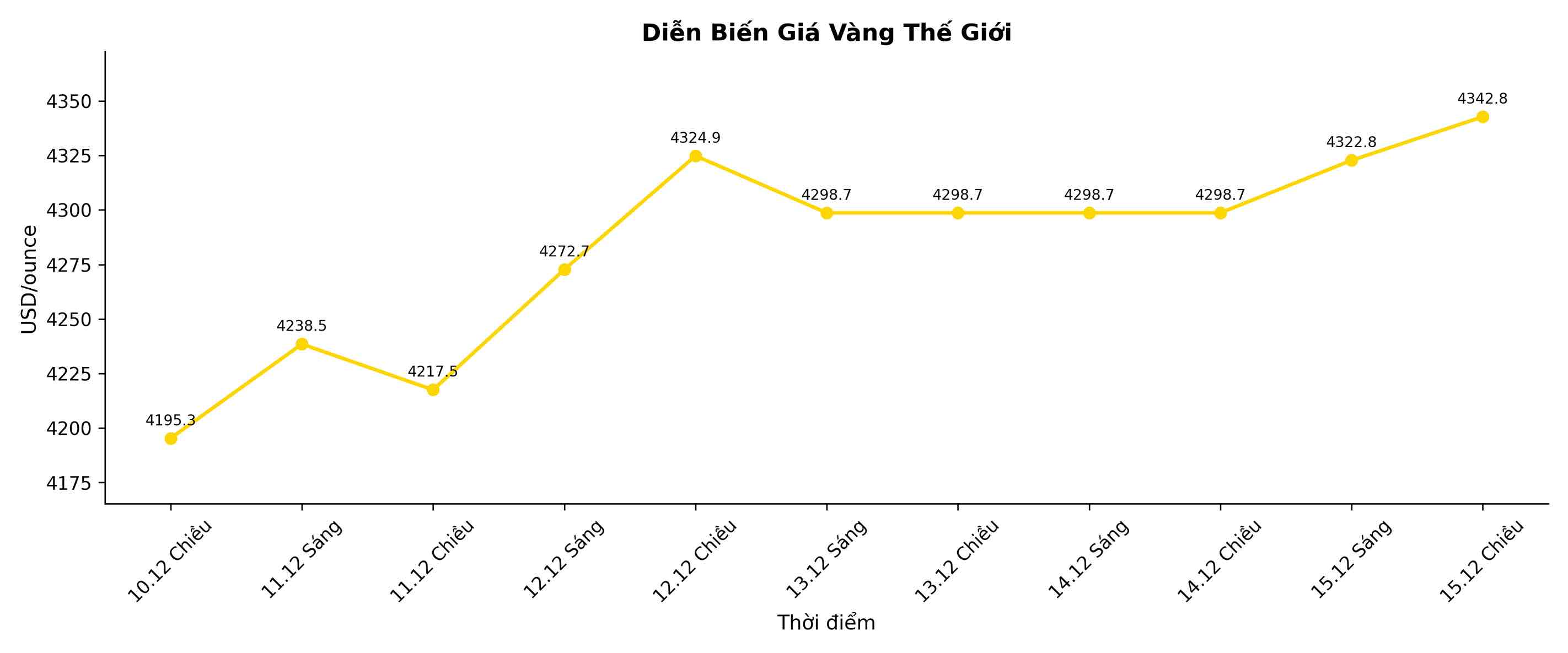

Gold prices continued to climb, recording the fifth consecutive increase, as investors rushed to "safe hiding" assets while Asian technology stocks simultaneously fell sharply. Selling pressure in the stock market caused gold prices to surpass the 4,335 USD/ounce mark, after increasing by more than 2% last week.

The trading atmosphere at the beginning of the week in Asia included cautious sentiment. Investors are increasingly skeptical about the ability of technology "big guys" to maintain sky-high valuations and spend heavily on artificial intelligence (AI). These concerns have strengthened gold's role as a traditional safe haven, especially in the last trading week of the year.

In addition, the prospect of lower interest rates in the US is also a major driver behind gold's increase. The US Federal Reserve (Fed) has cut interest rates for the third time in a row last week. In an interview with the Wall Street Journal on Friday, President Donald Trump called for a more aggressive Fed rate cut, while affirming that his successor Jerome Powell would "go directly to discuss with him" about monetary policy orientation. Mr. Trump also revealed that the two leading candidates for this position are Kevin Hassett and Kevin Warsh.

This year's precious metals market witnessed a spectacular breakthrough: gold increased by more than 60%, while silver even doubled, towards the strongest increase since 1979. This upward momentum is driven by a wave of net buying from central banks and the trend of withdrawing capital from government bonds and major currencies. According to the World Gold Council, the holding of gold ETFs has only decreased in one month, while the rest have increased continuously throughout the year.

Experts from Goldman Sachs Group Inc., led by Lina Thomas, commented: Strong central bank cash flow along with private investment capital flows in the context of the Fed's policy easing will continue to be the main driver to bring gold prices to around $4,900/ounce by the end of 2026.

The Goldman Sachs report highlights that this gold hoarding trend is not temporary, but will last for many years to come, with an average purchase of about 70 tons per month in 2026.

However, the analysis team of ANZ Group Holdings Ltd. Soni Kumari and Daniel Hynes believe that 2026 could be a "year and a half" for gold: Prices could peak at $4,800/ounce by the end of the second quarter, then gradually decrease towards the end of the year. However, they still believe that stable investment capital flows and central bank demand for gold will continue to support the market.

In parallel, silver is also benefiting strongly from expectations of a prolonged supply shortage after a historic "supply tightening" in October. The white metal, which set a record of $64.657 an ounce on Friday, is expected to continue holding prices thanks to sustained industrial demand and uncertainty over US import policy, according to Kumari and Hynes' analysis.

Notably, the US Geological Survey has recently added silver to its list of important minerals, making traders more cautious about the possibility of being taxed when exporting silver from the US. ANZ experts predict that silver will likely be exempt from import tax and if this decision is confirmed, global supply can be loosened, reducing scarce pressure in the market.

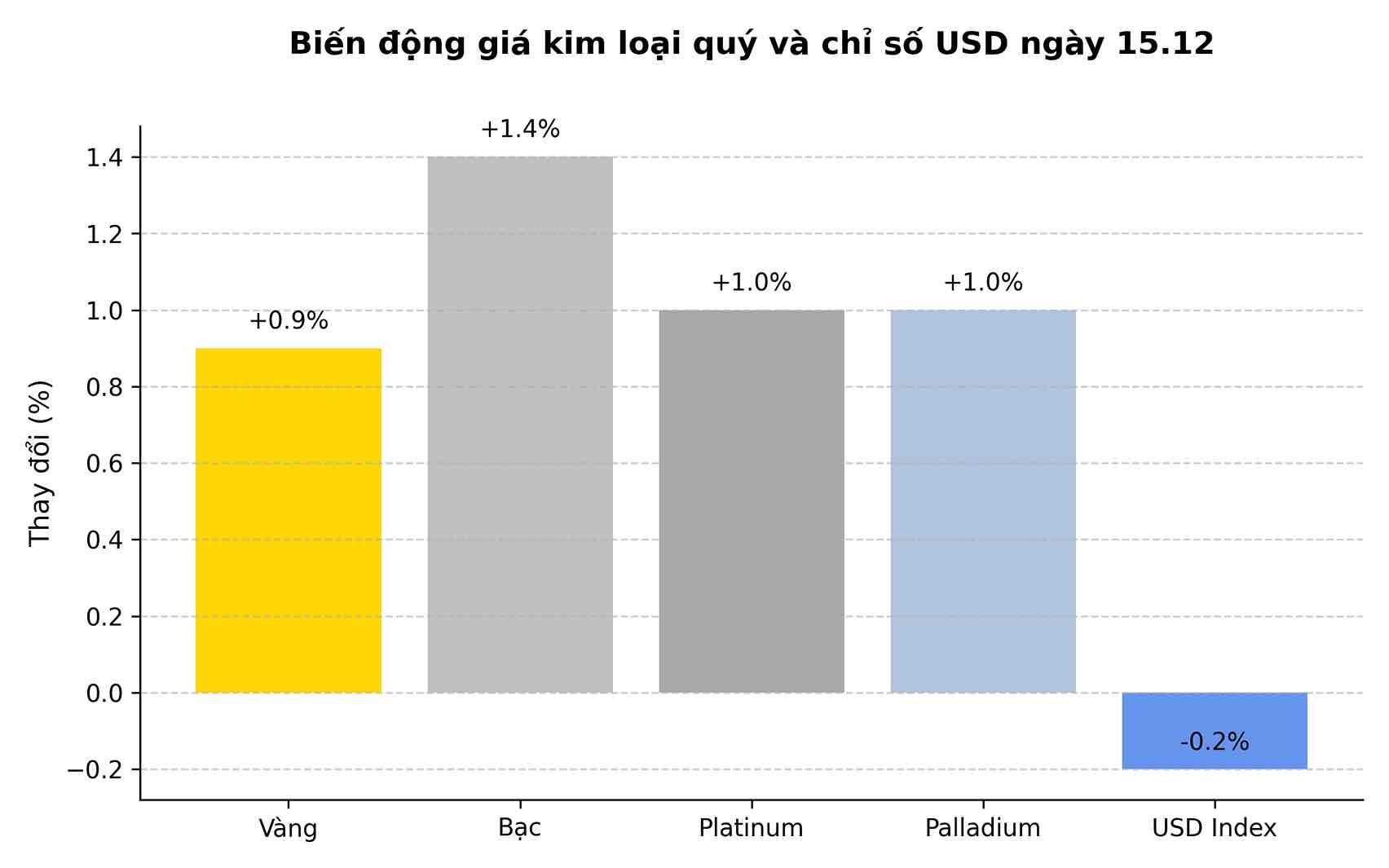

As of 1:44 p.m. in Singapore, gold increased by 0.9%, trading at $4,336.77/ounce. Silver rose 1.4%, reaching $62.80 an ounce after losing 2.5% on Friday. platinum and palladium both recorded an increase of about 1%, while the Bloomberg Dollar spot index decreased slightly.