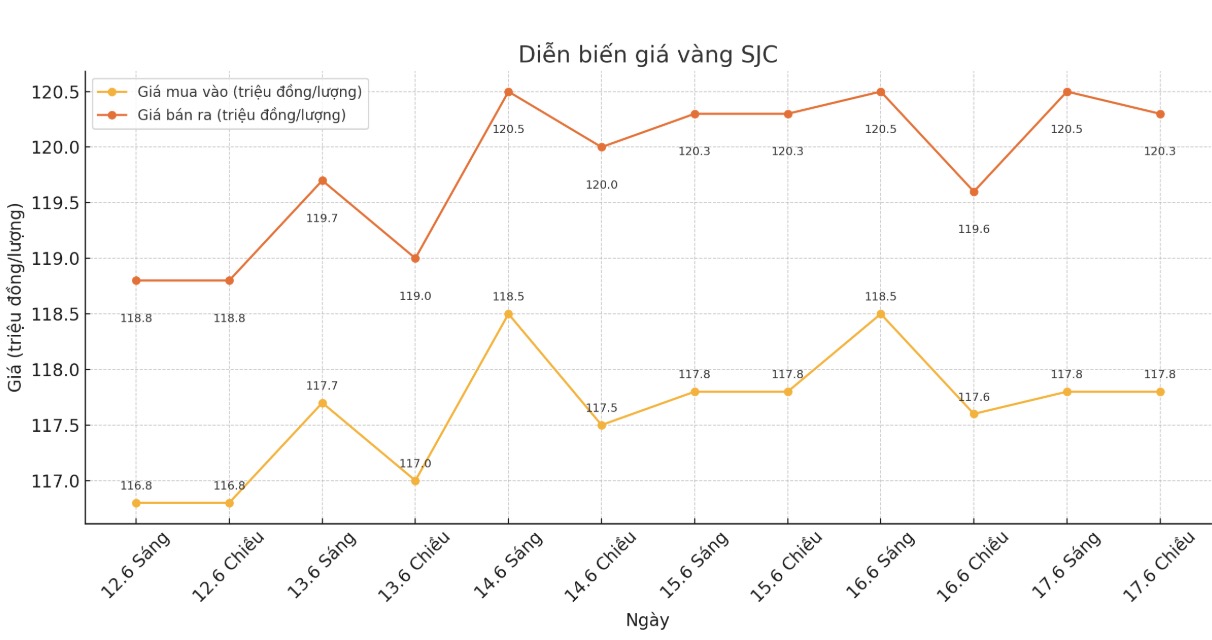

SJC gold bar price

As of 6:00 a.m. on June 18, the price of SJC gold bars was listed by Saigon Jewelry Company at 117.6-119 1.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.6-119 1.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.6-119 1.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 1.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

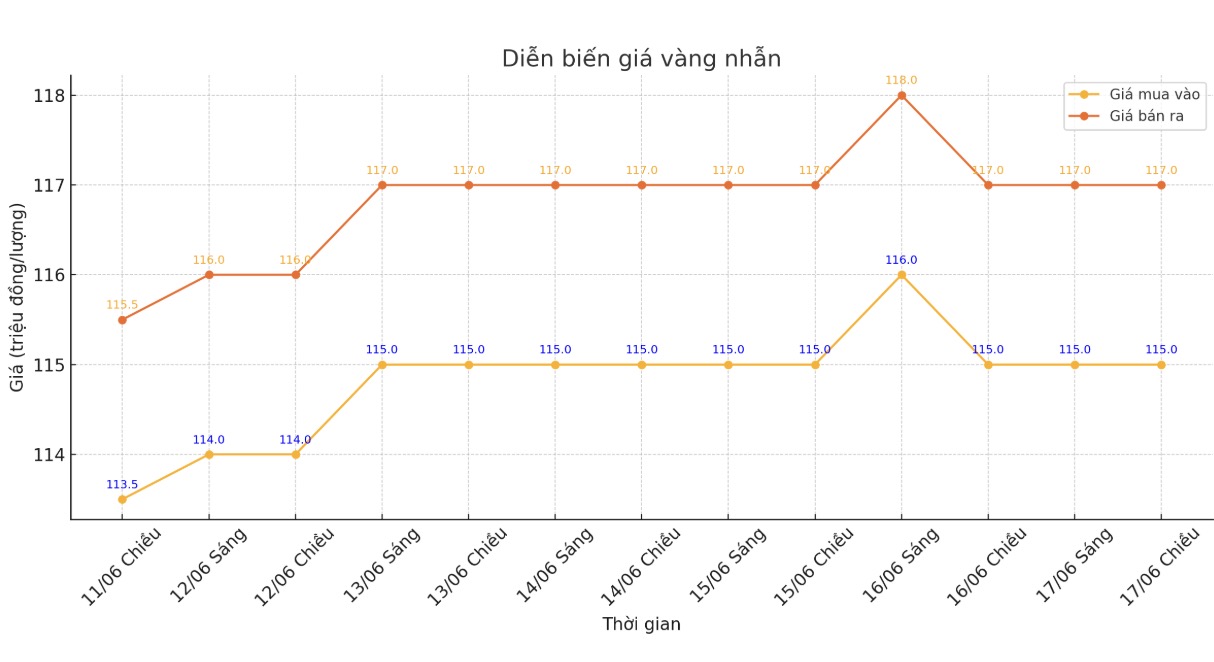

9999 gold ring price

As of 6:00 a.m. on June 18, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND115-117 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 1.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.9-116.9 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

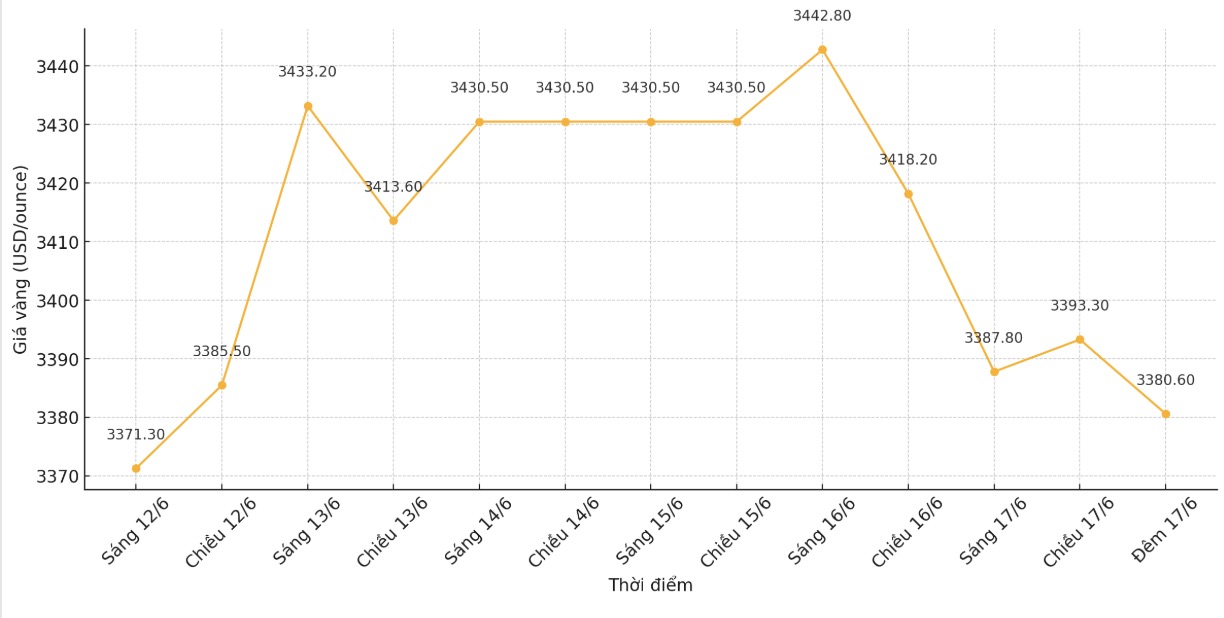

World gold price

The world gold price was listed at 11:39 p.m. on June 17 at 3,380.6 USD/ounce, down 14.9 USD/ounce compared to a day ago.

Gold price forecast

Gold prices fell slightly as market sentiment became somewhat more optimistic. However, silver prices increased sharply and reached their highest level in 13 years last night, due to technical transactions and investor purchases. August gold futures fell $13.4 to $3,403.9 an ounce. July silver futures rose $0.657 to $17.105 an ounce.

Stocks in Asia and Europe fluctuated in opposite directions but tended to increase slightly last night. US stock indexes are expected to open lower in today's trading session in New York. Although risk sentiment is not strong, there is no excessive risk risk risk this week.

US President Donald Trump left the Group of Seven (G7) Summit in Canada early due to tensions in the Middle East. In a conversation with reporters on Monday, Mr. Trump said he needed to be in Washington to help manage the US response to the conflict between Israel and Iran.

In social media posts, Trump has been tough on Iran, saying the country should have signed the deal I requested. He later said in another post that "People should immediately leave Tehran". He also said he was working on a "ms much bigger" deal than a ceasefire between Israel and Iran.

Meanwhile, the FOMC meeting of the US Federal Reserve (FED) took place this week, starting this morning and ending on Wednesday afternoon with a statement and press conference by Chairman Powell. The Fed is not expected to cut interest rates.

Technically, August gold futures are at a clear advantage in terms of short-term techniques. The next upside price target for buyers is to close above the resistance level of 3,500 USD/ounce. The next short-term bearish target for the bears is to push prices below $3,313.1/ounce.

The first resistance level was 3,450 USD/ounce and then 3,477.3 USD/ounce. The first support level was the overnight low of $3,391.30/ounce and then $3,358.5/ounce.

Key outside markets today showed the USD index rising slightly. Nymex crude oil prices are higher and are trading around $73/barrel. The current 10-year US Treasury yield is 4.419%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...