Gold prices surpassed $4,330/ounce after the latest data showed weak economic activity while price pressure increased in both the manufacturing and service sectors in December.

According to the report published by S&P Global on Tuesday, the preliminary Composite Output Index (CPI) fell to 53, from 54.2 in November. Economists had expected a more modest decline to 53.2.

This decline is mainly due to the service sector. The Service PMI fell to 52.9, down from 54.1 in November. According to consensus forecasts, analysts expect this index to reach about 53.

Meanwhile, the Manufacturing PMI also decreased slightly to 51.8, from 52.2 in the previous month. This figure is also lower than market expectations, as economists forecast a decrease in manufacturing PMI to 52.

Mr. Chris Williamson - Chief Economist for Enterprises at S&P Global Market Intelligence, said that the above figures show that the recent economic growth momentum is gradually losing momentum.

Although survey data still shows that GDP in the fourth quarter can grow at an annual rate of about 2.5%, growth has slowed down for two consecutive months. With the increase in new orders clearly weakening, especially in the period before the year-end shopping season, economic activities may continue to soften as we move into 2026" - he said.

Mr. Williamson also emphasized that signs of weakness are widespread.

The new work flow into the service sector, which accounts for the majority of the economy, has almost stagnated, while factory orders have decreased for the first time in a year.

Although manufacturers still report increased output, weaker sales suggest that current production levels are difficult to sustain and will have to be adjusted down if demand does not recover in the new year. Service providers also recorded one of the months with the slowest revenue growth rate since 2023, he said.

The biggest concern now is rising costs, with inflation reaching its highest level since November 2022, following one of the strongest price increases in three years, according to Williamson.

The re- rising prices are largely due to tariffs, with initial impacts in the manufacturing sector and now spreading to services, exacerbating the issue of payment capacity, he added.

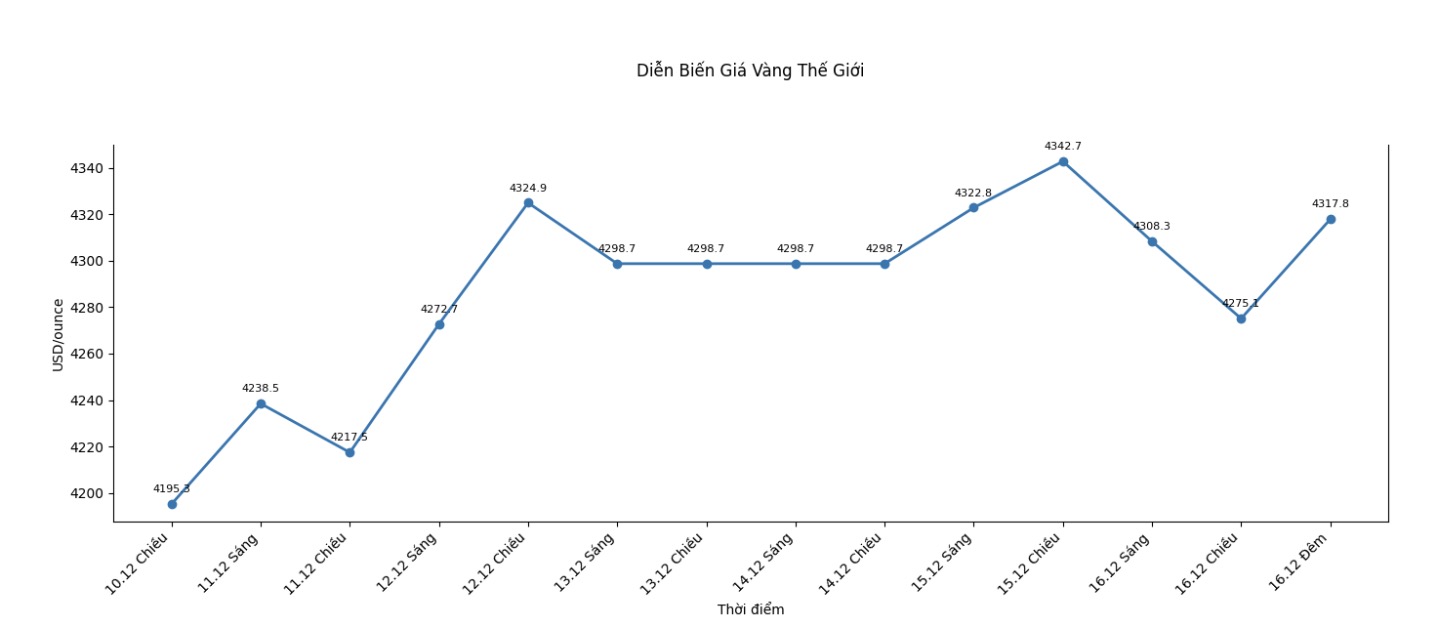

Immediately after weaker-than-expected PMI data was released, gold prices rebounded strongly, reaching a session high. The most recent spot gold was traded at $4,330.06/ounce, up 0.58% on the day.

See more news related to gold prices HERE...