World gold prices continue to hold firm above the 4,300 USD/ounce range, in the context of a series of newly released economic data showing a slowdown in the US labor market and consumer spending, thereby strengthening expectations for an loose monetary policy of the US Federal Reserve (FED).

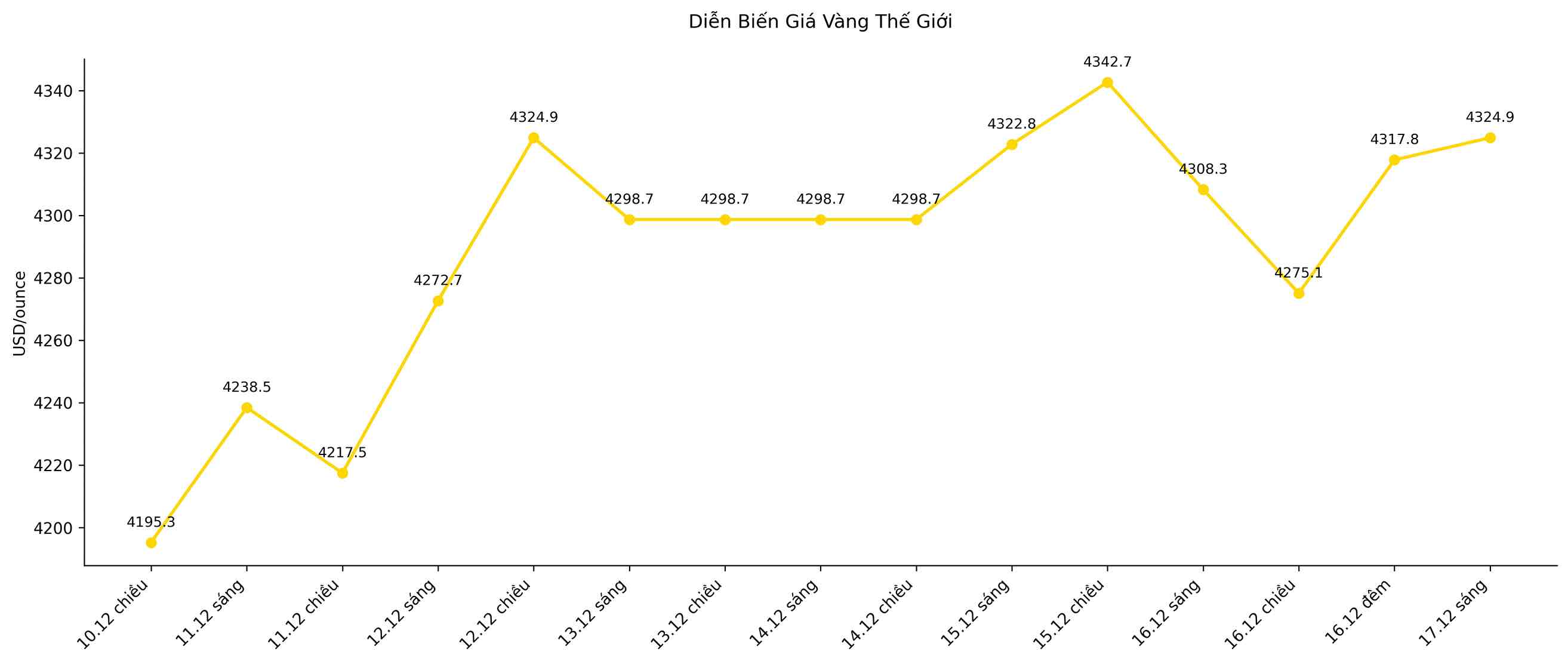

As of this morning, Asian time, gold is trading around $4,324.9/ounce, just less than $60 away from the historical peak of $4,381.52 set in October.Although the increase has slowed somewhat after a series of five consecutive increases, the precious metal still maintains a rare high price range.

The main driver comes from a series of US economic figures that were less than expected.The labor market continues to signal a cooling down, while consumer spending growth - an important pillar of the US economy - is slowing down.October retail sales did not increase compared to the previous month, lower than analysts' forecasts, causing gold to quickly rebound above the 4,300 USD/ounce mark right after the data was released.

From a policy perspective, the Fed made its third consecutive interest rate cut last week, creating an important leniency for non-interest-bearing assets such as gold.The market is still betting on the possibility of nearly 25% of the FED continuing to cut interest rates in January, although the US central bank is expected to be more cautious when assessing economic data due to the impact of government shutdowns.

In the short term, investors will be watching the upcoming US inflation report and the statements of FED officials this week. The developments of the USD and the next monetary policy signal are considered a key factor guiding the gold price trend, in the context of the precious metal still being prioritized by global cash flow as a safe haven channel.