed to keep interest rates unchanged at the upcoming meeting on March 18.

Gold - non-interest-generating assets often benefit in a low interest rate environment.

In geopolitical developments, an Iranian diplomat is said to have stated on Sunday that Tehran is pursuing a nuclear deal with the US to bring economic benefits to both sides.

I temporarily lowered the medium-term gold price target from 5,500 USD to near the 5,100 - 5,200 USD/ounce range, but the situation is still very volatile," said Zain Vawda - analyst at MarketPulse by OANDA.

Meanwhile, spot silver fell 0.4% to $77.09 an ounce, after plunging 3% at one point earlier in the session. Previously, the metal had risen 3.4% on Friday.

As a metal more sensitive to economic cycles, any signal of a strong economy reduces the shelter attractiveness of silver compared to gold. Positive job data shows that safe-haven asset demand is decreasing in the short term," Mr. Vawda added.

Platinum fell 0.9% to $2,043.6/ounce, while palladium lost 0.3% to $1,681.34/ounce.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.