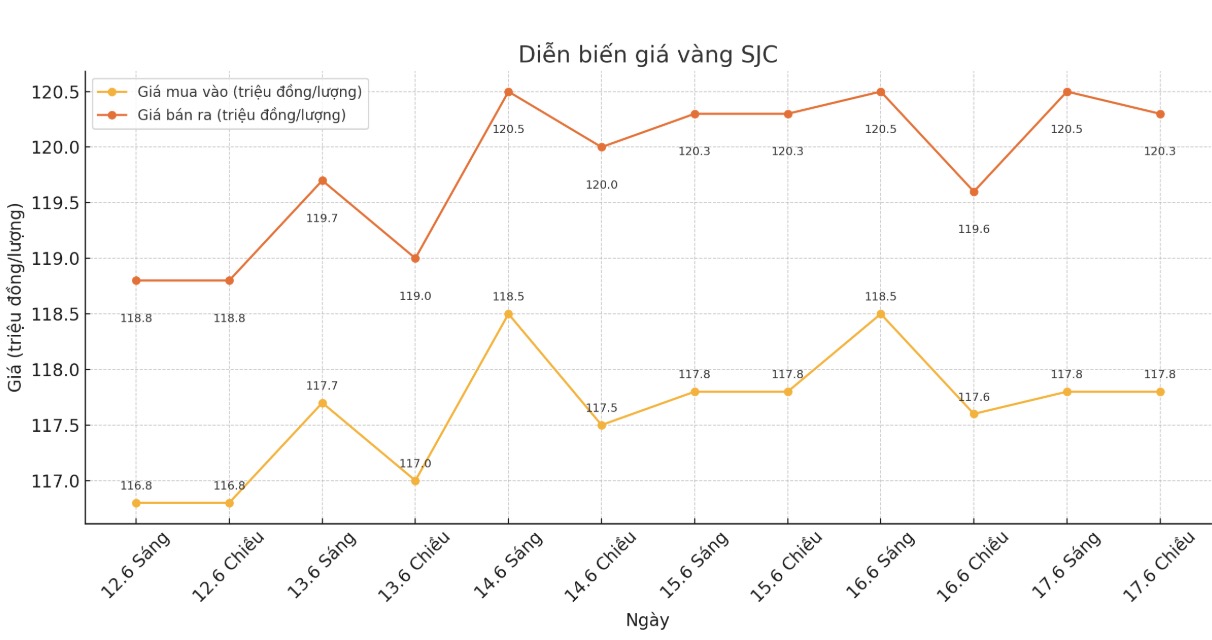

SJC gold bar price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.6-119 1.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.6-119 1.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.6-119 1.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 1.6 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

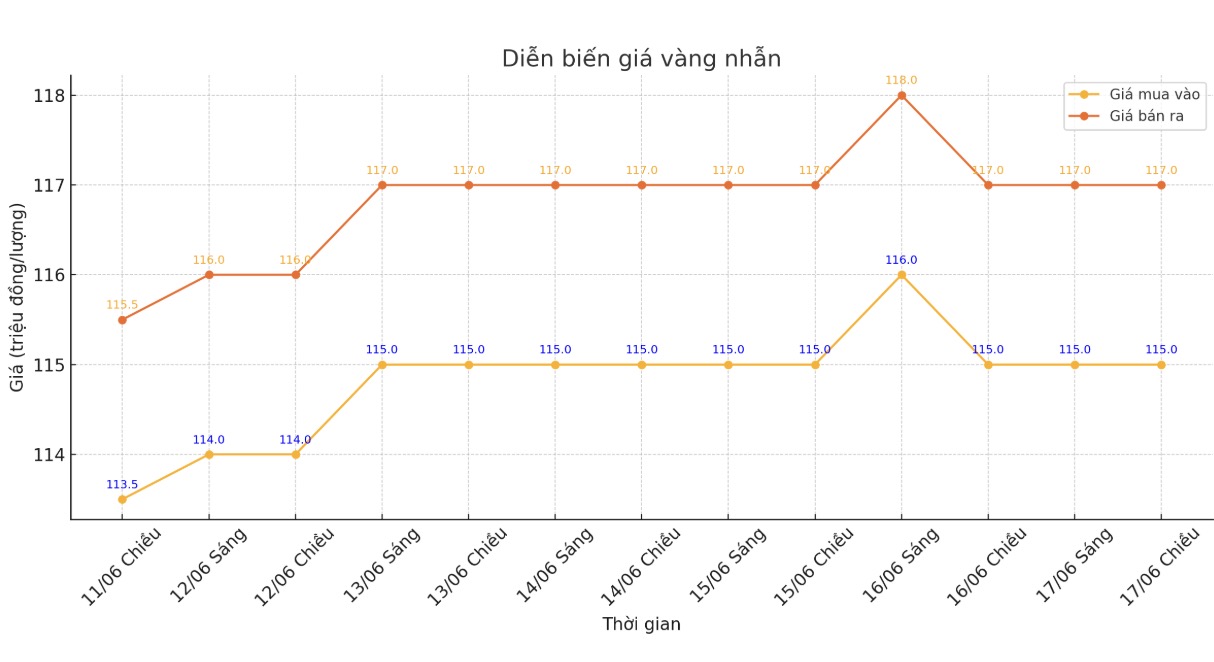

9999 gold ring price

As of 5:30 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 1.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.9-116.9 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

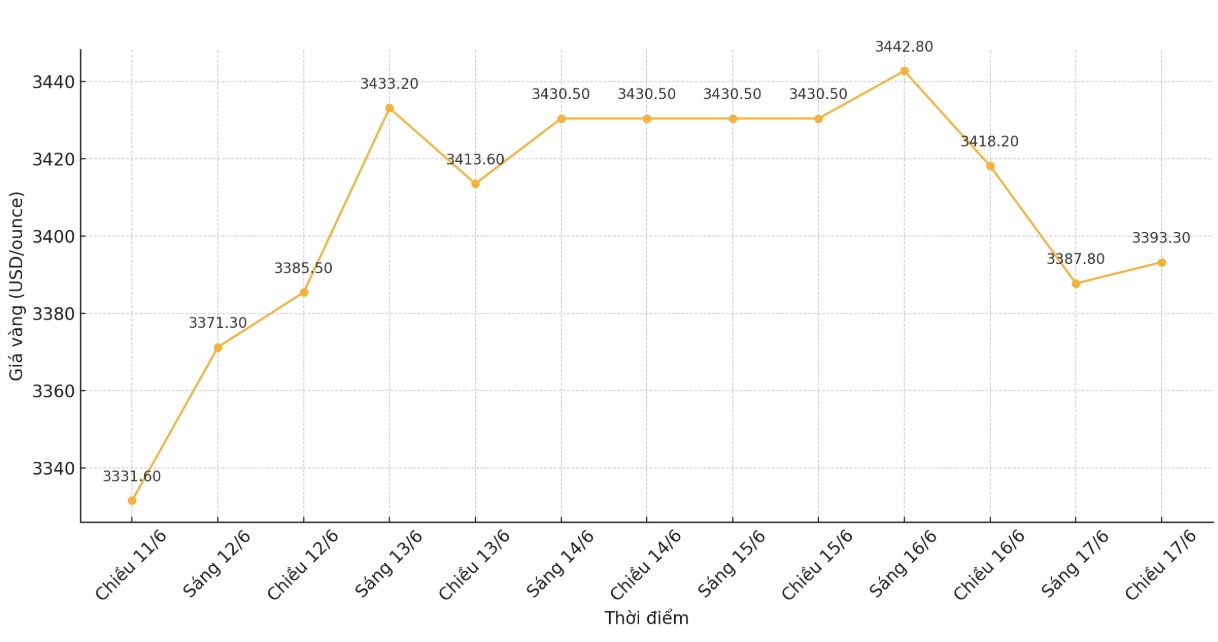

World gold price

The world gold price was listed at 5:30 p.m. at 3,393.3 USD/ounce, down 24.9 USD.

Gold price forecast

Although it decreased compared to a day ago, world gold prices showed signs of stabilizing again. Investors assessed the conflict between Israel and Iran, and paid attention to the policy meeting of the US Federal Reserve (FED) this week.

As of 8:51 a.m. GMT, US gold futures fell 0.5% to $3,401.30 an ounce.

Israel and Iran continued their attacks on Thursday in a row on Tuesday.

US President Donald Trump has asked for the evacuation of the Iranian capital Tehran and shortened his G7 summit visit to Canada. A separate report said he had asked the National Security Council to prepare in the situation room.

Han Tan, chief market analyst at Exinity Group, said: The market is waiting for new signals on whether the conflict between Israel and Iran will escalate or still be contained. Gold is still holding an upward trend as there are signs of escalating the Middle East conflict, thanks to the precious metal's position as a safe haven asset in recent times".

Sources say Tehran has asked Oman, Qatar and Saudi Arabia to urge Trump to press Israel to cease fire in the region, with Iran offering flexibility in nuclear negotiations in exchange.

Non-yielding gold is considered a protective against geopolitical and economic instability, often tending to develop in a low interest rate environment.

Citi, meanwhile, has lowered its short-term and long-term gold price forecast, predicting prices could fall below $3,000/ounce by the end of 2025 or early 2026, due to reduced investment demand and improved global growth prospects.

In other markets, spot silver rose 0.3% to $36.45 an ounce, platinum held steady at $1,246.59, while palladium fell 0.4% to $1,025.44.

See more news related to gold prices HERE...