Gold prices are approaching record levels as investors focus on US inflation data and monitor escalating geopolitical tensions in Venezuela. In the same direction, silver prices hit a new peak, continuing the strong increase of the precious metal group.

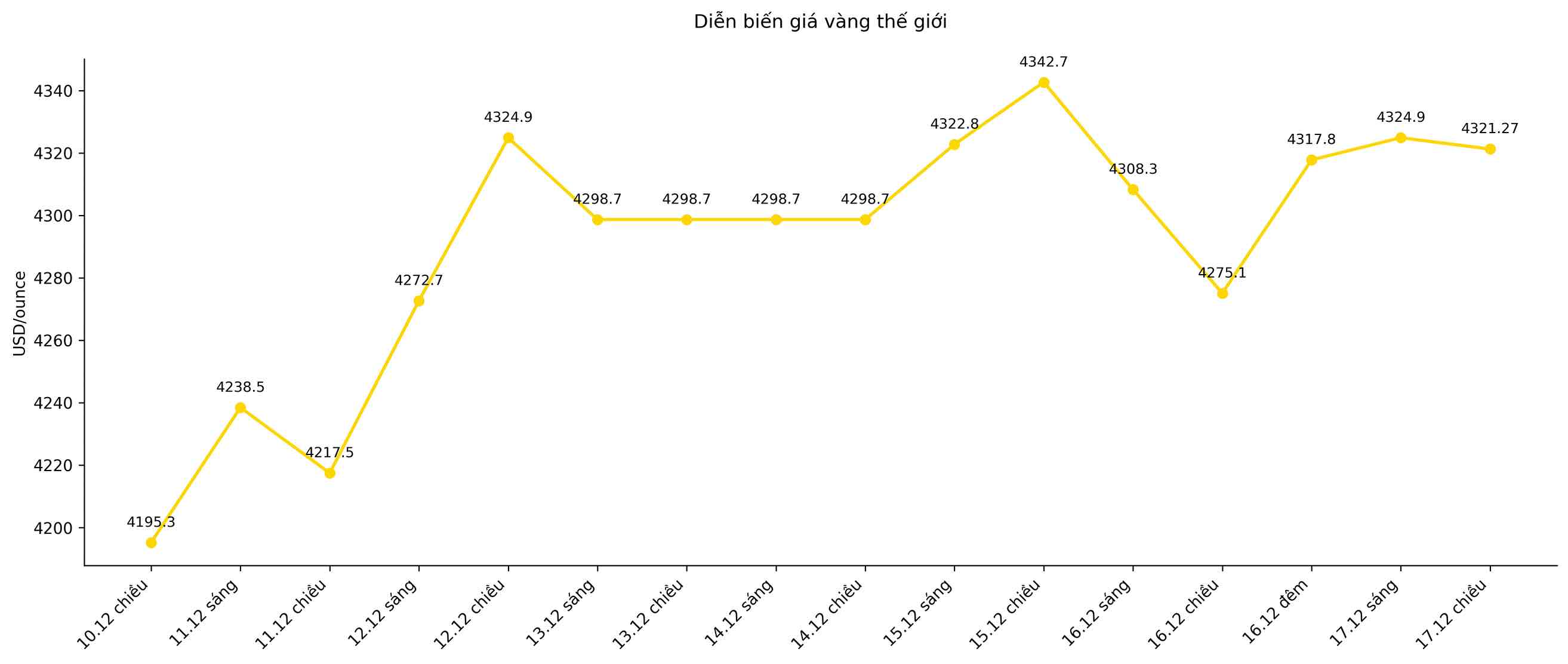

In the Asian trading session, gold fluctuated around 4,330 USD/ounce, only about 50 USD away from the historical peak. The recovery momentum comes after the previous slight adjustment session, when cash flow quickly returned to safe-haven assets due to new uncertainties in the global economy and geopolitics.

One of the important catalysts driving gold prices comes from developments in Venezuela. The US blockade of sanctioned tankers, along with increased military pressure in the region, has increased demand for gold as a risk-off channel.

Along with geopolitical factors, the market is also waiting for a series of policy signals from the US. Investors are paying attention to upcoming inflation data and statements from US Federal Reserve (Fed) officials to find clues for currency easing prospects. After three consecutive interest rate cuts, the market is still betting on the possibility of the Fed continuing to cut in the coming time, although the probability of a rate cut in January is currently only around 25%.

Recent economic data continues to reinforce the view that the Fed has more room to adjust policy. The non-farm payrolls report released on Tuesday showed that the US labor market is cooling down, but not strong enough to change expectations for the interest rate roadmap. With the US government having gone through a long period of closure, the Fed is said to be more cautious in assessing short-term economic data.

In the long term, the market is also closely monitoring the appointment of a new Fed Chairman, a factor that could shape monetary policy orientation next year. According to the Wall Street Journal, US President Donald Trump is scheduled to interview Fed Governor Chris Waller for the position this week, along with a number of other candidates, before making a decision in early January, according to US Treasury Secretary Scott Bessent.

The medium-term outlook for gold is still positively assessed by many organizations. According to Ms. Nicky Shiels, Head of Research at MKS Pamp SA, gold prices could average $4,500/ounce in 2026. However, she believes the precious metal will likely experience a short-term accumulation phase before forming a more sustained uptrend, following a strong breakout this year.

Since the beginning of the year, gold prices have increased by about two-thirds of their value, towards the strongest increase in more than four decades. The price increase momentum comes from the stable buying power of central banks, the trend of withdrawing capital from government bonds and major currencies, along with the risky geopolitical environment.

Not only gold, the precious metals market also broke out. Silver prices have continuously hit new peaks, while platinum has reached its highest level since 2011 thanks to the prospect of improved demand from the auto industry. This development shows that the wave of searches for safe-haven assets and industrial metals is spreading in the global market.