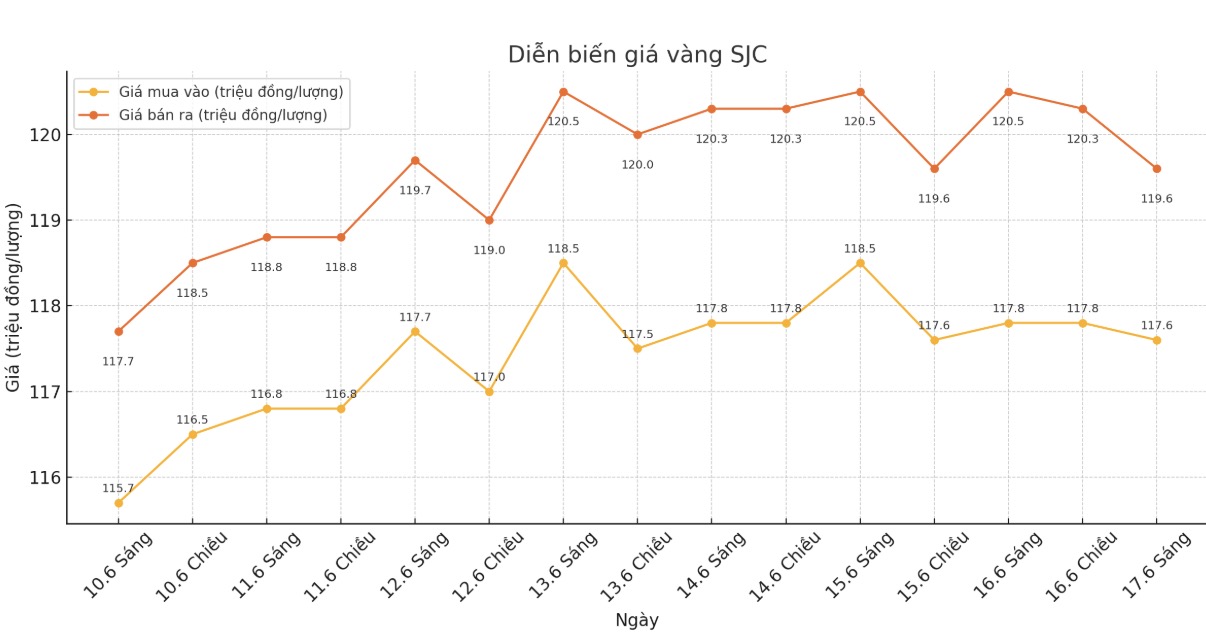

Updated SJC gold price

As of 11:05, the price of SJC gold bars was listed by Saigon Jewelry Company at 117.6-119 1.6 million VND/tael (buy in - sell out), down 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.6-119 1.6 million VND/tael (buy in - sell out), down 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.3-119.3 million VND/tael (buy in - sell out), down 1.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-119 1.6 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 300,000 VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

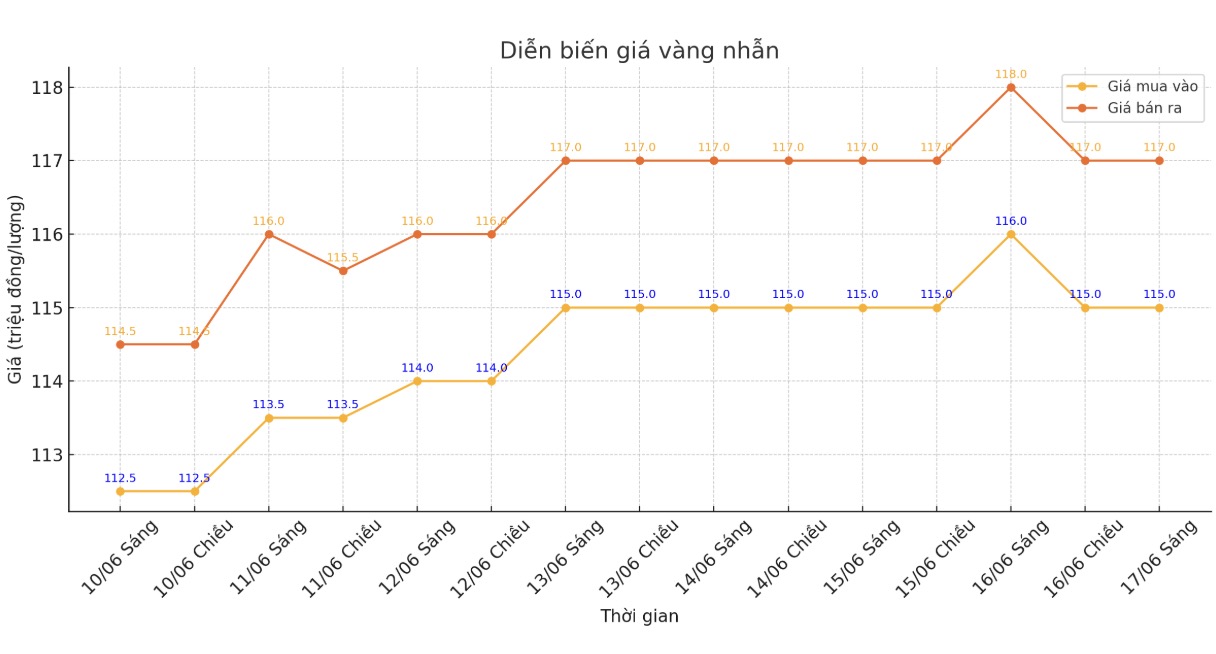

9999 round gold ring price

As of 11:08, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.9-116.9 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

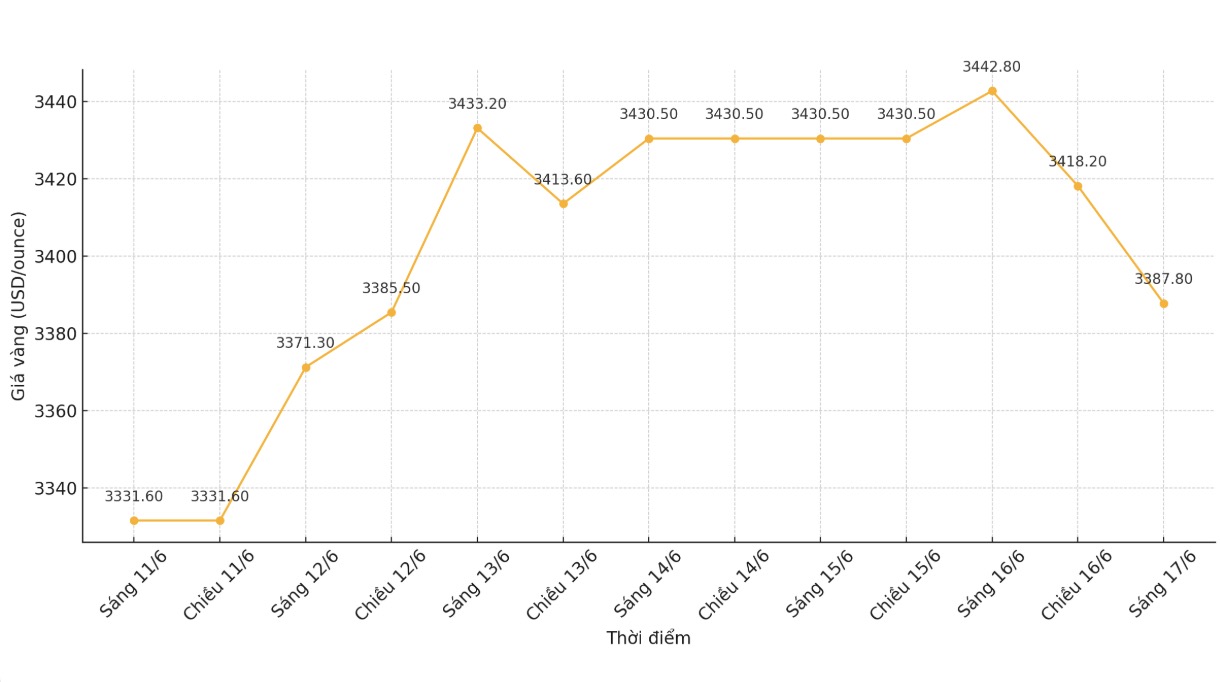

World gold price

At 11:09, the world gold price was listed around 3,387.8 USD/ounce, down 55 USD compared to 1 day ago.

Gold price forecast

Gold prices fell sharply due to improved risk-off sentiment, reflected in the increase in stock markets in the US and other places.

Asian and European stocks last night had mixed movements but generally tended to increase. Today's US stock indexes are expected to open higher in New York. The war between Israel and Iran continues, causing the market to be cautious but not to the point of panic. The two countries have been embroiled in armed conflicts for decades.

Spot gold fell partly due to a decline in New York's production index and improved risk-off sentiment.

Production activities in the New York area continued to decline further into the negative zone this month, according to the latest data released by the New York Federal Reserve.

The regional central bank said on Monday that the Empire State manufacturing survey index fell to -16 in June, after recording -9.2 in May. This data was far from expectations, with consensus forecasts predicting the index would improve to -5.5.

Based operations continued to decline in New York state in June, the report said. New orders and shipments have both decreased. The delivery time remains stable, but the ability to supply goods deteriorates. The inventory remained almost unchanged. Employment increased slightly for the first time in a few months, while the average working hours remained unchanged.

Input prices increased slowly but remained high, while outstanding prices increased more strongly. Businesses have been more optimistic about the outlook, with the general business conditions index in the future increasing above zero for the first time since 3" - the US Federal Reserve (FED) noted.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...