World gold prices decreased slightly in the trading session on Tuesday (December 16), but still anchored at a historic high after a year of explosive growth. This development continues to put expectations under pressure on monetary policy, causing the US Federal Reserve (Fed) to face important considerations when a series of US economic data is about to be released.

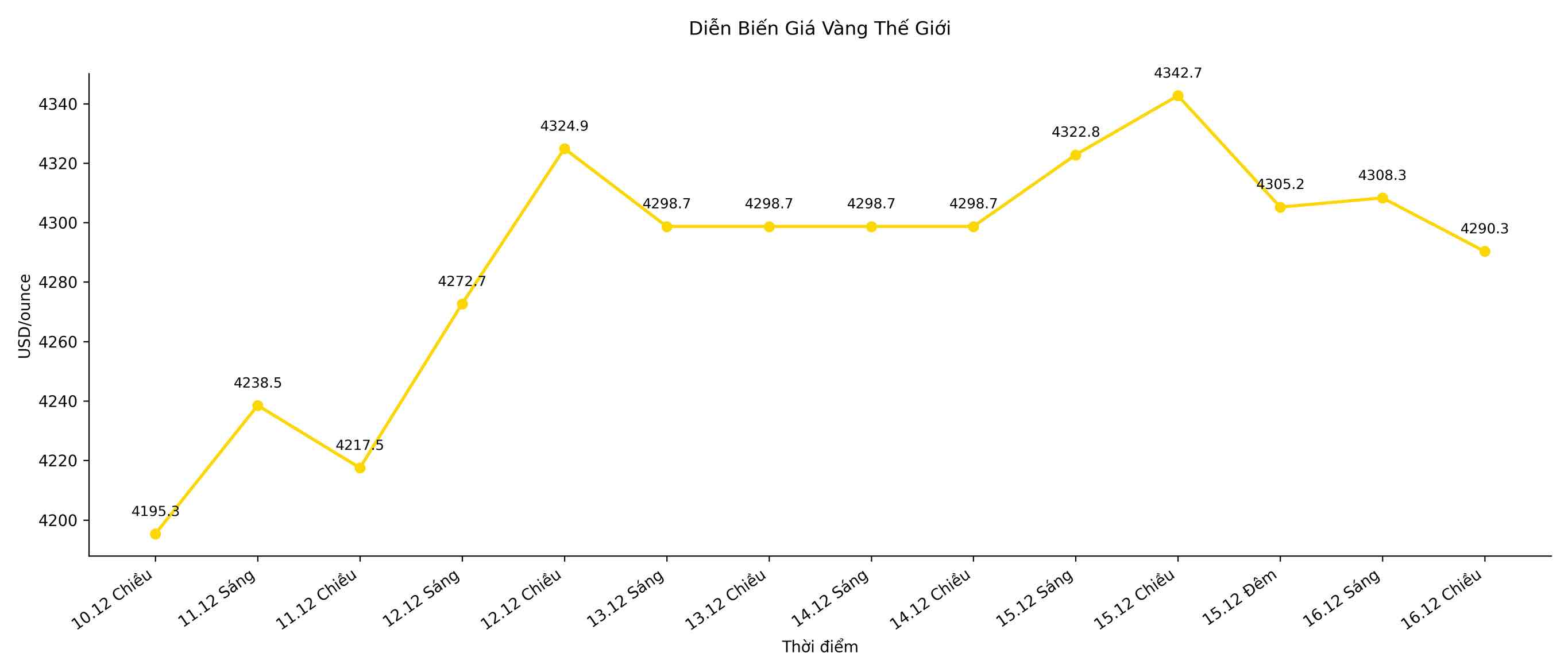

As of this afternoon's trading session, spot gold decreased by 0.3%, down to 4,290.33 USD/ounce. Despite the adjustment, this precious metal has recorded a strong increase of 64% since the beginning of the year, continuously breaking many price records.

US gold futures also fell 0.4%, trading around $4,316.40 an ounce.

According to Mr. Ilya Spivak - Head of Global Macro at Tastylive, gold prices are currently approaching the old peak around 4,380 USD/ounce set in mid-October.

The market is wondering whether there is enough confidence to break out higher or this will be the threshold that causes the increase to start weakening, said Mr. Spivak.

In the interest rate market, investors are pricing in a 76% chance that the Fed will cut interest rates by 25 basis points in January, and part are expecting two cuts, according to CME's FedWatch tool. Economic data released this week is expected to clarify the Fed's pace of monetary policy easing in 2026.

Notably, the US Combined Employment Report for October and November, due out on Tuesday, will lack some important details due to data collection disruption during the 43 days of government closures, including the unemployment rate in October.

Meanwhile, Fed Governor Stephen Miran said that inflation is still higher than the target, not fully reflecting the infrastructure's supply and demand factors, which is creating price pressure closer to the Fed's 2% target.

In addition to the jobs report, the market is also waiting for the weekly jobless claims and the personal consumption expenditure (PCE) index - the Fed's preferred inflation measure - to be released this weekend.

In the context of a downward trend in interest rates, gold - non-yielding assets - often benefits, although short-term adjustments still appear when investors take profits.

In other precious metals, silver prices fell 1.4%, to $63.03/ounce, after just reaching a historic peak of $64.65/ounce last weekend.

According to Mr. Tim Waterer - Head of Market Analysis at KCM Trade, silver is still maintaining a positive trend, thanks to persistent industrial demand, after increasing by 121% this year, driven by strong investment demand and tight inventories.

Meanwhile, platinum increased 1.3% to 1,806.46 USD/ounce, while palladium increased 1%, reaching 1,582.68 USD/ounce.