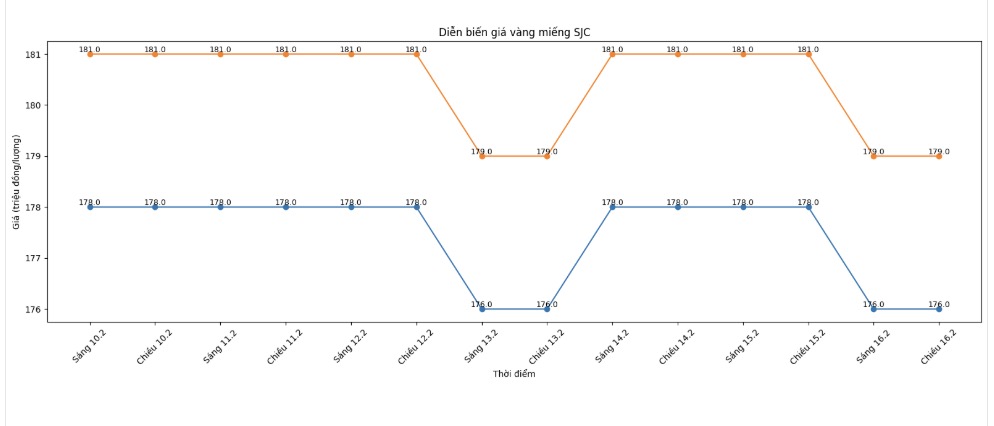

SJC gold bar price

As of 6:00 PM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

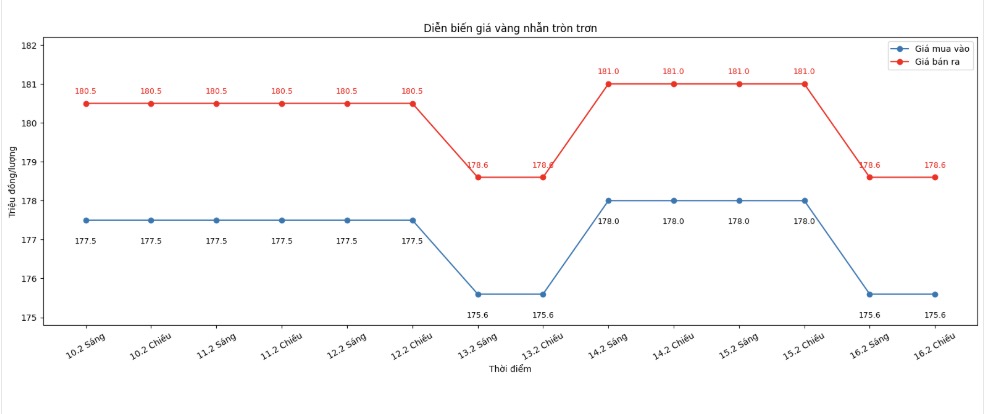

9999 gold ring price

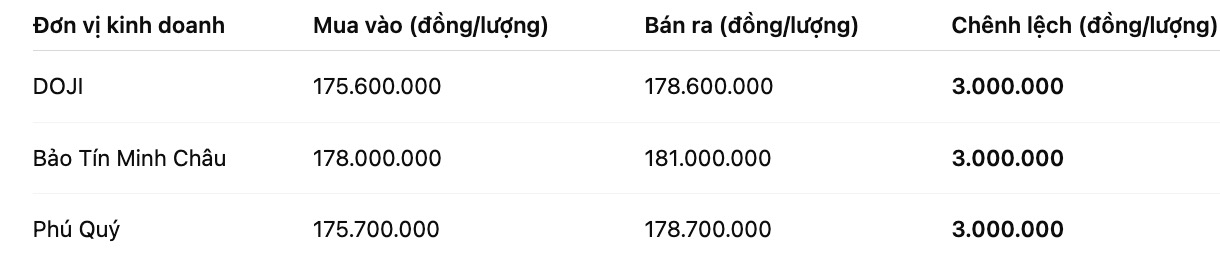

As of 6:00 PM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

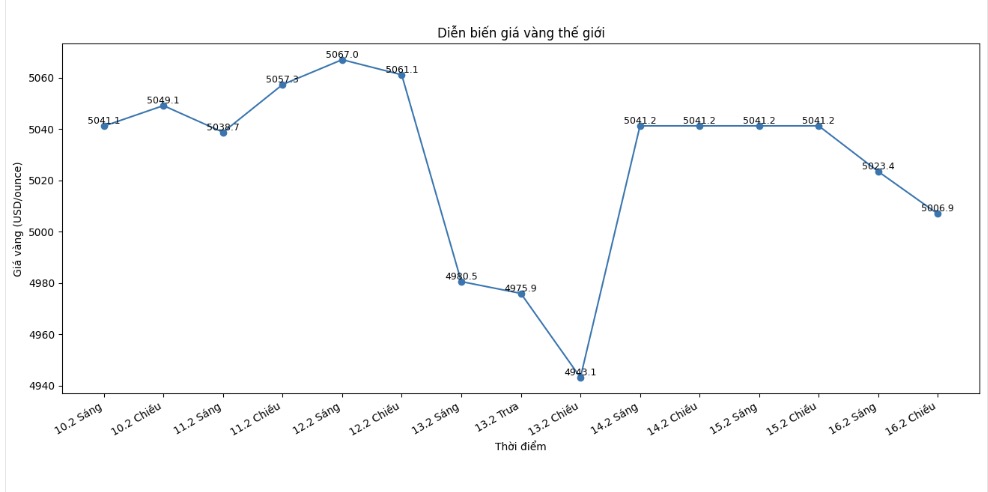

World gold price

At 5:50 PM, world gold prices were listed around the threshold of 5,006.9 USD/ounce; down 34.3 USD compared to the previous day.

Gold price forecast

World gold prices opened the new week in a weakening state as thin trading cash flow and the USD maintained its solid price momentum. Selling pressure appeared in the context of many major markets in the US and Asia having holidays, causing liquidity to decline significantly.

Recorded in the first session of the week, spot gold at one point lost more than 1% before narrowing its decline, falling back to around 5,000 USD/ounce. This development reflects the cautious sentiment of investors when lacking strong leading signals from the international financial market.

According to Mr. Giovanni Staunovo - UBS analyst, gold is currently fluctuating around the psychological threshold of 5,000 USD/ounce in a week with low liquidity due to the impact of the holidays. A thin trading environment often makes prices prone to abnormal fluctuations, especially when the market lacks support from large cash flows.

Another factor putting pressure on the precious metal is the slightly rising USD. As the greenback strengthens, gold - an asset valued in USD - becomes more expensive for investors holding other currencies, thereby limiting new buying demand.

From a macroeconomic perspective, recent US economic data shows a mixed picture. Inflation shows signs of cooling down as the consumer price index in January increased lower than forecast, but the labor market sends a positive signal with job growth exceeding expectations. This makes the monetary policy outlook of the US Federal Reserve (Fed) more unpredictable.

Investors are currently leaning towards the scenario of the Fed keeping interest rates unchanged in the March meeting. In an environment of high interest rates, gold - an unprofitable asset - is often less attractive than profitable investment channels.

Mr. Zain Vawda - an analyst at MarketPulse by OANDA said that he has temporarily lowered the medium-term gold price target to the 5,100 - 5,200 USD/ounce range, instead of higher levels before. However, this expert also emphasized that the market still has many potential fluctuations due to the simultaneous impact of monetary policy, the USD and geopolitical risks.

In the current context, analysts believe that gold may continue to struggle around the 5,000 USD/ounce mark in the short term. A clearer trend is likely to only form when new policy signals from the Fed appear or strong fluctuations in the global currency market.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...