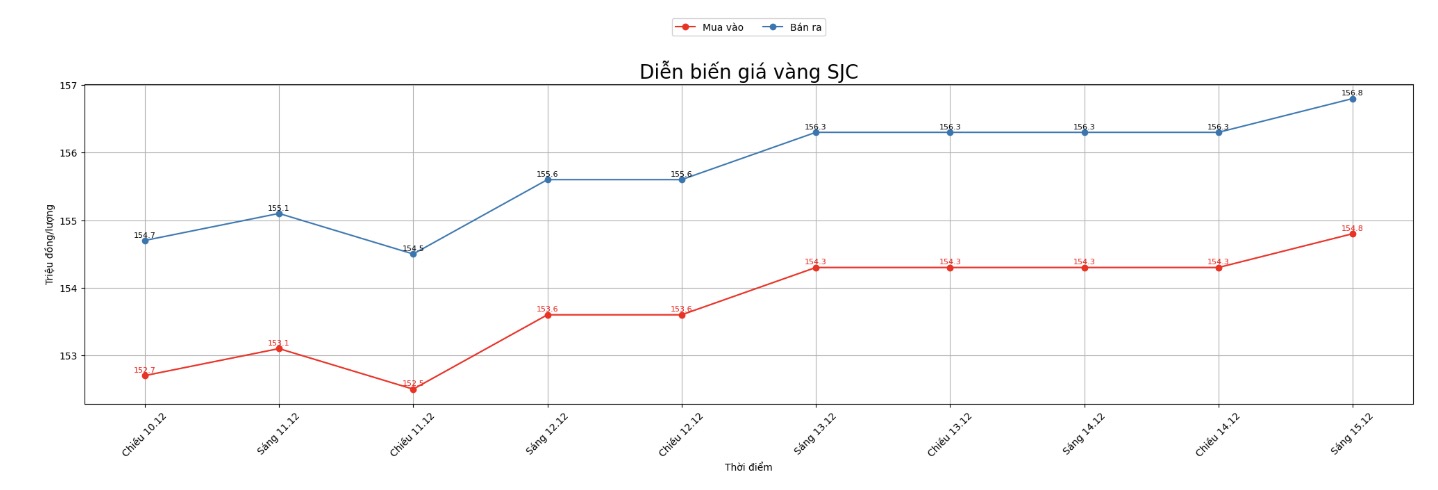

Updated SJC gold price

As of 10:30, the price of SJC gold bars was listed by DOJI Group at 154.8-156.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.8-156.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.8-156.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

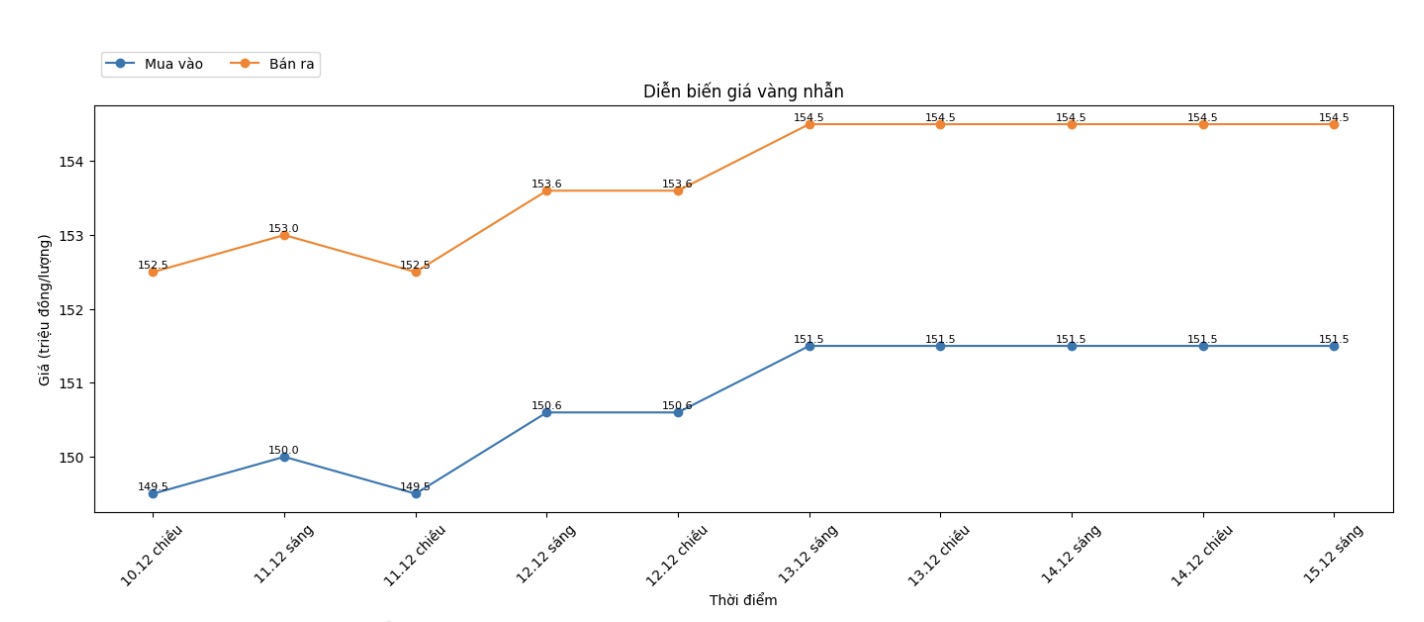

9999 round gold ring price

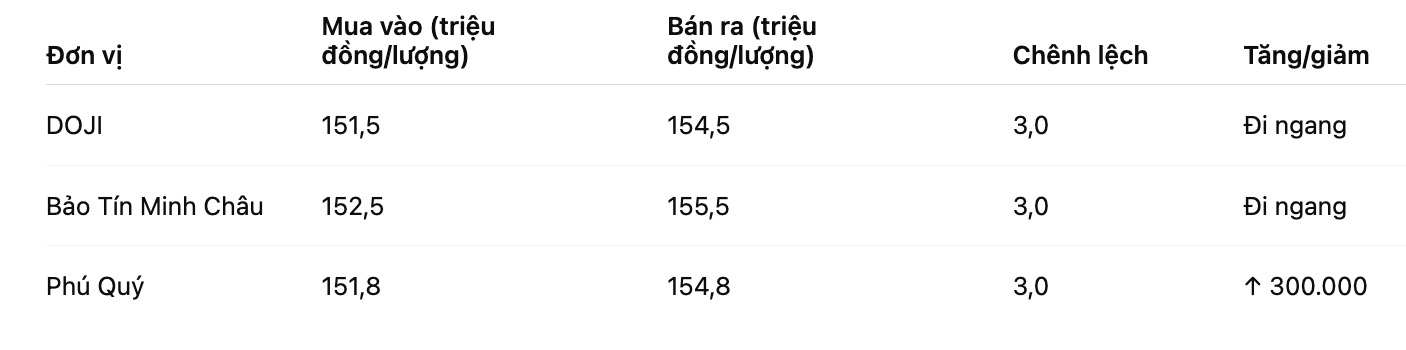

As of 10:30, DOJI Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.5-155.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.8-154.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

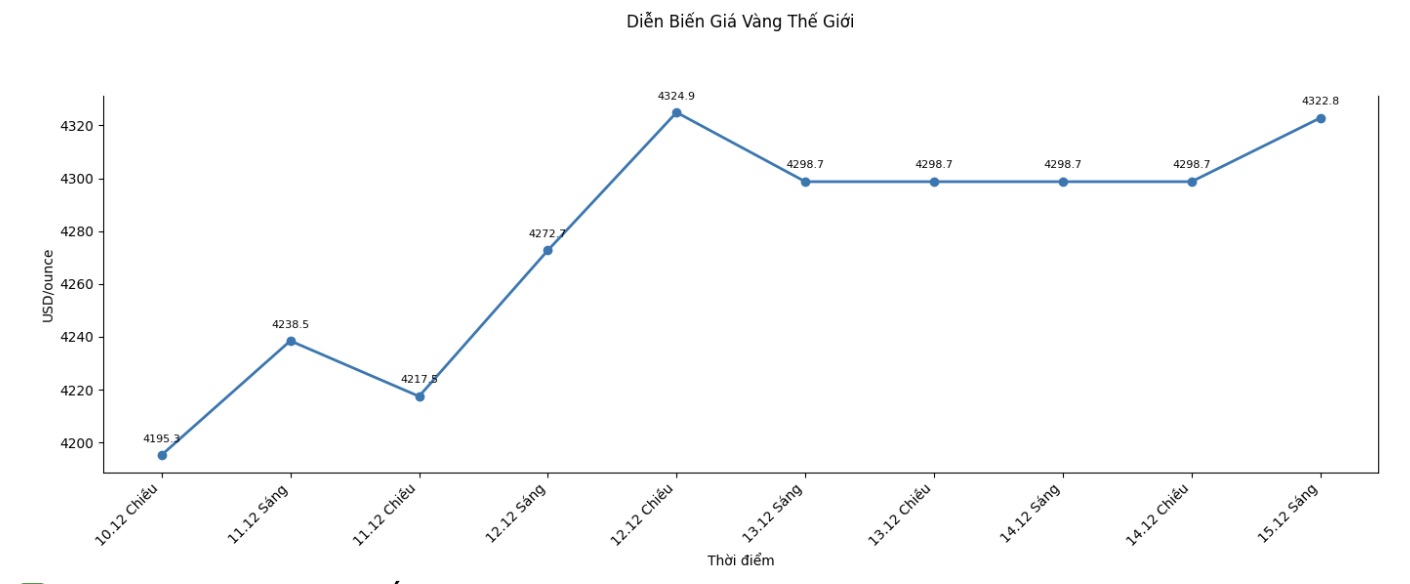

World gold price

At 10:30, the world gold price was listed around 4,322.8 USD/ounce, up 24.1 USD compared to a day ago.

Gold price forecast

Increase - Mr. Adrian Day, Chairman of Adrian Day Asset Management, commented. The resumption of large-scale Treasury bond purchases by the US Federal Reserve (Fed) is creating a positive support for gold prices.

Similarly, Mr. James Stanley - senior market strategist at Forex.com said that gold prices this week increased. According to him, gold has just broken out of a technical model of price increase, while the only remaining notable resistance is the all-time high.

At the moment, there is no reason to turn to the negative view, Mr. Stanley said. He said gold is in a favorable position to continue to rise in the long term, with the prospect of price increase lasting until 2026. This expert affirmed that he will maintain an optimistic view on gold until there are clear signs of cooling inflation, enough for the Fed to slow down monetary policy to tighten".

Mr. Marc Chandler - CEO at Bannockburn Global Forex - commented: "The accumulation period of gold is really constructive, and the basis spot gold price reached nearly 4,340 USD/ounce last weekend. The Fed's purchase of the Treasury note (T-bill) may have boosted new buying power more than the rate cut."

He also said that the Bank of Japan (BOJ) may raise interest rates, while the Bank of England (BOE) is likely to cut interest rates next week.

A stronger US dollar may have also contributed to supporting the yellow metal. However, the market has absorbed a large amount of information, and if the greenback enters the accumulation/adjustment phase while US yields remain high, gold could stagnate ahead of the recent peak around $4,380/ounce," Chandler added.

Alex Kuptsikevich, senior market analyst at FxPro, expects gold prices to continue to increase this week, but he believes that the price increase cycle is getting closer to the end.

"The precious metal is experiencing a real "crazy" at the end of the year, instead of cooling down to make a profit as expected. Silver (+120%) and platinum (+90%) have even performed better than gold in the past year. This strong increase further affirms the strength and seriousness of the price increase," he said.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...